FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

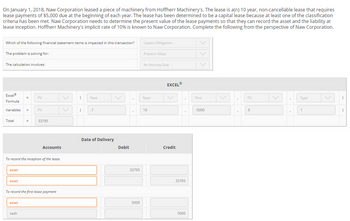

Transcribed Image Text:On January 1, 2018, Naw Corporation leased a piece of machinery from Hoffherr Machinery's. The lease is a(n) 10 year, non-cancellable lease that requires

lease payments of $5,000 due at the beginning of each year. The lease has been determined to be a capital lease because at least one of the classification

criteria has been met. Naw Corporation needs to determine the present value of the lease payments so that they can record the asset and the liability at

lease inception. Hoffherr Machinery's implicit rate of 10% is known to Naw Corporation. Complete the following from the perspective of Naw Corporation.

Which of the following financial statement items is impacted in this transaction?

The problem is solving for:

The calculation involves:

Excel®

Formula

Variables =

Total

asset

asset

=

asset

PV

To record the inception of the lease

cash

PV

33795

Accounts

To record the first lease payment

( Rate

( .1

Date of Delivery

Debit

33795

5000

Leases Obligation

Present Value

An Annuity Due

Nper

10

EXCELⓇ

Credit

33795

5000

Pmt

-5000

"

FV

0

Type

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (Type of Lease; Amortization Schedule) Macinski Leasing Company leases a new machine to Sharrer Corporation. The machine has a cost of $70,000 and fair value of $95,000. Under the 3-year, non-cancelable contract, Sharrer will receive title to the machine at the end of the lease. The machine has a 3-year useful life and no residual value. The lease was signed on January 1, 2020. Macinski expects to earn an 8% return on its investment, and this implicit rate is known by Sharrer. The annual rentals are payable on each December 31, beginning December 31, 2020. Instructions a. Discuss the nature of the lease arrangement and the accounting method that each party to the lease should apply. b. Prepare an amortization schedule that would be suitable for both the lessor and the lessee and that covers all the years involved. c. Prepare the journal entry at commencement of the lease for Macinski. d. Prepare the journal entry at commencement of the lease for Sharrer. e. Prepare the…arrow_forwardOn January 1, 2025, Sandhill, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Pronghorn Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement. (a) The agreement requires equal rental payments at the beginning each year. (b) The fair value of the building on January 1, 2025 is $5800000; however, the book value to Holt is $4750000. (c) The building has an estimated economic life of 10 years, with no residual value. Sandhill depreciates similar buildings using the straight-line method. (d) At the termination of the lease, the title to the building will be transferred to the lessee. (e) Sandhill's incremental borrowing rate is 10% per year. Pronghorn Warehouse Co. set the annual rental to ensure a 8% rate of return. The implicit rate of the lessor is known by Sandhill, Inc. (f) In…arrow_forwardCullumber Company leased equipment from Ayayai Company on July 1, 2025, for an eight-year period expiring June 30, 2033. One of the lease terms is a guaranteed residual amount of $13200. The residual expected by Cullumber will be $8100. The lease meets the criteria of a finance lease. What is the residual value amount that would be included in the calculation of Cullumber's lease liability/right- of use asset? The present value of $8100. The present value of $13200. The present value of $5100. The residual would not be included in the calculation of the lease liability/right-of-use asset.arrow_forward

- Assume that the lease contract involved an identified leased equipment at a cost of $120,000 by the lessor. The term of the lease is 6 years beginning December 31, 2021, with equal rental payments of $30,044 beginning December 31, 2021. The fair value of the equipment at commencement of the lease is $150,001. The equipment has a useful life of 6 years with no salvage value. The lease has an implicit interest rate of 8%, no bargain purchase option, and no transfer of title. Collectibility of lease payments is probable. Prepare the lessor's journal entries on December 31, 2021, at commencement of the lease. Show all your work for partial credits.arrow_forwardKeller Corporation (the lessee) entered into a general equipment lease with Dallo Company (the lessor) on January 1 of Year 1. The following information pertains to this lease agreement: 1. The equipment reverts back to the lessor at the end of the lease, and there is no bargain purchase option. 2. The lease term is 8 years and requires annual payments of $10,000 at the beginning of each year. 3. The fair value of the equipment at lease inception is $100,000. Assume that the present value of lease payments discounted at a 10% interest rate is $58,684.19. 4. The equipment has an estimated economic life of 20 years and has zero residual value at the end of this time. Required: Prepare the journal entry that Keller Corporation would make during the first year of the lease assuming that the lease is classified as an operating lease.arrow_forwardEdom Company, the lessor, enters into lease with Davis Company to lease equipment to Davis beginning January 1, 2016. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires annual rental receipts of $100,000 to be made in advance at the beginning of each year. 2. The equipment costs $313,000. The equipment has an estimated life of 6 years and, at the end of the lease term, has an unguaranteed residual value of $20,000 accruing to the benefit of Edom. 3. Davis agrees to pay all executory costs. 4. The interest rate implicit in the lease is 14%. 5. The initial direct costs are insignificant and assumed to be zero. 6. The collectibility of the rentals is reasonably assured, and there are no important uncertainties surrounding the amount of unreimbursable costs yet to be incurred by the lessor. Required: 1. Next Level Determine if the lease is a sales-type or direct financing lease from Edom's point of view…arrow_forward

- Baillie Power leased high-tech electronic equipment from Courtney Leasing on January 1, 2021. Courtney purchased the equipment from Doane Machines at a cost of $254,500, its fair value. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term Quarterly lease payments Economic life of asset 2 years (8 quarterly periods) $19,500 at Jan. 1, 2021, and at Mar. 31, June 30, Sept. 30, and Dec. 31 thereafter 5 years Interest rate charged by the lessor 12% Required: Prepare a lease amortization schedule and appropriate entries for Baillie Power from the beginning of the lease through December 31, 2021. December 31 is the fiscal year end for each company. Appropriate adjusting entries are recorded at the end of each quarter.arrow_forwardOn January 1, 2023, Wynn Manufacturing leased a floor of a building for use in its North American operations from Easymoney Bank. The 9-year, noncancellable lease requires annual lease payments of $12,000, beginning January 1, 2023, and at each January 1 thereafter through 2031.The lease agreement does not transfer ownership, nor does it contain a purchase option. The floor of the building has a fair value of $85,000 and an estimated remaining life of 10 years. Easymoney Bank's implicit rate of 11% is known to Wynn.What is the type of lease for the lessee? Group of answer choices finance lease operating lease direct financing lease sales-type leasearrow_forwardJensen Corporation leased industrial equipment to Francis Manufacturing on January 1, 2019. The following facts pertain to the lease: The lease term is 4 years. The annual lease payment is due at the beginning of each year starting on January 1, 2019. Each annual lease payment is $269,282 Ownership does not transfer at the end of the lease term and there is no bargain purchase option. The asset is not of a specialized nature. The industrial equipment has a fair value of $1,000,000, a book value to Jensen Corporation of $900,000, and a useful life of 5 years. Francis Manufacturing depreciates similar equipment using the straight-line method. The lease contains a guaranteed residual value of $50,000. The expected residual value is greater than $50,000. Jensen Corporation wants to earn a return of 8% on the lease, and collectability of the payments is probable. This rate is known by Francis…arrow_forward

- Federated Fabrications leased a tooling machine on January 1, 2024, for a three-year period ending December 31, 2026. . The lease agreement specified annual payments of $34,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. . The company had the option to purchase the machine on December 30, 2026, for $43,000 when its fair value was expected to be $58,000, a sufficient difference that exercise seems reasonably certain. . The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor's implicit rate of return was 12%. Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Required: 1. Calculate the amount Federated should record as a right-of-use asset and lease llability for this finance lease. 2. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term. 3. Prepare…arrow_forwardSarasota Corporation entered into a lease agreement on January 1, 2020, to provide Ivanhoe Company with a piece of machinery. The terms of the lease agreement were as follows. 1. The lease is to be for 3 years with rental payments of $9,066 to be made at the beginning of each year. 2. The machinery has a fair value of $61,000, a book value of $46,800, an end-of-life salvage value of $0, and an economic life of 8 years. 3. At the end of the lease term, both parties expect the machinery to have a residual value of $39,200, none of which is guaranteed. 4. The lease does not transfer ownership at the end of the lease term, does not have a bargain purchase option, and the asset is not of a specialized nature. 5. The implicit rate is 6%, which is known by Ivanhoe. 6. Collectibility of the payments is probable. 7. Assume that the lessor uses straight-line depreciation. (a) Evaluate the criteria for classification of the lease, and describe the nature of the…arrow_forwardOn December 31, 2016, IU Corporation signed a 6-year, non-cancelable lease for a machine. The terms of the lease called for IU Corporation to make payments of $12,108 at the beginning of each year, starting December 31, 2016. The machine has an estimated useful life of 8 years and a $6000 unguaranteed residual value. The machine reverts to the lessor at the end of the lease term. IU Corporation uses the straight-line method of depreciation for all of its plant assets. IU’s incremental borrowing rate is 8 percent, and the lessor’s implicit rate is unknown.On December 31, 2017, how much would IU Corporation DEBIT interest expense (rounded to the nearest dollar)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education