Economics:

10th Edition

ISBN: 9781285859460

Author: BOYES, William

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

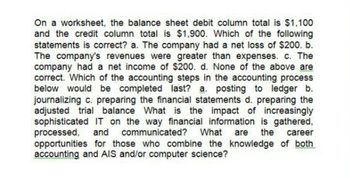

Transcribed Image Text:On a worksheet, the balance sheet debit column total is $1,100

and the credit column total is $1,900. Which of the following

statements is correct? a. The company had a net loss of $200. b.

The company's revenues were greater than expenses. c. The

company had a net income of $200. d. None of the above are

correct. Which of the accounting steps in the accounting process

below would be completed last? a. posting to ledger b.

journalizing c. preparing the financial statements d. preparing the

adjusted trial balance What is the impact of increasingly

sophisticated IT on the way financial information is gathered,

processed, and communicated? What are the career

opportunities for those who combine the knowledge of both

accounting and AIS and/or computer science?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Investors sometimes fear that a high-risk investment is especially likely to have low returns. Is this fear true? Does a high risk mean the return must be low?arrow_forwardHow is buying a house to live in a type of financial investment?arrow_forwardWhich has a higher average return over time: stocks, bands, or a savings account? Explain your answer.arrow_forward

- The Darkroom Windowshade Company has 100,000 shares of stock outstanding. The investors in the firm awn the following numbers of shares: investor 1 has 20,000 shares; investor 2 has 18,000 shares; investor 3 has 15,000 shares; investor 4 has 10,000 shares; investor 5 has 7,000 shares; and investors 6 through 11 have 5,000 shares each. What is the minimum number of investors it would take to vote to change the companys top management? If investors I and 2 agree to vote together, can they be certain of always getting their way in how the company will he run?arrow_forwardExplain how a company can fail when the safeguards that should be in place fail.arrow_forwardIf you owned a small firm that had become somewhat established, but you needed a surge of financial capital to cant out a major expansion, would you prefer to raise the funds through borrowing or by issuing stock? Explain your choice.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Economics Today and Tomorrow, Student Edition

Economics

ISBN:9780078747663

Author:McGraw-Hill

Publisher:Glencoe/McGraw-Hill School Pub Co

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning