Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

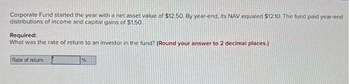

Transcribed Image Text:Corporate Fund started the year with a net asset value of $12.50. By year-end, its NAV equaled $12.10. The fund paid year-end

distributions of income and capital gains of $1.50.

Required:

What was the rate of return to an investor in the fund? (Round your answer to 2 decimal places.)

Rate of return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- On May 29, 2021, the market value of the investments contained in the Apple Growth Fund, a mutual fund, was $28,400,000. Liabilities for the fund were $2,840,000. If the fund had 1,730,000 shares outstanding, calculate the net asset value per share. Round your answer to the nearest cent. smarrow_forwardAn Active manager of AMF Fund has delivered the following six -monthly returns in the last 5 Years versus the Benchmark NIFTY Calculate the Information Ratio & Interpret the same ? . Also calculate the annualized Information Ratio. ? Period (Semi Annual) Return of Fund % (Rp) NIFTY Return % (Rb) 1 4.5 5.5 2 3.25 3.75 3 7.25 6.5 4 2.45 2.15 5 -1.05 -1.25 6 -0.35 0.25 7 1.15 -2.5 8 5.45 5.75 9 3.9 4.2 10 4.8 -0.1arrow_forwardAn investor is evaluating the historical performance of an investment fund. The following annual returns are provided to the investor: Fund Value Year 0 $260 Year 1 286 Year 2 328 Year 3 315 Year 4 310 Year 5 305 Required: a. Calculate the investment returns for each year. b. Compute the arithmetic mean return. c. Calculate the geometric mean return.arrow_forward

- A year ago, an investor bought 100 shares of a mutual fund at $7.50 per share. This year, the fund paid dividends of $0.75 per share capital gains of $0.50 per share. a. Find the investor's holding period return, given that this no-load fund now has a net asset value of $8.20. b. Find the holding period return, assuming all the dividends and capital gains distributions are reinvested into additional shares of the fund at an average price of $7.75 per share.arrow_forwardA mutual fund with K100 million in assets at the start of the year and with 10 million shares outstanding invests in a portfolio of stocks that provides no income but increases in value by 10 %. Required: a. What is the rate of return in the fund? b. If a fund has an initial NAV of K20 at the start of the month makes income distributions K0.15 and capital gain distributions of K0. 05 and ends the month with NAV of K20.10. Calculate the monthly rate of return. c. An equity fund has a front end load of 4 % and special fees of 0.5% annually as well as back-end fees that start at 5 % and fall by 1 % for each full year the investor holds the portfolio until the fifth year. Assuming the rate of return on the fund net of operating expenses is 10 % annually, what will be the value of a K10 000 investment in the equity fund shares if the shares are sold after 1 year, 4 years and 10 years?arrow_forwardA mutual fund had an NAV of $26.4000 a year ago. During the year the fund paid dividends of $1.4000 and had a capital gains distribution of $1.2000 per share. Find the HPR with the current NAV at $28.8400? O 14.5% 17.5% 19.1% O 23.6%arrow_forward

- You deposit $600 today into a fund that you intend to leave invested for 6 years. The fund earns 6% interest compounded annually. Indicate the inputs to be entered into the financial calculator keys. What is the value of the fund to be accumulated at the end of year 6? (Round future value answer to two decimal places (e.g., 52.75) and interest rate to one decimal place (e.g., 527.5).) Inputs Calculator N Keys Future value $ 6 I 6 PV 600arrow_forwardAn investment manager had a fund with a value of 100,000 on December 31, 2017. On June 30, 2018 that fund had dropped in value to 90,000 and a new deposit of 110,000 was received. On December 31, 2018 the account balance was 220,000. Find the time-weighted rate of return for 2018 Find the exact (to five decimal points) dollar-weighted rate of return for 2018arrow_forwardYou invested in the no-load Best Mutual Fund one year ago by purchasing 900 shares of the fund at the net asset value of $19.44 per share. The fund distributed dividends of $1.88and capital gains of $2.12. Today, the NAV is $21.36. What was your holding period return?arrow_forward

- 4. ( Fund A earns interest at a simple rate of i% a year. $P is invested in fund A. (a) What is the accumulated value in fund A at time t years. (b) Calculate the effective rate of interest in year 1, year 2 and year 3. Solution:arrow_forwardDuring the past 10 years, the percent returns on two mutual funds (aggressive and passive) expressed in percentages were as follows: Year -10 -9 -8 -7 -6 -5 -4 -3 -2 Last Year Aggressive Fund 0% 6% 1% 2% 8% 1% 5% 1% 1% 5% Note that this is a sample of returns. a) Compute the expected return for the two funds. Round your answers to two decimal places. Aggressive = Number Passive = Number b) Compute the variance and standard deviation of the returns of the two funds. Round your answers to two decimal places. Variance: Aggressive = Number Passive = Number Standard Deviation: Aggressive = Number Passive = Number Passive Fund 4% 4% 4% 3% 4% 2% 2% 3% 4% 2% % %arrow_forwardWhen Fund H started on 1/1/21, it had $318,225,000 in assets under management (AUM). The annual holding period return was 3.65% in 2021, -20.48% in 2022, and 31.48% in 2023. Some investors redeemed shares, resulting in a net cash outflow of $120,204,000 on 12/31/21. There were also new investors buying the fund shares, resulting in a net cash inflow of $27,885,000 on 12/31/22. The dollar- weighted average return of the fund is % per year during the three-year period. Multiple Choice O O O O O 3.55 3.86 5.12 4.32 2.97arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education