FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

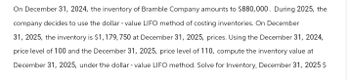

Transcribed Image Text:On December 31, 2024, the inventory of Bramble Company amounts to $880,000. During 2025, the

company decides to use the dollar-value LIFO method of costing inventories. On December

31, 2025, the inventory is $1,179,750 at December 31, 2025, prices. Using the December 31, 2024,

price level of 100 and the December 31, 2025, price level of 110, compute the inventory value at

December 31, 2025, under the dollar - value LIFO method. Solve for Inventory, December 31, 2025 $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Crane Company uses a periodic inventory system and the average cost method. At December 31, 2025, the following information has been compiled for its finished goods inventory: Replacement value Cost Expected selling price Normal profit margin Selling costs $13100 $14900 $15380 15% 5% of expected selling price After applying LCNRV, Crane, which uses the cost of goods sold method to record inventory write-downs, will make an entry O crediting Inventory for $480. O debiting Cost of Goods Sold for $289. O crediting Cost of Goods Sold for $1800. O debiting Inventory Loss for $480.arrow_forwardGive me correct answer with explanation.harrow_forwardDineshbhaiarrow_forward

- Carswell Electronics adopted the dollar-value LIFO method on January 1, 2018, when the inventory value ofits one inventory pool was $720,000. The company decided to use an external index, the Consumer Price Index(CPI), to adjust for changes in the cost level. On January 1, 2018, the CPI was 240. On December 31, 2018, inventory valued at year-end cost was $880,000 and the CPI was 264.Required:Calculate the inventory value at the end of 2018 using the dollar-value LIFO method.arrow_forwardUMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forwardMetlock Corporation adopted the dollar-value LIFO retail inventory method on January 1, 2024. At that time the inventory had a cost of $43,000 and a retail price of $100,000. The following information is available. Year-End Inventory at Retail Current Year Cost-Retail% Year-End Price Index 2024 $127,200 59% 106 2025 149,850 62% 111 2026 128,800 63% 115 2027 165,000 60% 125 The price index at January 1, 2024, is 100. Compute the ending inventory at December 31 of the years 2024-2027. (Round ratios for computational purposes to O decimal places, e.g. 78% and final answers to O decimal places, e.g. 28,987.) Ending inventory $ 2024 $ 2025 2026 $ $ 201arrow_forward

- Presented below is information related to Splish Company. December 31, 2022 December 31, 2023 December 31, 2024 December 31, 2025 December 31, 2026 December 31, 2027 2022 2023 Date 2024 2025 2026 2027 $ $ $ $ $ Ending Inventory (End-of-Year Prices) $ $83,600 117,832 Compute the ending inventory for Splish Company for 2022 through 2027 using the dollar-value LIFO method. 116,501 131,709 157,765 190,224 Ending Inventory 83,600 207,802 Price Index 100 100 104 119 129 139 144arrow_forwardOn January 1, 2019, Lexor Company adopted the dollar-value-LIFO method of inventory costing. Lexor's ending inventory records appear as follows: Year Current cost Index 2019 $ 42,000 100 (1.00) 2020 58,000 110 (1.10) 2021 60,100 120 (1.20) 2022 68,200 130 (1.30) Compute the ending inventory for the years 2019, 2020, 2021, and 2022, using the dollar-value LIFO method. Round to the nearest dollar. Show all work. You can use the previous homework template that you used forarrow_forwardA company adopted dollar - value LIFO on January 1, 2024, when the inventory value was $367,000 and the cost index was 1.35. On December 31, 2024, the inventory was valued at year-end cost of $402,000 and the cost index was 1.40. The company would report a LIFO inventory of: Note: Round your final answer to the nearest whole dollar amount.arrow_forward

- You have the following information for Bramble Inc. for the month ended June 30, 2022. Bramble uses a periodic inventory system. Date Description Quantity Unit Cost orSelling Price June 1 Beginning inventory 40 $31 June 4 Purchase 135 34 June 10 Sale 110 61 June 11 Sale return 15 61 June 18 Purchase 55 37 June 18 Purchase return 10 37 June 25 Sale 65 67 June 28 Purchase 35 41arrow_forwardBoulder, Incorporated is computing its inventory at December 31, 2022. The following information relates to the five major inventory items regularly stocked for resale: Item A B C D E Item A B Required: Using the lower of cost or net realizable value, compute the total valuation for each inventory item at December 31 2022, and the total inventory valuation. C Ending Inventory, Quantity on December 31, 2022 Unit Hand 140 190 45 340 740 D E Total Inventory Valuation $ Net Realizable Value (Market) at Cost when Acquired (FIFO) December 31, 2022 $44 $39 $54 $56 $104 $84 $66 $16 0 $64 $19arrow_forwardMercury Company has only one inventory pool. On December 31, 2024, Mercury adopted the dollar-value LIFO inventory method. The inventory on that date using the dollar-value LIFO method was $215,000. Inventory data are as follows: Year 2025 2026 2027 Ending Inventory at Year-End Costs $ 262,500 350,750 354,000 Ending Inventory at Base Year Costs $ 250,000 305,000 295,000 Required: Compute the inventory at December 31, 2025, 2026, and 2027, using the dollar-value LIFO method. Note: Round "Year end cost index" to 2 decimal places. Inventory Layers Converted to Base Year Cost Inventory Layers Converted to Cost Inventory at Date Year-End Cost Year-End Cost Index 12/31/2024 12/31/2025 12/31/2026 = Inventory DVL Cost Ending Inventory at Base Year Ending Inventory at Base Year Year-End Cost Index Cost Cost Inventory Layers Converted to Cost Base $ ° Base 2025 $ 0 Base 2025)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education