Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

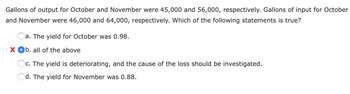

Transcribed Image Text:Gallons of output for October and November were 45,000 and 56,000, respectively. Gallons of input for October

and November were 46,000 and 64,000, respectively. Which of the following statements is true?

a. The yield for October was 0.98.

X Ob. all of the above

c. The yield is deteriorating, and the cause of the loss should be investigated.

Od. The yield for November was 0.88.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 54) For the current year ending April 30, MJW Company expects fixed costs of $70,000, a unit variable cost of $60, and a unit selling price of $95. (a) Compute the anticipated break-even sales (units). (b) Compute the sales (units) required to realize an operating profit of $8,000. (a) (b)arrow_forwardJuniper Design Ltd. of Manchester, England, provides design services to residential developers. Last year, the company had net operating income of $430,000 on sales of $1,500,000. The company's average operating assets for the year were $1,700,000 and its minimum required rate of return was 10%. Required: Compute the company's residual income for the year. Residual income < Prev 2 of 13 Next 近arrow_forwardGas was 3.21 a gallon on Monday. On Wednesday, gas prices increased 3.3%. On Friday, prices decreased 8.3%. What was the price of a gallon of gas on Friday?arrow_forward

- If variable cost of goods sold totaled $101,100 for the year (16,850 units at $6 each) and the planned variable cost of goods sold totaled $109,680 (13,710 units at $8 each), the effect of the unit cost factor on the change in contribution margin is: a.$18,840 decrease b.$33,700 increase c.$33,700 decrease d.$18,840 increasearrow_forwardThe Johnson Corporation reported a LIFO reserve of $45,000 at the end of the year. The beginning LIFO reserve was $60,000. The cost of goods sold was $260,000 under LIFO. The cost of goods sold under FIFO should be: Multiple Choice $245,000. $260,000. $275,000. $305,000.arrow_forwardLast year company A introduced a new product and sold 25,900 units at $97.00 per unit. The product variable expense $67.00 per unit with a fixed price expense of $835,500 per year. a. What is the product's net income or loss last year? b. What is the product break-even point in unit sales and dollar sales? c. Assume the company has conducted a market study that estimates it can increase sales by 5,000 units for each $2.00 reduction in its selling price. If the company would only consider increments of $2.00(e.g. $68,$66, etc) What is the maximum annual profit that can be earned on this product? What sales volume and selling price per unit generate the maximum profit? d. What would be the break-even point in unit sales and dollar sales using the selling price that was determined in the required letter c above? Thank you,arrow_forward

- Juniper Design Limited of Manchester, England, provides design services to residential developers. Last year, the company had net operating income of $490,000 on sales of $2,100,000. The company's average operating assets for the year were $2,300,000 and its minimum required rate of return was 11%. Required: Compute the company's residual income for the year. Residual incomearrow_forwardMace Company acquired equipment that cost $39,200, which will be depreciated on the assumption that the equipment will last six years and have a $1,400 residual value. Component parts are not significant and need not be recognized and depreciated separately. Several possible methods of depreciation are under consideration. Required: 1. Prepare a schedule that shows annual depreciation expense for the first two years, assuming the following (Round your answer to nearest whole dollar.): a. Declining-balance method, using a rate of 30%. b. Productive-output method. Estimated output is a total of 210,000 units, of which 24,000 will be produced the first year; 36,000 in each of the next two years; 30,000 the fourth year; and 42,000 the fifth and sixth years. c. Straight-line method. Year (a) DB 30% 1 2 (b) Productive Output (c) SL Darrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education