FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

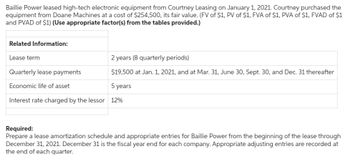

Transcribed Image Text:Baillie Power leased high-tech electronic equipment from Courtney Leasing on January 1, 2021. Courtney purchased the

equipment from Doane Machines at a cost of $254,500, its fair value. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1

and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Related Information:

Lease term

Quarterly lease payments

Economic life of asset

2 years (8 quarterly periods)

$19,500 at Jan. 1, 2021, and at Mar. 31, June 30, Sept. 30, and Dec. 31 thereafter

5 years

Interest rate charged by the lessor 12%

Required:

Prepare a lease amortization schedule and appropriate entries for Baillie Power from the beginning of the lease through

December 31, 2021. December 31 is the fiscal year end for each company. Appropriate adjusting entries are recorded at

the end of each quarter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2020, Mountain Inc. leases a machine used in its operations. The annual lease payment is $10,000 due on December 31 of 2020, 2021, and 2022. The fair value of the machine on January 1, 2020 is $26,730. The machine has no residual value. Mountain could borrow on a three-year collateralized loan at 6%. If the lease is accounted for as a finance lease, the total expenses related to this lease contract that Mountain Inc. will report in its income statement for the year ending December 31, 2020 is Select one: a. $10,600 b. $10,514 c. $10,717 d. $10,000arrow_forwardThe following facts pertain to a non-cancelable lease agreement between Cullumber Leasing Company and Crane Company, a lessee. Commencement date Annual lease payment due at the beginning of each year, beginning with January 1, 2025 Residual value of equipment at end of lease term, guaranteed by the lessee January 1, 2025 $125,377 $54,000 Expected residual value of equipment at end of lease term $49,000 Lease term 6 years Economic life of leased equipment 6 years Fair value of asset at January 1, 2025 $660,000 Lessor's implicit rate 8 % Lessee's incremental borrowing rate 8 % The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment. Click here to view factor tables. (a) Prepare an amortization schedule that would be suitable for the lessee for the lease term. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to O decimal places e.g. 5,275.) Date 1/1/25 $ 1/1/25…arrow_forwardBaillie Power leased high-tech electronic equipment from Courtney Leasing on January 1, 2021. Courtney purchased the equipment from Doane Machines at a cost of $252,000, its fair value. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term Quarterly lease payments Economic life of asset Interest rate charged by the lessor Required: Prepare a lease amortization schedule and appropriate entries for Baillie Power from the beginning of the lease through December 31, 2021. December 31 is the fiscal year end for each company. Appropriate adjusting entries are recorded at the end of each quarter. Complete this question by entering your answers in the tabs below. Amort Schedule General Journal 01/01/2021 03/31/2021 06/30/2021 09/30/2021 12/31/2021 03/31/2022 06/30/2022 09/30/2022 Total Prepare a lease amortization schedule. (Round your intermediate calculations and final answers to the nearest…arrow_forward

- The following information relates to an equipment lease with an inception date of January 1: Fair value of equipment at lease inception, $56,000 Lease term, 5 years Economic life of property, 6 years Implicit interest rate, 7% Annual lease payment due on December 31, $13,200 The equipment reverts back to the lessor at the end of the lease term. How much is recorded as the lease liability on the lease inception date? Select one: a. $66,000 b. $56,000 c. $57,911 d. $54,123arrow_forwardOscar, Inc., leased equipment from Reynolds Company on January 1, 2023. Reynolds manufactured theequipment at a cost of $200,000. The equipment has a fair value of $260,000.Information related to the lease appears below:Lease term 5 yearsFirst lease payment January 1, 2023Subsequent lease payments December 31, 2023, 2024, 2025, 2026Economic life of the equipment 6 yearsEstimated value of equipment at end of economic life $0Purchase option, reasonably expected to be exercised by Oscar $20,000Implicit and incremental borrowing rate 8% Prepare the entries to record the lease and the first payment for both the lessee and the lessor onJanuary 1, 2023.arrow_forwardOn January 1, 2024, Lesco Leasing leased equipment to Quality Services under a finance/sales - type lease designed to earn Lesco a 12% rate of return for providing long-term financing. The lease agreement specified: Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Ten annual payments of $56, 000 beginning January 1, 2024, the beginning of the lease and each December 31 thereafter through 2032. The estimated useful life of the leased equipment is 10 years with no residual value. Its cost to Lesco was $322,741. The lease qualifies as a finance lease/sales - type lease. A 10-year service agreement with Quality Maintenance Company was negotiated to provide maintenance of the equipment as required. Payments of $5,000 per year are specified, beginning January 1, 2024. Lesco was to pay this cost as incurred, but lease payments reflect this expenditure. Also included in the $56,000 payments is an insurance premium of…arrow_forward

- Manufacturers Southern leased high-tech electronic equipment from Edison Leasing on January 1, 2021. Edison purchased the equipment from International Machines at a cost of $126,890. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term 2 years (8 quarterly periods) Quarterly rental payments $16,700 at the beginning of each period Economic life of asset 2 years Fair value of asset $126,890 Implicit interest rate 6% (Also lessee’s incremental borrowing rate) Required:Prepare a lease amortization schedule and appropriate entries for Manufacturers Southern from the beginning of the lease through January 1, 2022. Amortization of the right-of-use asset is recorded at the end of each fiscal year (December 31) on a straight-line basis.arrow_forwardAcme Auto Repair entered into an agreement to lease equipment from Cromley Motor Products on July 1, 2022, The lease calls for five equal annual payments of $420,000, beginning July 1, 2023. Similar transactions have carried an 8% interest rate. At what amount would Acme would record the right-of-use asset? (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)arrow_forwardEdison Leasing leased high-tech electronic equipment to Manufacturers Southern on January 1, 2024. Edison purchased the equipment from International Machines at a cost of $139,107. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Related Information: Lease term 2 years (8 quarterly periods) Quarterly rental payments $ 18,000 at the beginning of each period Economic life of asset 2 years Fair value of asset $ 139,107 Implicit interest rate (Also lessee’s incremental borrowing rate) 4% Required: Prepare a lease amortization schedule and appropriate entries for Edison Leasing from the beginning of the lease through January 1, 2025. Edison’s fiscal year ends December 31arrow_forward

- Big Bucks leased equipment to Shannon Company on July 1, 2021. The lease payments were calculated to provide the lessor a 9% return. Ten annual lease payments of $39,000 are due each July 1, beginning July 1, 2021. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare the journal entries to record the lease by Shannon at July 1, 2021, and at December 31, 2021, the end of the reporting period. Consider this to be a finance lease. 2. Prepare the journal entries to record the lease by Shannon at July 1, 2021, and at December 31, 2021, the end of the reporting period. Consider this to be an operating lease. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entries to record the lease by Shannon at July 1, 2021, and at December 31, 2021, the end of the reporting period. Consider this to be an operating lease. (If no entry is required for a…arrow_forwardOn January 1, 2021, National Insulation Corporation (NIC) leased equipment from United Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by NIC. Portions of the United Leasing's lease amortization schedule appear below: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Jan. 1 2021 2021 2022 2023 2024 2025 2026 1. 2. WN 3. 4. 2038 2039 2040 2041 7 Payments 14,500 14,500 14,500 14,500 14,500 14,500 14,500 14,500 14,500 38,449 5. 6. Net investment Effective Decrease in Interest Balance 11,800 11,584 11,351 11,099 10,827 5,250 4,510 3,711 2,848 Lease term Asset's residual value Effective annual interest rate Lease payments for United Lease payments for NIC 7. 8. Right-of-use asset Required: 1. What is the lease term In years? 2. What is the asset's residual value expected at the end of the lease term?…arrow_forwardKing Company leased equipment from Mann Industries. The lease agreement qualifies as a finance lease and requires annual lease payments of $52,538 over a six-year lease term (also the asset’s useful life), with the first payment at January 1, the beginning of the lease. The interest rate is 5%. The asset being leased cost Mann $230,000 to produce. Required:1. Determine the price at which the lessor is “selling” the asset (present value of the lease payments).2. What would be the amounts related to the lease that the lessor would report in its income statement for the year ended December 31 (ignore taxes)?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education