FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

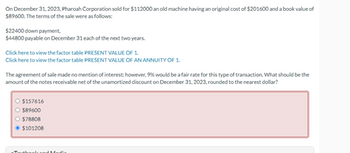

Transcribed Image Text:On December 31, 2023, Pharoah Corporation sold for $112000 an old machine having an original cost of $201600 and a book value of

$89600. The terms of the sale were as follows:

$22400 down payment.

$44800 payable on December 31 each of the next two years.

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1.

The agreement of sale made no mention of interest; however, 9% would be a fair rate for this type of transaction. What should be the

amount of the notes receivable net of the unamortized discount on December 31, 2023, rounded to the nearest dollar?

O $157616

$89600

$78808

$101208

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An investor purchased an auto body shop for $200,000 using a mortgage of 70 percent of the purchase price. The loan terms were: 6 percent interest rate, 25-year amortization period, 10-year term, 12 payments per year, and loan costs of 2 percent of loan amount. The buyer incurred acquisition costs of $8,000. At the time of purchase the original basis was allocated 75 percent for improvements and 25 percent for land. The projected NOI for year one is $25,000. This investor's marginal tax rate is 28 percent, so what is the cash flow after tax for year one of the projection? O $10,662 O $11,109 O $12,549 O $14,176arrow_forward7. On January 1, 2020 Gingerbread, Corp. purchased a reindeer merry-go-round as an attraction to draw customers during the holiday season. The following information is available: Invoice price $280,000 Shipping cost $4,000 Set-up cost $2,000 Insurance to cover years 2020 and 2021 $12,000 Necessary repair during set-up 500 Determine the amount to be record as the capitalized cost of the asset. a.286,000 b.280,000 c.286,500 d.298,500arrow_forwardxyz company purchased an equipment for $15,000 cash and signed a note for 5 equal payments of $10,000 at the end of each year for 5 years. The implied interest rate is 6%. At the time of acquisition, what amount would the equipment be recorded at?arrow_forward

- A property was purchased for $3976.00 down and payments of $1249.00 at the end of every six months for 6 years. Interest is 8% per annum compounded monthly. What was the purchase price of the property? How much is the cost of financing? The purchase price of the property was $ $☐ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardThe following proforma shows unleveraged cash flows for a property if an investor were to purchase it today and resell it at the end of the third year: (Show answer in Excel) What is the present value of the each of the discounted cash flows from Year 1, Year 2, and Year 3, using a discount rate of 8.75% (hint: calculate each on separately)? What is the Net Present Value of this investment?arrow_forwardOn July 1, 2020, FDN Company purchased an equipment for P47,100,000. After 5 years of its estimated useful life, it can be sold for P100,000. How much is the carrying amount of the equipment as of December 31, 2021?arrow_forward

- Hi, I need help inputting the two remaining values in the blank cells. Thank you.arrow_forwardIn 2018 an asset was purchased for $2,000,000. The asset qualified for Initial Allowance. The Initial Allowance (I.A) Rate was 20%. Annual Allowance (A.A) Rate was 10%. The asset was sold in 2020 for $1,000,000. Capital allowance is on the reducing balance basis. The balancing adjustment is: a.A Balancing Charge of $260,000 b.A Balancing Allowance of $134,000 c. ABalancing Allowance of $260,000 d. A Balancing charge of $200,000arrow_forwardAn art collector purchased a painting 30yrs ago for $587,000. Today this painting is estimated to be $11.74 million. Based on this estimate, what is the annual compound rate of appreciation for the painting since the art collector's initial purchase?arrow_forward

- Determine what the interest rate would have been if a financial asset valued at $156,500 amounted to a total value of $199,800 after 2 years.arrow_forwardNeed help for questions B & Carrow_forwardCurrent Attempt in Progress On December 31, 2025, Novak Company acquired a computer from Plato Corporation by issuing a $576,000.00 zero-interest-bearing note, payable in full on December 31, 2029. Novak Company's credit rating permits it to borrow funds from its several lines of credit at 12%. The computer is expected to have a 5-year life and a $77,000 salvage value. Click here to view factor tables. (a) Your answer is partially correct. Prepare the journal entry for the purchase on December 31, 2025. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 2 decimal places, e.g. 58,971.23. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date December 31, 2025 Account Titles and Explanation Equipment Discount on Notes Payable Notes Payable Debit…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education