FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Use the above information to prepare a December 31 balance sheet for Ernst Consulting.

ERNST CONSULTING

Balance Sheet

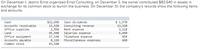

Transcribed Image Text:On December 1, Jasmin Ernst organized Ernst Consulting; on December 3, the owner contributed $83,540 in assets in

exchange for its common stock to launch the business. On December 31, the company's records show the following items

and amounts.

$12,650

13,520

2,850

45,940

17,530

8,110

83,540

$ 1,570

13,520

3,110

6,490

Cash

Cash dividends

Accounts receivable

Consulting revenue

Office supplies

Rent expense

Salaries expense

Telephone expense

Miscellaneous expenses

Land

Office equipment

Accounts payable

850

660

Common stock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Packard Company engaged in the following transactions during Year 1, its first year of operations: (Assume all transactions are cash transactions.) 1) Acquired $1.400 cash from the issue of common stock. 2) Borrowed $870 from a bank. 3) Earned $1,100 of revenues. 4) Paid expenses of $340 5) Paid a $140 dividend During Year 2. Packard engaged in the following transactions: (Assume all transactions are cash transactions.) 1) Issued an additional $775 of common stock. 2) Repaid $535 of its debt to the bank. 3) Earned revenues of $1,200. 4) Incurred expenses of $540. (5) Paid dividends of $190. The amount of total liabilities on Packard's Year 1 balance sheet is Multiple Choice с $870 $1,210 $610 $335 Drow 50 Nextarrow_forwardYou are the bookkeeper for Harley Inc., a newly formed corporation. Harley had the following transactions for their business: * Four shareholders contributed $40,000 ($10,000 each) in exchange for Harley common stock. * Harley purchased inventory for $5,000. Harley received an invoice for the inventory that is due in 30 days. What are the effects on Harley's accounting equation? A B D Based on the two transactions, Assets increased by $40,000, Liabilities decreased by $5,000 and Shareholder Equity increased by $45,000. Based on the two transactions, Assets increased by $45,000, Liabilities increased by $5,000 and Shareholder Equity increased by $40,000. C Based on the two transactions, Assets increased by $15,000, Liabilities increased by $5,000 and Shareholder Equity increased by $10,000. Based on the two transactions, Assets increased by $35,000, Liabilities decreased by $5,000 and Shareholder Equity increased by $40,000.arrow_forwardMultiple Choice $1,095 $990 $5,665 $5,365arrow_forward

- Required information [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,000 in assets in exchange for its common stock to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable Office supplies Office equipment Land Accounts payable Common stock Net income $ 11,360 Cash dividends 14,000 Consulting revenue 3,250 Rent expense 18,000 Salaries expense ERNST CONSULTING Income Statement Using the above information prepare a December income statement for the business. 46,000 Telephone expense 8,500 Miscellaneous expenses 84,000 For Month Ended December 31 $ 2,000 14,000 0 3,550 7,000 760 580arrow_forwardThe information on the following page was obtained from the records of Breanna Inc.: Accounts receivable $ 10,700 Accumulated depreciation 50,700 Cost of goods sold 121,000 Income tax expense 8,500 Cash 62,000 Net sales 203,000 Equipment 127,000 Selling, general, and administrative expenses 36,000 Common stock (8,000 shares) 94,000 Accounts payable 13,900 Retained earnings, 1/1/19 28,800 Interest expense 5,900 Merchandise inventory 38,500 Long-term debt 35,000 Dividends declared and paid during 2019 15,800 Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2019, and that all income statement items reflect activities that occurred during the year ended December 31, 2019. There were no changes in paid-in capital during the year.Required: Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2019, and a…arrow_forwardKrespy Corp. has a cash balance of $7,500 before the following transactions occur:- received customer payments of $965 supplies purchased on account $435 services worth $850 performed, 25% is paid in cash the rest will be billed corporation pays $275 for an ad in the newspaper bill is received for electricity used $235. dividends of $2,500 are distributed What is the balance in cash after these transactions are journalized and posted?arrow_forward

- On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $85,050 in assets in exchange for its common stock to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable Office supplies Office equipment Land Accounts payable Common stock $ 7,950 Cash dividends Consulting revenue Rent expense 17,450 4,200 19,060 Salaries expense 46,010 Telephone expense 9,430 Miscellaneous expenses 85,050 Exercise 1-20 (Algo) Preparing a balance sheet LO P2 Use the above information to prepare a December 31 balance sheet for Ernst Consulting. ERNST CONSULTING Balance Sheet < Prev 10 of 10 Next $ 3,070 17,450 0 4,530 8,090 880 690arrow_forwardP.nilesharrow_forwardRahularrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardMaben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $30,000 cash from the issue of common stock. 2. Borrowed $40,000 cash from National Bank. 3. Earned cash revenues of $48,000 for performing services. 4. Paid cash expenses of $45,000. 5. Paid a $1,000 cash dividend to the stockholders. 6. Acquired an additional $20,000 cash from the issue of common stock. 7. Paid $10,000 cash to reduce the principal balance of the bank note. 8. Paid $53,000 cash to purchase land. 9. Determined that the market value of the land is $75,000. e. Determine the net cash flows from operating activities, investing activities, and financing activities that Maben would report on the Year 1 statement of cash flows. Note: Enter cash outflows as negative amounts. Net cash flows from operating activities Net cash flows from investing activities Net cash flows from financing activitiesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education