Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

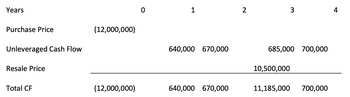

The following proforma shows unleveraged cash flows for a property if an investor were to purchase it today and resell it at the end of the third year: (Show answer in Excel)

- What is the

present value of the each of the discounted cash flows from Year 1, Year 2, and Year 3, using a discount rate of 8.75% (hint: calculate each on separately)? - What is the

Net Present Value of this investment?

Transcribed Image Text:Years

Purchase Price

Unleveraged Cash Flow

Resale Price

Total CF

(12,000,000)

(12,000,000)

1

640,000 670,000

640,000 670,000

2

3

685,000 700,000

10,500,000

11,185,000 700,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2,350,000. The fixed asset will be depreciated straight-line to zero over its three-year tax life. The project is estimated to generate $2,860,000 in annual sales, with costs of $1,850,000. The project requires an initial investment in net working capital of $176,000, and the fixed asset will have a market value of $211,000 at the end of the project. Assume that the tax rate 25 percent and the required return on the project is 11 percent. What are the net cash flows of the project each year? What is the NPV of the project? Give typing answer with explanation and conclusionarrow_forwardPLEASE HELP WITH SHOWING THE COMPLETE CASH FLOW DIAGRAM, FACTOR FORMULA, EQUATION, EXCEL FORMULA, EQUATION AND STEPS. Titan, LLC has a new maintenance cost of $500 at the end of year 1, then $150 at the end of year two that increases by $50 (G) to year 10. How much should Titan, LLC set aside presently to pay for this new expense if interest rates are 8% compounded annually?arrow_forwardConsider the following cash flows: Year 01234 Cash Flow -$5,100 1,500 2,600 1,300 1,000 What is the payback period for the cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Payback period yearsarrow_forward

- What is the present worth (P) of all the cash flows if F=16000, n=6 years, and i= 8% per year? Select one: O a. $16,480.00 b. $103,824.00 O c. $10,082.71 O d. $34,608.00arrow_forwardWhat is the payback period for the following set of cash flows? Year Cash Flow 0 -$ 3,000 1 2,400 2 1, 600 3 2,200 4 2,200 A) 1.44 years B)1.32 years C)1.68 years D)2, 200arrow_forwardSuppose an investor is interested in purchasing the following income producing property at a current market price of $ 1,490,000. The prospective buyer has estimated the expected cash flows over the next five years to be as follows: Year 1 = $88,000, Year 2 = $90,662, Year 3 = $91,923, Year 4 = $95,778, Year 5 = $97,000. Assuming that the required rate of return is 15% and the estimated proceeds from selling the property at the end of year five is $1,860,000, what is the NPV of the project? What is the IRR of the project?arrow_forward

- Troy will receive $8678 at the end of Year 2. At the end of the following two years, he will receive $8260 and $2665, respectively. What is the future value of these cash flows at the end of Year 6 if the interest rate is 4 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardCalculate the present value of the following future cash flows, rounding all calculations to the nearest dollar: 11. 12. 13. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) $5,000received in threeyears with interest of 10% $5,000received in each of the following threeyears with interest of 10% Payments of $2,000 $3,000 and $4,000received in years 12and 3respectively, with interest of 7% 11. Calculate the present value of $5,000 received in three years with interest of 10%. (Enter any factor amounts to three decimal places, X.XXX.) Future value 5000 × X Present value factor .751 = Present value = 3755 12. Calculate the present value of $5,000 received in each of the following three years with interest of 10%. (Enter any factor amounts to three decimal places, X.XXX.) Amount of each cash inflow X Annuity present value factor 5000 × 2.487 = Present value of an annuity 12435 13. Calculate the present value for…arrow_forwardIf you invest $8,800, what is your rate of return if you will receive the following cash flows at the end of these years: Yr. 1 $2,000; Yr. 2 $2,100; Yr. 3 $2,200; Yr. 4 $2,300; Yr. 5 $3,700?arrow_forward

- Assume that you are looking at three perpetuities. Perpetuity 1 (P₁) has annual cash flows of $850 in Years 1 through infinity (1-x) and a present value at Year 0 of $10.119.047619. Perpetuity 2 (P₂) has annual cash flows of $620 in Years 11 through infinity (11 - oo) and the same effective rate as Perpetuity 1. Perpetuity 3 (P3) has annual cash flows of $780 in Years 25 though infinity (25 - 0) and the same effective rate as Perpetuities 1 and 2. Given this information, determine the value of all three perpetuities when evaluated at Year 35. $239.599.69 O $248,272.58 $245,381.62 O$242,490.65 O $254,054.51arrow_forwardAssume that at the beginning of the year, you purchase an investment for $6,500 that pays $95 annual income. Also assume the investment's value has increased to $7,050 by the end of the year. a. What is the rate of return for this investment? Note: Input the amount as a positive value. Enter your answer as a percent rounded to 2 decimal places.arrow_forwardWhat is the future value at the end of year 3 of the following set of cash flows if the interest rate is 8%? (the cash flows occur at the end of each period) (round answer to nearest penny and enter in the following format 12345.67) Year 0 cash flow = 2000 Year 1 cash flow = 1700 Year 2 cash flow = 700 Year 3 cash flow = 900 Answer: کےarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education