FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please don't give solution in image format..

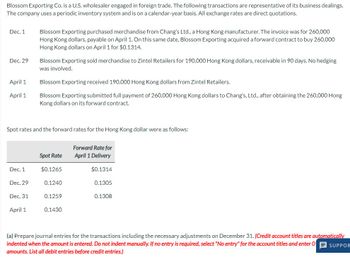

Transcribed Image Text:Blossom Exporting Co. is a U.S. wholesaler engaged in foreign trade. The following transactions are representative of its business dealings.

The company uses a periodic inventory system and is on a calendar-year basis. All exchange rates are direct quotations.

Dec. 1

Dec. 29

April 1

April 1

Blossom Exporting purchased merchandise from Chang's Ltd., a Hong Kong manufacturer. The invoice was for 260,000

Hong Kong dollars, payable on April 1. On this same date, Blossom Exporting acquired a forward contract to buy 260,000

Hong Kong dollars on April 1 for $0.1314.

Blossom Exporting sold merchandise to Zintel Retailers for 190,000 Hong Kong dollars, receivable in 90 days. No hedging

was involved.

Blossom Exporting received 190,000 Hong Kong dollars from Zintel Retailers.

Blossom Exporting submitted full payment of 260,000 Hong Kong dollars to Chang's, Ltd., after obtaining the 260,000 Hong

Kong dollars on its forward contract.

Spot rates and the forward rates for the Hong Kong dollar were as follows:

Forward Rate for

April 1 Delivery

Spot Rate

Dec. 1

$0.1265

$0.1314

Dec. 29

0.1240

0.1305

Dec. 31

0.1259

0.1308

April 1

0.1430

(a) Prepare journal entries for the transactions including the necessary adjustments on December 31. (Credit account titles are automatically

indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O SUPPOR

amounts. List all debit entries before credit entries.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is lossy compression? a MP3 is compressed music. b Reduce the size of files by taking out less important information. It drops nonessential information to decrease file size. Reduce the size of the file without losing any information and the original file can be reconstructed from a compressed version. d Joint Photographic Experts Group JPEG) is a compressed image. O O O Carrow_forwardWhat are some limitations of using the direct write-off method?arrow_forwardhelp please, the answers I put are not correctarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education