FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

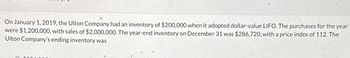

Transcribed Image Text:On January 1, 2019, the Ulton Company had an inventory of $200,000 when it adopted dollar-value LIFO. The purchases for the year

were $1,200,000, with sales of $2,000,000. The year-end inventory on December 31 was $286,720, with a price index of 112. The

Ulton Company's ending inventory was

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, a Company adopted the dollar-value LIFO method for its one inventory pool. The pool's value on this date was $810,000. The 2024 and 2025 ending inventory valued at year-end costs were $845,000 and $924,000, respectively. The appropriate cost indexes are 1.04 for 2024 and 1.05 for 2025 Required: Complete the below table to calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO method. Note: Round "Year end cost index" to 2 decimal places. Round other final answer values to the nearest whole dollars. Inventory Layers Converted to Base Year Cost Inventory Layers Converted to Cost Inventory DVL Cost Inventory at Date Year-End 01/01/2024 12/31/2024 12/31/2025 Cost Inventory Inventory Year-End Cost Layers at Base Year Inventory Layers at Base Year-End Cost Index Index Year Cost Cost Layers Converted to Cost Base Base 2024 Base 2024 2025 Marrow_forwardFlint Corporation began operations on January 1, 2025, with a beginning inventory of $30,360 at cost and $50,600 at retail. The following information relates to 2025. Net purchases ($108,290 at cost) Net markups Net markdowns Sales revenue Retail $149,600 10,000 4,900 128,300 * Assume instead that Flint decides to adopt the dollar-value LIFO retail method. The appropriate price indexes are 100 at January 1 and 110 at December 31. Compute the ending inventory to be reported in the balance sheet. (Round ratios for computational purposes to 2 decimal places, e.g. 78.72% and final answer to 0 decimal places, e.g. 28,987.) Ending inventory using the dollar-value LIFO retail method $ 1arrow_forwardDuring 2020, Harmony Co. sold $520,000 of merchandise at marked retail prices. At the end of 2020, the following Information was avallable from Its records: At Cost At Retail $256, 800 Beginning inventory Net purchases $127,600 231, 240 393,600 Assume that in addition to estimating Its ending inventory by the retall method, Harmony Co. also took a physical inventory at the marked selling prices of the Inventory Items at the end of 2020. Assume further that the total of this physical Inventory at marked selling prices was $109,200. a. Determine the amount of this Inventory at cost. (Round your intermedlate calculations and final answer to 2 decimal places.) Inventory at cost b. Determine Harmony's 2020 Inventory shrinkage from breakage, theft, or other causes at retall and at cost. (Round your intermedlete calculatlons and final answers to 2 decimal places.) At Cost At Retail Estimated inventory that should have been on hand Physical inventory Inventory shrinkagearrow_forward

- On January 1, 2024, the Coldstone Corporation adopted the dollar-value LIFO retail inventory method. Beginning inventory at cost and at retail were $170,000 and $273,000, respectively. Net purchases during the year at cost and at retail were $719,200 and $890,000, respectively. Markups during the year were $9,000. There were no markdowns. Net sales for 2024 were $844,400. The retail price index at the end of 2024 was 1.05. What is the inventory balance that Coldstone would report in its 12/31/2024 balance sheet? Note: Do not round intermediate calculations. Multiple Choice $249,600 $327,600 $202,760 $262,080arrow_forwardOn December 31, 2018, Inventory for Company X was $30,000. On December 31, 2019 the Inventory amount was $15,000. During 2019, the change in Inventory represented: A $15,000 Operating Outflow. A $15,000 Operating Inflow. A $45,000 Operating Inflow. A $45,000 Operating Outflow.arrow_forwardCrane Company had a January 1 inventory of $298000 when it adopted dollar-value LIFO. During the year, purchases were $1760000 and sales were $3040000. December 31 inventory at year-end prices was $390880, and the price index was 112. What would be reported for Crane Company's ending inventory? a) $355120 b)$349000 c) $390880 d)$327800arrow_forward

- On January 1, 2024, a Company adopted the dollar-value LIFO method for its one inventory pool. The pool’s value on this date was $750,000. The 2024 and 2025 ending inventory valued at year-end costs were $793,000 and $882,000, respectively. The appropriate cost indexes are 1.04 for 2024 and 1.05 for 2025. Required: Complete the below table to calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO method. Note: Round "Year end cost index" to 2 decimal places. Round other final answer values to the nearest whole dollars.arrow_forwardOn January 1, 2024, a Company adopted the dollar-value LIFO method for its one inventory pool. The pool’s value on this date was $660,000. The 2024 and 2025 ending inventory valued at year-end costs were $690,000 and $760,000, respectively. The appropriate cost indexes are 1.04 for 2024 and 1.08 for 2025. Required: Complete the below table to calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO method.arrow_forwardOn December 31, 2019, the inventory of Powhattan Company amounts to $800,000. During 2020, the company decides to use the dollar-value LIFO method of costing inventories. On December 31, 2020, the inventory is $1,053,000 at December 31, 2020, prices. Using the December 31, 2019, price level of 100 and the December 31, 2020, price level of 108, compute the inventory value at December 31, 2020, under the dollar-value LIFO method.arrow_forward

- Silvia Company's 2021 balance sheet reveals that inventories reported on a LIFO basis are $25,000,000. In a footnote, management stated that the LIFO reserve was $3,500,000. How much would Silvia's ending inventory be using FIFO?arrow_forwardRF Company had January 1 inventory of $150,000 when it adopted dollar-value LIFO. During the year, purchases were $900,000 and sales were $1,500,000. December 31 inventory at year-end prices was $215,040, and the price index was 112. What is RF Company's ending inventory? Group of answer choices $150,000. $192,000. $197,040. $215,040.arrow_forwardOn January 1, 2020, Crow Company changed from FIFO to LIFO for income tax and external reporting purpos- es. On that same date, the beginning FIFO inventory (the base inventory for LIFO purposes) was $95,000. The following information is available from Crow's records for years 2020 through 2023. Year 2020 2021 2022 2023 Ending Inventory on a FIFO Basis Ending Inventory at Base Year Costs $113,600 84,600 85,200 92,900 a. $125,000 110,000 115,000 130,000 Required Compute the price indices used to calculate ending inventory at base year costs. Round to two decimals. Hint: Divide ending inventory on a FIFO basis by ending inventory at base year for each year. b. Compute the ending inventory on a dollar-value LIFO basis for each year, 2020 through 2023. Prepare the journal entry at each year-end, 2020 through 2023, to adjust inventory to LIFO.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education