FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

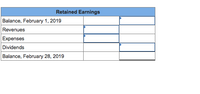

Exercise 4-13 (Algo) Calculate retained earnings LO 3

On February 1, 2019, the balance of the retained earnings account of Blue Power Corporation was $441,000. Revenues for February totaled $86,100, of which $80,500 was collected in cash. Expenses for February totaled $78,600, of which $64,800 was paid in cash. Dividends declared and paid during February were $7,200.

Required:

Calculate the retained earnings balance at February 28, 2019. (Amounts to be deducted should be indicated with a minus sign.)

Required:

Calculate the retained earnings balance at February 28, 2019. (Amounts to be deducted should be indicated with a minus sign.)

Transcribed Image Text:Retained Earnings

Balance, February 1, 2019

Revenues

Expenses

Dividends

Balance, February 28, 2019

Expert Solution

arrow_forward

Step 1

Retained earnings at the end are calculated by adding the net income to the opening retained earnings and deducting the dividend paid by the company.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Computing Financial Statement Measures The following pretax amounts are taken from the adjusted trial balance of Mastery Inc. on December 31, 2020, its annual year-end. Assume that the income tax rate for all items is 25%. The average number of common shares outstanding during the year was 20,000. Balance, retained earnings, December 31, 2019 $ 45,000 Sales revenue 300,000 Cost of goods sold 105,000 Selling expenses 36,000 Administrative expenses 34,000 Gain on sale of investments 10,000 Unrealized holding gain on debt investments, net of tax 4,250 Prior period adjustment, understatement of depreciation from prior period (2019) 20,000 Dividends declared and paid 16,000 Required Compute the following amounts for the year-end financial statements of 2020. Do not use negative signs with any of your answers. Round the per share amount to two decimal places. Item Amount a. Gross profit (2020). b. Operating income (2020). c. Net…arrow_forwardfind P/E Ratio 2019. i attached balance sheet and income statementarrow_forwardQuestion 66 Using Financial Statements for 2018-2019. Net asset value per share of preferred stock for 2019 is $685.71. TRUE OR FALSE?arrow_forward

- PE.17-07B - Times interest earned A company reports the following: Income before income tax $8,000,000 Interest expense 500,000 Determine the number of times interest charges are earned.arrow_forwardRetained Earnings Statement Financial information related to Healthy Products Company for the month ended November 30, 2018, is as follows: Net income for November $93,500 Cash dividends paid during November 7,000 Retained earnings, November 1, 2018 2,940,000 a. Prepare a retained earnings statement for the month ended November 30, 2018. If a net loss is incurred or dividends were paid, enter that amount as a negative number using a minus sign. Healthy Products Company Retained Earnings Statement For the Month Ended November 30, 2018 $fill in the blank 0079c8fa300c05b_2 $fill in the blank 0079c8fa300c05b_4 fill in the blank 0079c8fa300c05b_6 fill in the blank 0079c8fa300c05b_8 $fill in the blank 0079c8fa300c05b_10 b. Why is the retained earnings statement prepared before the November 30, 2018, balance sheet? To arrive at the number of shares outstanding. To calculate the net income for the year. To calculate the ending…arrow_forwardExercise 6The following items were taken from the financial statements of Young Company, Inc. Unearned Revenue $ 950 Accumulated depreciation $ 5,600 Prepaid expenses 900 Accounts payable 1,444 Equipment 11,300 Notes payable 1,498 Accounts Receivable 1,734 Common Stock 8,000 Notes Receivable 3,490 Retained Earnings (1/1/2019) 4,200 Cash 2,648 Inventory 1,920 2019 net income was $1,000 and Dividends were $700. Instructions:(a) Prepare a statement of owner’s equity in good form for the year ended December 31, 2019 (b) Prepare a balance sheet in good form as of December 31, 2019.arrow_forward

- Retained earnings statement Climate control system co. offers its services to residents in the spokane area. selected accounts from the ledger of climate control systems for the fiscal year ended december 31,2018 are as follows: Retained Earnings Dec.31 160,000 Jan.1(2018) Dec.31 4150800 700 000 Dividends Mar.31 June 30 sep 30dec 31 40000 40000 40000 40000 Dec 31 160000 Income Summary Dec 31 4,530,000 Dec 31 5,230,000 31 700,000 Prepare a retained earnings statement for the year.arrow_forwardView Policies Current Attempt in Progress The shareholders' equity accounts of Sandhill Inc. at December 31, 2023, are as follows: Preferred shares, $3 noncumulative, unlimited number authorized, 5,000 issued Common shares, unlimited number authorized, 140,000 issued Retained earnings Accumulated other comprehensive loss Sandhill has a 35% income tax rate. During the following fiscal year ended December 31, 2024, the company had the following transactions and events: Feb. July Dec. 1 Repurchased 10,000 common shares for $40,000. Announced a 2-for-1 preferred stock split. The market price of the preferred shares at the date of announcement was $150. 12 1 $500,000 700,000 550,000 (48,000) Dec. 18 Dec. 31 Declared the annual cash dividend ($1.50 post-split) to the preferred shareholders of record on January 10, 2025, payable on January 31, 2025, Declared a 10% stock dividend to common shareholders of record at December 20, distributable on January 12. 2025. The fair value of the common…arrow_forwardQuestion 1 At year-end 2018, Marvel Company total assets were $4.5 million, and its accounts payable were $850,000. Sales, which in 2018 were $5.5 million, are expected to increase by 25% in 2019. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Marvel typically uses no current liabilities other than accounts payable. Common stock amounted to $ 2.25 million in 2018, and retained earnings were $150,000. Marvel has arranged to sell $25,000 of new common stock in 2019 to meet some of its financing needs. The remainder of its financing needs will be met by issuing new long-term debt at the end of 2019. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales is 2.5%, and 55% of earnings will be paid out as dividends. b. How much new long-term debt financing will be needed in 2019? (Hint: AFN – New stock = New long-term debt.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education