Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Don't use

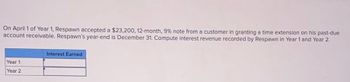

Transcribed Image Text:On April 1 of Year 1, Respawn accepted a $23,200, 12-month, 9% note from a customer in granting a time extension on his past-due

account receivable. Respawn's year-end is December 31. Compute interest revenue recorded by Respawn in Year 1 and Year 2.

Interest Earned

Year 1

Year 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan.arrow_forwardCee Co.s fiscal year begins April 1. At the beginning of its fiscal year, Cee Co. estimates that it will owe 17,400 in property taxes for the year. On June 1, its property taxes are assessed at 17,000, which it pays immediately. Prepare the related journal entries for April 1, May 1, and June 1. Then compute the monthly property tax expense that Cee Co. would record during June through March.arrow_forwardChemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms of the note show a maturity date of 36 months, and an annual interest rate of 8%. What is the accumulated interest entry if 9 months have passed since note establishment?arrow_forward

- Arvan Patel is a customer of Banks Hardware Store. For Mr. Patels latest purchase on January 1, 2018, Banks Hardware issues a note with a principal amount of $480,000, 13% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Banks Hardware Store for the following transactions. A. Note issuance B. Subsequent interest entry on December 31, 2018 C. Honored note entry at maturity on December 31, 2019.arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forwardAnderson Air is a customer of Handler Cleaning Operations. For Anderson Airs latest purchase on January 1, 2018, Handler Cleaning Operations issues a note with a principal amount of $1,255,000, 6% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Handler Cleaning Operations for the following transactions. A. Entry for note issuance B. Subsequent interest entry on December 31, 2018 C. Honored note entry at maturity on December 31, 2019arrow_forward

- The following transactions are from Ohlm Company. Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $13,700, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $7,300, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,700, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. April 16 Privet dishonored her note. May 31 Midnight Company dishonored its note. August 7 Accepted a(n) $7,250, 90-day, 12% note in granting a time extension on the past-due account receivable of Mulan Company. September 3 Accepted a $3,390, 60-day, 12% note in granting Noah Carson a time extension on his past-due account receivable. November 2…arrow_forwardon december 1st Daw company accepts a $18,000, 45-day, 10% note from a customer. 1. prepare the year end adjusting entry to record accrued interest revenue on december 31st. 2. prepare the entry required on the notes maturity date assuming it is honored. note: using 360 days a yeararrow_forwardYear 1 Dec. 16 Accepted a $10,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. 31 Made an adjusting entry to record the accrued interest on the Todd note.arrow_forward

- Following are transactions for Vitalo Company. 1 Accepted a $12,000, 180-day, 6% note from Kelly White in granting a time extension on her past-due account receivable. Nov. Dec. 31 Adjusted the year-end accounts for the accrued interest earned on the White note. Apr. 30 White honored her note when presented for payment. th and April 30 and use those calculated values to prepare your Complete the table to calculate the interest amounts at December 31st journal entries. (Do not round intermediate calculations. Use 360 days a year.) Complete this question by entering your answers in the tabs below. Interest General Amounts Journal Complete the table to calculate the interest amounts at December 31st and April 30th. November 1 January 1 Total Through Through Through Maturity December 31 April 30 Principal Rate (%) Time Total interestarrow_forwardPrepare journal entries to record transactions for Vitalo Company. Nov. 1 Accepted a $6,000, 180-day, 8% note from Kelly White in granting a time extension on her past-due account receivable. Dec. 31 Adjusted the year-end accounts for the accrued interest earned on the White note. Apr. 30 White honored her note when presented for payment.arrow_forwardThe following transactions are from Ohlm Company. (Use 360 days a year.) Year 1 Dec. 16 Accepted a $10,700, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 Feb. 14 Received Todd’s payment of principal and interest on the note dated December 16. Mar. 2 Accepted a(n) $6,600, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Co. 17 Accepted a(n) $3,300, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. Apr. 16 Privet dishonored her note. May 31 Midnight Co. dishonored its note. Aug. 7 Accepted a(n) $7,900, 90-day, 10% note in granting a time extension on the past-due account receivable of Mulan Co. Sep. 3 Accepted a(n) $3,210, 60-day, 11% note in granting Noah Carson a time extension on his past-due account…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub