FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

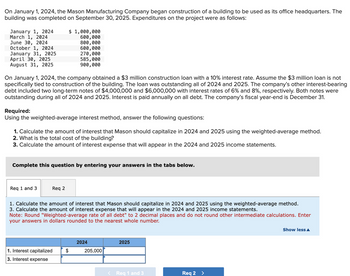

Transcribed Image Text:On January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The

building was completed on September 30, 2025. Expenditures on the project were as follows:

January 1, 2024

32

March 1, 2024

June 30, 2024

October 1, 2024

January 31, 2025

April 30, 2025

August 31, 2025

On January 1, 2024, the company obtained a $3 million construction loan with a 10% interest rate. Assume the $3 million loan is not

specifically tied to construction of the building. The loan was outstanding all of 2024 and 2025. The company's other interest-bearing

debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were

outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company's fiscal year-end is December 31.

Required:

Using the weighted-average interest method, answer the following questions:

$ 1,000,000

600,000

800,000

600,000

270,000

585,000

900,000

1. Calculate the amount of interest that Mason should capitalize in 2024 and 2025 using the weighted-average method.

2. What is the total cost of the building?

3. Calculate the amount of interest expense that will appear in the 2024 and 2025 income statements.

Complete this question by entering your answers in the tabs below.

Req 1 and 3

Req 2

1. Calculate the amount of interest that Mason should capitalize in 2024 and 2025 using the weighted-average method.

3. Calculate the amount of interest expense that will appear in the 2024 and 2025 income statements.

Note: Round "Weighted-average rate of all debt" to 2 decimal places and do not round other intermediate calculations. Enter

your answers in dollars rounded to the nearest whole number.

1. Interest capitalized $

3. Interest expense

2024

205,000

2025

< Req 1 and 3

Req 2 >

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 11 On January 1, 2024, a company began construction of an automated cattle feeder system. The system was finished and ready for use on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 September 1, 2024 December 31, 2024 March 31, 2025 September 30, 2025 The company borrowed $790,000 on a construction loan at 8% interest on January 1, 2024. This loan was outstanding throughout the construction period. The company had $4,700,000 in 8% bonds payable outstanding in 2024 and 2025. Average accumulated expenditures for 2024 was: Multiple Choice $440,000. $490,000 $720,000. $300,000 $ 420,000 $ 420,000 $ 420,000 $ 300,000 $600,000.arrow_forward8arrow_forwardIn early February 2020, Bridgeport Corp. began construction of an addition to its head office building that is expected to take 18 months to complete. The following 2020 expenditures relate to the addition: Feb. 1 Mar. 1 July 1 Dec. 1 Dec. 31 Payment #1 to contractor Payment to architect Payment #2 to contractor Payment #3 to contractor Asset carrying amount $168,000 21,000 64,400 177,000 Amount of interest $ $430,400 On February 1, Bridgeport issued a $102,000, three-year note payable at a rate of 11% to finance most of the initial payment to the contractor. No other asset-specific debt was entered into. Details of other interest-bearing debt during the period are provided in the table below: Other Debt Instruments Outstanding-2020 9%, 15-year bonds, issued May 1, 2005, matured May 1, 2020 6%, 10-year bonds, issued June 15, 2014 6%, 12-year bonds, issued May 1, 2020 Principal amount $303,000 $500,000 $303,000 What amount of interest should be capitalized for the fiscal year ending…arrow_forward

- Beck Construction Company began work on a new building project on January 1, 2023. The project is to be completed by December 31, 2025, for a fixed price of $149 million. The following are the actual costs incurred and estimates of remaining costs to complete the project that were made by Beck's accounting staff: Years 2023 2024 2025 Actual costs incurred in each year $ 42 million $ 69 million, $ 47 million Required: What amount of gross profit (or loss) would Beck record on this project in each year, assuming that Beck recognizes revenue for this project upon completion of the project? Years 2023 2024 2025 Note: Enter "None" if there is no requirement of recognizing profit or loss. Loss amounts should be indicated with a minus sign. Enter your answers in millions (1.e., 10,000,000 should be entered as 10). Estimated remaining costs to complete the project (measured at December 31 of each year) $ 84 million $ 69 million $0 million Gross Profit (or Loss) recognized million million…arrow_forwardOn January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 March 1, 2024 June 30, 2024 October 1, 2024 January 31, 2025 April 30, 2025 August 31, 2025 $1,000,000 600,000 800,000 600,000 270,000 585,000 900,000 On January 1, 2024, the company obtained a $3 million construction loan with a 10% interest rate. The loan was outstanding all of 2024 and 2025. The company's other interest-bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company's fiscal year-end is December 31. 4. Compute the cost to be allocated to the building in 2025 other than Capitalized Interest, Show your computation in the workpaper provided. 4. 1/31/2025 4/30/2025 8/31/2025…arrow_forward5) In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 2,100,000 $ 2,450,000 $ 2,695,000 Estimated costs to complete as of year-end 4,900,000 2,450,000 0 Billings during the year 2,200,000 2,350,000 5,450,000 Cash collections during the year 1,900,000 2,300,000 5,800,000 Westgate recognizes revenue over time according to percentage of completion. 4. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years assuming the following costs incurred and costs to complete information. (Do not round intermediate calculations and round your final answers to the nearest whole dollar amount. Loss amounts should be indicated with a minus sign.) 2021 2022 2023 Costs incurred…arrow_forward

- sarrow_forwardRequired information [The following information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: 2024 2025 2026 Cost incurred during the year Estimated costs to complete as of year-end Billings during the year $ 2,542,000 5,658,000 2,020,000 $ 3,772,000 1,886,000 4,294,000 $ 2,074,600 0 Cash collections during the year 1,810,000 3,800,000 3,686,000 4,390,000 Westgate recognizes revenue over time according to percentage of completion. 2-a. In the journal below, complete the necessary journal entries for the year 2024 (credit "Cash, Materials, etc." for construction costs incurred). 2-b. In the journal below, complete the necessary journal entries for the year 2025 (credit "Cash, Materials, etc." for construction costs incurred). 2-c. In the journal below, complete the necessary journal…arrow_forward10) On January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 $ 1,000,000 March 1, 2024 600,000 June 30, 2024 800,000 October 1, 2024 600,000 January 31, 2025 270,000 April 30, 2025 585,000 August 31, 2025 900,000 On January 1, 2024, the company obtained a $3 million construction loan with a 10% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2024 and 2025. The company’s other interest-bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company’s fiscal year-end is December 31. Required: Using the weighted-average interest method, answer the…arrow_forward

- A-7arrow_forwardOn January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 March 1, 2024 June 30, 2024 October 1, 2024 January 31, 2025 April 30, 2025 August 31, 2025 On January 1, 2024, the company obtained a $3,900,000 construction loan with a 12% interest rate. The loan was outstanding all of 2024 and 2025. The company's other interest-bearing debt included two long-term notes of $6,000,000 and $9,000,000 with interest rates of 8% and 10%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company's fiscal year-end is December 31. Required: 1. Calculate the amount of interest that Mason should capitalize in 2024 and 2025 using the specific interest method. 2. What is the total cost of the building? 3. Calculate the amount of interest expense that will appear in…arrow_forwardhslarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education