FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

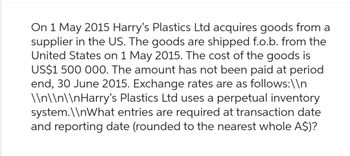

Transcribed Image Text:On 1 May 2015 Harry's Plastics Ltd acquires goods from a

supplier in the US. The goods are shipped f.o.b. from the

United States on 1 May 2015. The cost of the goods is

US$1 500 000. The amount has not been paid at period

end, 30 June 2015. Exchange rates are as follows:\\n

\\n\\n\\nHarry's Plastics Ltd uses a perpetual inventory

system.\\nWhat entries are required at transaction date

and reporting date (rounded to the nearest whole A$)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Arbie Corporation, a Philippine importer, purchased merchandise from T Company of Thailand for 300,000 baht on March 1, 2016, when the spot rate for a baht was P1.63. The accounts payable denominated in baht was not due until May 30, 2016, so Arbie Company immediately entered into a 90-day forward contract to hedge the transaction against exchange rate changes. The contract was made at a forward exchange rate of P1.65 per baht. Arbie settled the forward contract and the accounts payable on May 30, 2016 when the spot rate for a baht is P1.60. On the settlement of the forward contract on May 30, 2016, Arbie should record a forex gain loss of:arrow_forwardTurbo Corporation (a U.S.-based company) acquired merchandise on account from a foreign supplier on November 1, 2017, for 100,000 markkas. It paid the foreign currency account payable on January 17, 2018. The following exchange rates for 1 markka are known:a. How does the fluctuation in exchange rates affect Turbo’s 2017 income statement?b. How does the fluctuation in exchange rates affect Turbo’s 2018 income statement?arrow_forwardAustin Powers plc, the British subsidiary of a U.S. company reported cost of goods sold in Great Britain Pounds for the current year ended December 31. The beginning inventory was £18300, and the ending inventory was £15100. Purchases of £22600 were made evenly throughout the year. Spot rates for various dates are as follows: Date the beginning inventory was acquired Rate at the start of the year £1 = $1.11 £1 = $1.11 £1 = $1.14 £1 = $1.18 Average rate for the year Date the ending inventory was acquired Assume that the U.S.dollar is the functional currency of the British subsidiary. Given the facts above, the amount of cost of goods sold, restated in US $, that should appear in the consolidated income statement is: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. Your Answer:arrow_forward

- Stuff Company is a subsidiary of Pland Corporation and is located in Madrid, Spain, where the currency is the euro (€). Data on Stuff's inventory and purchases are as follows: Inventory, January 1, 20X7 Purchases during 20x7 Inventory, December 31, 20x7 The beginning inventory was acquired during the fourth quarter of 20X6, and the ending inventory was acquired during the fourth quarter of 20X7. Purchases were made evenly over the year. Exchange rates were as follows: Fourth quarter of 20x6 January 1, 20X7 Average during 20x7 Fourth quarter of 20x7 December 31, 20x7 € 226,000 866,000 194,000 €1-$1.29015 €1$ 1.32030 € 1$ 1.39655 €1-$1.45000 € 1$ 1.47280 Required: a. Show the remeasurement of cost of goods sold for 20X7, assuming that the U.S. dollar is the functional currency. Note: Round your intermediate calculations and final answer to nearest dollar amount. a. Cost of goods sold b. Cost of goods sold b. Show the translation of cost of goods sold for 20X7, assuming that the euro is…arrow_forwardBrandlin company of anaheim, california, sells parts to a foreign customer on december 1, 2017, with payment of 24,000 korunas to be received on march 1, 2018. Brandlin enters into a forward contact on december 1, 2017 to sell 24,000 korunas on march 1, 2018. Relevant exchange rates for the korunas on various dates are as follow: date spot rate forward rate december 1, 2017 4.20 4.275 december 31, 2017 4.30 4.400 march 1, 2018 4.45 n/a brandli's incremental borrowing rate is 12 percent. The present value factor for two months at annual interest rate of 12 percent (1 percent per month) is 0.9803. Brandlin must close its books and prepare financial statements at december 31. 1. Assuming that brandlin designates the forward contract as a cash flow hedge of a foreign currency receivable and recognizes any premium or discount…arrow_forwardA U.S. company's foreign subsidiary had these amounts in local currency units (LCU) in 2024: Cost of goods sold Beginning inventory Ending inventory LCU 5,230,000 536,000 622,000 The average exchange rate during 2024 was $1.30 = LCU 1. The beginning inventory was acquired when the exchange rate was $1.10 = LCU 1. Ending inventory was acquired when the exchange rate was $1.40 LCU 1. The exchange rate on December 31, 2024, was $1.45 = LCU 1. Required: Assuming that the foreign country is highly inflationary, determine the amount at which the foreign subsidiary's cost of goods sold should be reflected in the U.S. dollar income statement. Cost of goods soldarrow_forward

- On 1 March 2025, Quality Furniture Importers acquires furniture from a supplier in New Zealand. The furniture is shipped f.o.b. from New Zealand on 1 September 2025. The cost of the furniture is NZD $800 000. The amount has not been paid at 30 September 2025 and exchange rates are as follows: 1 September 2025 A$1.00 = NZD $1.08 30 September 2025 A$1.00 = NZD $1.06 Required: What is the amount payable at 1 September and 30 September 2025 in Australian dollars? (Rounded to the nearest whole A$.) ANSWER a): Did the Australian dollar strengthen or weaken? ANSWER b): Prepare the journal entries for the above dates showing the amount of exchange gain or lossarrow_forwardplease step by step solution.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education