FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

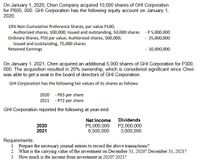

Transcribed Image Text:On January 1, 2020, Chen Company acquired 10,000 shares of GHI Corporation

for P600, 000. GHI Corporation has the following equity account on January 1,

2020.

10% Non-Cumulative Preference Shares, par value P100;

Authorized shares, 100,000; Issued and outstanding, 50,000 shares - P 5,000,000

Ordinary Shares, P50 par value; Authorized shares, 500,000;

Issued and outstanding, 75,000 shares

Retained Earnings

- 25,000,000

- 10,000,000

On January 1, 2021, Chen acquired an additional 5,000 shares of GHI Corporation for P300,

000. The acquisition resulted in 20% ownership, which is considered significant since Chen

was able to get a seat in the board of directors of GHI Corporation.

GHI Corporation has the following fair values of its shares as follows:

2020 - P65 per share

2021 - P72 per share

GHI Corporation reported the following at year-end:

Net Income

Dividends

2020

2021

P5,000,000

6,500,000

P2,000,000

3,000,000

Requirements:

1. Prepare the necessary journal entries to record the above transactions?

2. What is the carrying value of the investment on December 31, 2020? December 31, 2021?

3. How much is the income from investment in 2020? 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The equity section of Windsor SA appears below as of December 31, 2022. Share capital-preference (6% preference shares, R$50 par value, authorized 94,600 shares, outstanding 84,600 shares) Share capital-ordinary (R$1 par, authorized and issued 10,000,000 shares) Share premium-ordinary Retained earnings Net income Earnings Per Share: Income from continuing operations Discontinued operations, net of tax R$125,960,000 Net income 31,020,000 R$ R$4,230,000 Net income for 2022 reflects a total effective tax rate of 20%. Included in the net income figure is a loss of R$11,280,000 (before tax) as a result of discontinued operations. Preference dividends of R$253,800 were declared and paid in 2022. Dividends of R$ 940,000 were declared and paid to ordinary shareholders in 2022. 10,000,000 Compute earnings per share data as it should appear on the income statement of Windsor SA. (Round answers to 2 decimal places, e.g. 1.48.) 19,270,000 156,980,000 R$190,480,000arrow_forwardOn January 1, 2020, Stellar Industries had stock outstanding as follows. 6% Cumulative preferred stock, $100 par value, issued and outstanding 9,300 shares $930,000 Common stock, $10 par value, issued and outstanding 220,000 shares 2,200,000 To acquire the net assets of three smaller companies, Stellar authorized the issuance of an additional 160,800 common shares. The acquisitions took place as shown below. Date of Acquisition Shares Issued Company A April 1, 2020 48,000 Company B July 1, 2020 82,800 Company C October 1, 2020 30,000 On May 14, 2020, Stellar realized a $93,600 (before taxes) insurance gain on discontinued operations. On December 31, 2020, Stellar recorded income of $282,000 from continuing operations (after tax).Assuming a 20% tax rate, compute the earnings per share data that should appear on the financial statements of Stellar Industries as of December 31, 2020. Stellar IndustriesIncome Statement…arrow_forwardOn January 1, 2020, Splish Industries had stock outstanding as follows. 6% Cumulative preferred stock, $100 par value, issued and outstanding 9,600 shares $960,000 Common stock, $10 par value, issued and outstanding 181,000 shares 1,810,000 To acquire the net assets of three smaller companies, Splish authorized the issuance of an additional 159,600 common shares. The acquisitions took place as shown below. Date of Acquisition Shares Issued Company A April 1, 2020 49,200 Company B July 1, 2020 79,200 Company C October 1, 2020 31,200 On May 14, 2020, Splish realized a $90,000 (before taxes) insurance gain on discontinued operations. On December 31, 2020, Splish recorded income of $312,000 from continuing operations (after tax).Assuming a 20% tax rate, compute the earnings per share data that should appear on the financial statements of Splish Industries as of December 31, 2020. (Round answer to 2 decimal places, e.g. $2.55.) Splish Industries Income…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education