FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

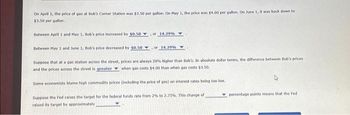

Transcribed Image Text:On April 1, the price of gas at Bob's Corner Station was $3.50 per gallon. On May 1, the price was $4.00 per gallon. On June 1, it was back down to

$3.50 per gallon.

Between April 1 and May 1, Bob's price increased by $0.50

Between May 1 and June 1, Bob's price decreased by $0.50

Suppose that at a gas station across the street, prices are always 20% higher than Bob's. In absolute dollar terms, the difference between Bob's prices

and the prices across the street is greater when gas costs $4.00 than when gas costs $3.50.

Some economists blame high commodity prices (including the price of gas) on interest rates being too low,

Suppose the Fed raises the target for the federal funds rate from 2% to 2.75%. This change of

raised its target by approximately

of 14.29% Y

or 14.29%Y

percentage points means that the Fed

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 1998, the average price of a gallon of gas was $1.02. Today, the average price of a gallon of gas is $2.81. At what annual rate has a gallon of gas increased over the last 20 years? (Answer as a percent. Enter only numbers and decimals in your response. Round to 2 decimal places.)arrow_forwardA farmer wants to sell future harvest of wheat at the current rate of Rs.18, but he fears that the wheat prices might fall in the next 3 months. In this case, he enters a contract with a grocery store for selling them 1000kgs of wheat at Rs.18 in 3 months. Draw the pay-off chart for the farmer.arrow_forwardGas was 3.21 a gallon on Monday. On Wednesday, gas prices increased 3.3%. On Friday, prices decreased 8.3%. What was the price of a gallon of gas on Friday?arrow_forward

- You sell $5 million dollars' worth of delivery trucks to Walmart on account and offer them a 2% discount if they pay within 15 days, with the invoice due after 45 days (2/15, n/45). Unfortunately, Walmart returns all of the trucks after one week because they discover that the model you sold them is not approved for use in California. Which of the following is part of the correct journal entry to make at the time that Walmart returns the trucks? DEBIT to Sales Returns of $5 million CREDIT to Sales Discount of $100,000 CREDIT to Accounts Receivable of $4.9 million CREDIT to Sales Revenue of $5 millionarrow_forwardThe EPA rating of a car is 21 mpg. If this car is driven 1,000 miles in 1 month and the price of gasoline remained constant at $3.07 per gallon, calculate the fuel cost (in dollars) for this car for one month. (Round your answer to the nearest cent.) $?arrow_forward* Your answer is incorrect. Sheridan Beverages sells bottles of premium champagne. It currently costs $41 per bottle to produce each bottle of champagne. Sheridan has overhead costs of $2700 per month, and expects to incur this amount each month. Sheridan produced and sold 100 bottles of champagne last month and expects to continue this production and sales pattern for the rest of this current year. Its closest competitor currently sells its bottles of champagne at $75.00 per bottle. What is the lowest price that Sheridan could sell each bottle of champagne for to make a monthly operating profit? $75.00 O $68.01 $65.01 O $78.00arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education