FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:a.

1

B

4

5

6

7

8

9

0

-1

2

3

54

55

56

67

58

59

70

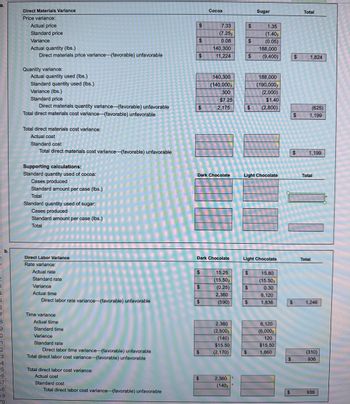

Direct Materials Variance

Price variance:

Actual price

Standard price

Variance

Actual quantity (lbs.)

Direct materials price variance (favorable) unfavorable

Quantity variance:

Actual quantity used (lbs.)

Standard quantity used (lbs.)

Variance (lbs.)

Standard price

Direct materials quantity variance (favorable) unfavorable

Total direct materials cost variance (favorable) unfavorable

Total direct materials cost variance:

Actual cost

Standard cost

Total direct materials cost variance (favorable) unfavorable

Supporting calculations:

Standard quantity used of cocoa:

Cases produced

Standard amount per case (lbs.)

Total

Standard quantity used of sugar:

Cases produced

Standard amount per case (lbs.)

Total

Direct Labor Variance

Rate variance:

Actual rate

Standard rate

Variance

Actual time

Direct labor rate variance (favorable) unfavorable

Time variance

Actual tiime

Standard time

Variance

Standard rate

Direct labor time variance (favorable) unfavorable

Total direct labor cost variance (favorable) unfavorable

Total direct labor cost variance:

Actual cost

Standard cost

Total direct labor cost variance (favorable) unfavorable

$

$

$

$

$

$

$

Cocoa

Dark Chocolate

$

7.33

(7.25)

0.08

140,300

11,224

Dark Chocolate

$

140,300

(140,000)

300

$7.25

2,175

15.25

(15.50)

(0.25)

2,360

(590)

2,360

(2,500)

(140)

$15.50

(2,170)

2,360

(140)

$

$

$

188,000

(190,000)

(2,000)

$1.40

$ (2,800)

Light Chocolate

$

$

Sugar

Light Chocolate

$

1.35

(1.40)

(0.05)

188,000

(9,400)

$

15.80

(15.50)

0.30

6,120

1,836

6,120

(6,000)

120

$15.50

1,860

$

$

$

$

$

Total

(625)

$ 1,199

1,824

1,199

Total

Total

1,246

(310)

936

936

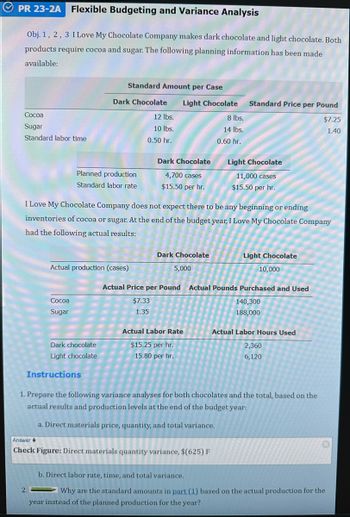

Transcribed Image Text:PR 23-2A Flexible Budgeting and Variance Analysis

Obj. 1, 2, 3 I Love My Chocolate Company makes dark chocolate and light chocolate. Both

products require cocoa and sugar. The following planning information has been made

available:

Cocoa

Sugar

Standard labor time

Planned production

Standard labor rate

Cocoa

Sugar

Standard Amount per Case

Dark Chocolate Light Chocolate

Actual production (cases)

Dark chocolate

Light chocolate

Instructions

12 lbs.

10 lbs.

0.50 hr.

Dark Chocolate

4,700 cases

$15.50 per hr.

I Love My Chocolate Company does not expect there to be any beginning or ending

inventories of cocoa or sugar. At the end of the budget year, I Love My Chocolate Company

had the following actual results:

Dark Chocolate

5,000

Actual Price per Pound

$7.33

1.35

Actual Labor Rate

$15.25 per hr.

15.80 per hr.

8 lbs.

14 lbs.

0.60 hr.

Standard Price per Pound

$7.25

1.40

Answer

Check Figure: Direct materials quantity variance, $(625) F

Light Chocolate

11,000 cases

$15.50 per hr.

Light Chocolate

10,000

Actual Pounds Purchased and Used

140,300

188,000

Actual Labor Hours Used

2,360

6,120

1. Prepare the following variance analyses for both chocolates and the total, based on the

actual results and production levels at the end of the budget year:

a. Direct materials price, quantity, and total variance.

b. Direct labor rate, time, and total variance.

Why are the standard amounts in part (1) based on the actual production for the

year instead of the planned production for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi i need help answering this question please! The last section got a bit cut off for part e but it is asking for the debit and credit accounts for the sale of boxed chocolate. Thanks!arrow_forwardPlease do not give solution in image format thankuarrow_forwardgoogle X S Dallas X B Score X Assignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false Ingredient Cocoa Sugar Milk Check My Work x M mybo X Standard Direct Materials Cost per Unit Billingsly Company produces chocolate bars. The primary materials used in producing chocolate bars are cocoa, sugar, and milk. The standard costs for a batch of chocolate (7,650 bars) are as follows: Quantity Price $0.30 per lb. $0.60 per lb. 150 gal. $1.20 per gal. Determine the standard direct materials cost per bar of chocolate. If required, round to the nearest cent. per bar 570 lbs. 180 lbs. Cenga x Cenga Cenga x B G Catho X + ChromeOS update for Android ... Update required today Nov 14 • 19m 6:30 :arrow_forward

- Need Help with this Questionarrow_forwardQuestion 4.1 White Wizard Company makes golf equipment for retailers around the world. Below you will find a number of activities and cost at White Wizard Company. Required: Please list the activity as either, “Batch-level”, “Unit-level”, “Product-level”, “Customer-level” or “Organization-sustaining”. Activity Level 1) A sales representative visits an old customer to check on how the company’s golf carts are working out and to try and make a new sale. 2) A steering wheel is installed in a golf cart. 3) The marketing department has a catalogue printed and then mails them to golf course managers. 4) Completed golf carts are individually tested on the company’s test track. 5) Molding and sanding each unit of product 6) An outside lawyer draws up a new generic sales contract for the company, limiting Go Pro’s liability…arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education