FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

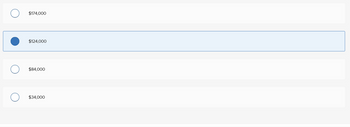

Question

Olly & Sons is a construction company. The company started the year with $90,000 in the land account. During Year 2, Olly & Sons purchased multiple lots of land. The first lot cost $25,000, the second lot cost $28,000 and the third lot cost $31,000. The company sold one lot that had a cost of $50,000 for $50,000. What is the ending balance in the land account?

Transcribed Image Text:$174,000

$124,000

$84,000

$34,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Northwest Delivery Company acquired an adjacent lot to construct a new warehouse, paying $75,000 and giving a short-term note for $90,000. Legal fees paid were $2,500, delinquent taxes assumed were $22,400, and fees paid to remove an old building from the land were $14,500. Materials salvaged from the demolition of the building were sold for $7,500. A contractor was paid $660,000 to construct a new warehouse. Determine the Cost of the land to be reported on the balance sheet.arrow_forwardDaly Publishing Corporation recently purchased a truck for $43,000. Under MACRS, the first year's depreciation was $8,600. The truck driver's salary in the first year of operation was $61,800. The company's tax rate is 30 percent. Required: 1-a. Calculate the after-tax cash outflow for the acquisition cost and the salary expense. 1-b. Calculate the reduced cash outflow for taxes in the first year due to the depreciation. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Calculate the after-tax cash outflow for the acquisition cost and the salary expense. After-Tax Cash Outflow Acquisition cost Salary expensearrow_forwardStilton Ltd purchases a new delivery truck for $80,000 . The logo of the company is painted on the side of the truck for $1,000 . The truck registration is $500 , and a 12 -month accident insurance policy is $1,500 . The truck undergoes safety testing for $660 . What does Stilton Ltd record as the cost of the new truck? Select one: a. $81,660 . b. $80,000 . c. $83,060 . d. $81,000arrow_forward

- Franklin Manufacturing Company was started on January 1, year 1, when it acquired $81,000 cash by issuing common stock. Franklin immediately purchased office furniture and manufacturing equipment costing $7,700 and $24,900, respectively. The office furniture had an eight-year useful life and a zero salvage value. The manufacturing equipment had a $3,600 salvage value and an expected useful life of three years. The company paid $11,200 for salaries of administrative personnel and $15,500 for wages to production personnel. Finally, the company paid $16,110 for raw materials that were used to make inventory. All inventory was started and completed during the year. Franklin completed production on 4,900 units of product and sold 3,970 units at a price of $15 each in year 1. (Assume that all transactions are cash transactions and that product costs are computed in accordance with GAAP.) Required a. Determine the total product cost and the average cost per unit of the inventory produced in…arrow_forwardVijayarrow_forwardValaarrow_forward

- Thomas Ramsey is the owner of Atlas Magazine. On January 1, Atlas Magazine purchased printing equipment for printing $89,000. The equipment is estimated to have a useful life of 4 years and a salvage value of $17,000. Thomas estimates the equipment will produce 500,000 magazines during its useful life. It produces the following units: 125,000 in year 1, 150,000, in year 2, 75,000 in year 3, and 100,000 in year 4. Required: Record your answers below, use the following page to show your work 1. Calculate depreciation expense and the book value at the end of the third year using the straight-line depreciation method. Depreciation expense: Book Value: 2. Calculate depreciation expense and the book value at the end of the second year usin the double declining balance depreciation method. Depreciation expense:_ X x Book Value: 49,000 × 44, 500 = 39605 Xarrow_forward2. A vehicle is purchased by ABC Co. The vehicle cost $35,000 and has a useful life of 5 years or 100,000 miles with a salvage value of $3,000 at the end of its useful life. There is a 6 percent sales tax due on the vehicle upon registration with the Registry of Motor Vehicles, and the registration fee is $120 in order to get new plates. Every year a $75 dollar license renewal fee is charged by the Registry. After six months, the vehicle is brought to the dealer for a $75.00 oil and filter change. In its six months of operation, it has a flat tire that cost $35 to repair. Two years down the road, the engine of the truck seizes and an engine replacement is performed, which cost $3,000. With regard to the above example, which of these expenditures are capitalized, and which are expensed? The cost of the vehicle The sales tax The plate and registration fee Annual registration fee The oil and filter change The flat tire repair The engine replacementarrow_forwardOn October 29th, Raider Red acquired a printer and office chairs for $1,000. The printer has a selling price of $700 and the office chairs have a selling price of $800. Determine the historical costs for the office chairs acquired by Raider Red:arrow_forward

- Joy's House of Cheese (stocks Cougar Cheese) purchases a tract of land and an existing building for $940,000. The company plans to remove the old building and construct a new building on the site in a few months. In addition to the purchase price, Joy's pays closing costs, including title insurance of $2,400. The company also pays $12,800 in property taxes, which includes $8,400 of back taxes (unpaid taxes from previous years) paid by Joy's on behalf of the seller and $4,400 due for the current fiscal year after the purchase date. Shortly after closing, the company pays a contractor $47,000 to tear down the old building and remove it from the site. Joy is able to sell salvaged materials from the old building for $3,800 and pays an additional $10,400 to level the land to make it ready for use. Required: Determine the amount Joy's should record as the cost of the land. (Amounts to be deducted should be indicated by a minus sign.) Total cost of the land $arrow_forwardKelly Company acquired an iron mine for $2,349,000. Kelly paid a $1,000 filing fee with the county recorder, $50,000 license fee to the state, and $100,000 for a geologic survey. It was estimated that the land would have a value of $400,000 after completion of the mining operations, and that 1,000,000 tons of iron ore could be extracted from the mine. During the first year of operations, 100,000 tons of iron ore were extracted and 80,000 tons of iron ore were sold for $5 per ton. How much gross profit is shown on the Income Statement for the current period? What is the amount of depletion to record in the current period?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education