FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

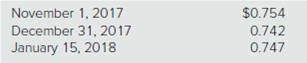

Turbo Corporation (a U.S.-based company) acquired merchandise on account from a foreign supplier on November 1, 2017, for 100,000 markkas. It paid the foreign currency account payable on January 17, 2018. The following exchange rates for 1 markka are known:

a. How does the fluctuation in exchange rates affect Turbo’s 2017 income statement?

b. How does the fluctuation in exchange rates affect Turbo’s 2018 income statement?

Transcribed Image Text:November 1, 2017

December 31, 2017

January 15, 2018

$0.754

0.742

0.747

Expert Solution

arrow_forward

Step 1

Step by stepSolved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Last year, the Mexican peso/U.S. dollar exchange rate was MXN13.3769/$. Today, the exchange rate is MXN16.4196/$. A U.S. firm has total assets worth MXN14,680,000 located in Mexico that did not change in value over the year. What was the change in the value of the assets in dollars on the company's U.S. balance sheet? $187,009.61 −$187,009.61 $203,360.75 $0 −$203,360.75arrow_forwardA U.S. company sells a product to a British company with the transaction listed in British pounds. On the date of the sale, the transaction total of $14,500 is billed as £10,000, reflecting an exchange rate of 1.45 (that is, $1.45 per pound). Prepare the entry to record (1) the sale and (2) the receipt of payment in pounds when the exchange rate is 1.35.arrow_forward1. On November 1, 2020, an entity acquired on account goods from a foreign supplier at a cost of $3,000. The accounts payable are paid on January 30, 2021. On December 1, 2020, an entity sold on account goods to a foreign customer at a selling price of $2,500. The accounts receivable is collected on February 28, 2021. The entity is operating in Philippine economy wherein the functional currency is the Philippine Peso. The following exchange rates are provided Buying spot rate Selling spot rate November 1, 2020 P40 P42 December 1, 2020 39 40 December 31, 45 45.5 2020 January 30, 2021 45.5 46 February 28, 2021 46 46.5 What is the carrying amount of monetary asset on December 31, 2020?arrow_forward

- Company X is a U.S.-based IT company with operations and earnings in a number of foreign countries. The company's profits by subsidiary, in local currency (in millions), are shown in the following table for 2019 and 2020. Net Income Japanese Subsidiary Britih Subsidiary 2019 JPY 200 GBP 100.00 2020 JPY 1,480 GBP 108.40 The average exchange rate for each year, by currency pairs, is the following. Exchange Rate USD = 1 GBP JPY = 1 USD 2019 97.57 1.5646 2020 90.88 1.6473 Use the above data, Students answer the following questions. a. What is Company X's consolidated profits in U.S. dollars in 2019 and 2020? b. If the same exchange rates are used for both years, what is the change in corporate earnings on a "constant currency" basis? c. Using the results of the constant currency analysis in part b, is it possible to separate Company X's growth in earnings between local currency earnings and foreign exchange rate impacts on a consolidated basis?arrow_forwardBrandt Corp. (a U.S.-based company) sold parts to a South Korean customer on December 1, 2020, with payment of 10 million South Korean won to be received on March 31, 2021. The following exchange rates apply: Date Spot Rate Forward Rate(to March 31, 2021) December 1, 2020 $ 0.0035 $ 0.0034 December 31, 2020 0.0033 0.0032 March 31, 2021 0.0038 N/A 1. Assuming that Brandt did not hedge his foreign exchange risk, how much foreign exchange gain or loss should it report on its 2020 income statement with regard to this transaction? a. 3000 gain b. 2000 loss c. 5000 gain d. 1000 loss 2. Assuming that Brandt entered into a forward contract to sell 10 million South Korean won on December 1, 2020, as a fair value hedge of a foreign currency receivable, what is the net impact on its net income in 2020 resulting from a fluctuation in the value of the won? Brandt amortizes forward points on a monthly basis using a straight-line method. Ignore…arrow_forward1 . PL Co purchased goods on credit from a US supplier costing $US 225,000 on 5th June 2020 when the exchange rate was A$1 = US0.69 . On 30 June 2020, balance date , the exchange rate was A$1 = US0.72 . PL Co paid the US supplier on 7th July 2020 when the exchange rate was A$1 = 0.74. Required : Prepare the journal entries for the abovearrow_forward

- ASSUME THAT THE U.S. DOLLAR IS THE FUNCTIONAL CURRENCY. Ruthie Inc. had a debit adjustment of $7900 for the year ended December 31, 2019, from restating its foreign subsidiary's accounts from their local currency units into U.S. dollars. Additionally, Ruthie had a receivable from a foreign customer. It is denominated in the customer's local currency. On December 31, 2018, this receivable for 300,000 local currency units (LCU) was correctly included in Ruthie's balance sheet at $124200. When the receivable was collected on February 15, 2019, the U.S. dollar-equivalent was $122200. In Ruthie's 2019 consolidated statement of income, how much should be reported as foreign exchange gain/(loss) in computing net income? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. IF THE NUMBER IS NEGATIVE, TYPE -1000 INSTEAD OF ($1,000) Your Answer:arrow_forwardOn October 15, 2009, Talud Limited, a Canadian company, sold a custom er in England for €10,000, when the exchange rate was €1 = $2.20. On December 31, 2009, the exchange rate at Talud's year-end was €1 = 2.25 and dropped to €1 = 2.10 on the settlement date, February 15, 2010. Record journal entries on the date of sale, year-end adjustment, and settlem ent date.arrow_forwardASSUME THAT THE LOCAL CURRENCY UNIT IS THE FUNCTIONAL CURRENCY. Cade Inc. had a debit adjustment of $6400 for the year ended December 31, 2019, from restating its foreign subsidiary's accounts from their local currency units into U.S. dollars. Additionally, Cade had a receivable from a foreign customer. It is denominated in the customer's local currency. On December 31, 2018, this receivable for 300,000 local currency units (LCU) was correctly included in Cade's balance sheet at $121000. When the receivable was collected on February 15, 2019, the U.S. dollar-equivalent was $123800. In Cade's 2019 consolidated statement of income, how much should be reported as foreign exchange gain/(loss) in computing net income? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. IF THE NUMBER IS NEGATIVE, TYPE -1000 INSTEAD OF ($1,000) Your Answer:arrow_forward

- ABC Corp., a US corporation, purchased goods on credit from a British company on April 8, 2007. ABC made a payment of 10,000FC on May 8, 2007. The exchange rate was $1= FC .50 on April 8 and $1= FC .60 on May 8. What amount of foreign exchange gain or loss should be recognized on May 8 ?arrow_forwardAssume that Gilligan Ltd enters into a contract to buy inventory from an overseas supplier. On1 February 2023 it acquires the material at a cost of US$500,000 payable in two months’ time.The exchange rate at the time is A$1 = US$1.15. The actual debt is considered to be a tradepayable and is a primary financial instrument. The exchange rate on 1 April 2023 is A$1 =US$1.09.Required:(a) As the debt is payable in two months’ time describe the potential risk to Gilligan Ltd.(b) Assume that McCoy Ltd is concerned about possible adverse exchange ratemovements, what action could the company take?arrow_forward5. On April 10, 2022, when the spot rate is $1.20/€, a U.S. company sells merchandise to a customer in Italy at a price of € 100,000. The spot rate is $1.21/€ on June 30, the company's year-end. Payment, in euros, is received on August 10, 2022, when the spot rate is $1.18/€. What amount does the company report as accounts receivable on its June 30, 2022, balance sheet? Select one: a. $118,000 b. $121,000 c. $100,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education