FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

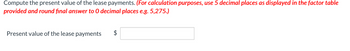

Transcribed Image Text:Compute the present value of the lease payments. (For calculation purposes, use 5 decimal places as displayed in the factor table

provided and round final answer to O decimal places e.g. 5,275.)

Present value of the lease payments

$

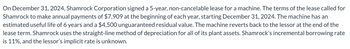

Transcribed Image Text:On December 31, 2024, Shamrock Corporation signed a 5-year, non-cancelable lease for a machine. The terms of the lease called for

Shamrock to make annual payments of $7,909 at the beginning of each year, starting December 31, 2024. The machine has an

estimated useful life of 6 years and a $4,500 unguaranteed residual value. The machine reverts back to the lessor at the end of the

lease term. Shamrock uses the straight-line method of depreciation for all of its plant assets. Shamrock's incremental borrowing rate

is 11%, and the lessor's implicit rate is unknown.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What are liabilities that will be due within a short time (usually one year or less) and that are to be paid out of current assets called? Group of answer choices equity liabilities current liabilities fixed liabilities contra liabilitiesarrow_forwardi need the answer quicklyarrow_forwardHardevarrow_forward

- Calculate the missing information for the installment loan that is being paid off early. Sum-of-the- Digits Number of Payments Sum-of-the- Number of Payments Payments Remaining Rebate Digits Payments Remaining Payments Made Fraction 36 21 15 120 666 0.1802arrow_forwardi need the answer quicklyarrow_forwardThe interest / paid on an amortization of a loan of PV dollars where N payments of PMT dollars have been made is given by the formula:arrow_forward

- Sh5 Please help me. Solution Thankyou.arrow_forwardConsider an asset with upfront cost of $32,639. The cost associated with it during the first year of operation is $3,415. The cost associated with it during the second year of operation is $12,099. With an interest rate of 0.08, what is a levelized cost payment payable at the end of years 1 and 2, which has the same present value as the actual cost stream at the end of period 0. The annuity formula for an interest rate of 0.08 and t payments is given by 0+ 2)-(¹-0)arrow_forwardHh.169.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education