FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

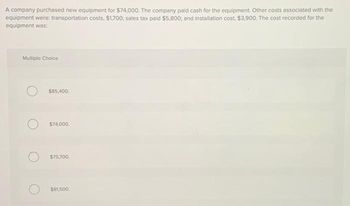

Transcribed Image Text:A company purchased new equipment for $74,000. The company paid cash for the equipment. Other costs associated with the

equipment were: transportation costs, $1,700; sales tax paid $5,800; and installation cost, $3,900. The cost recorded for the

equipment was:

Multiple Choice

$85,400

$74,000.

$75,700.

$81,500.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject - account Please help me. Thankyou.arrow_forwardCullumber Company purchased equipment and these costs were incurred: Cash price $71000 Sales taxes 2700 Insurance during transit 800 Installation and testing 850 Total costs $75350 Cullumber will record the acquisition cost of the equipment as $74500. $73700. $75350. $71000.arrow_forwardprovide him with cost data on the company's elevator. This information is presented below. Old Elevator New Elevator Purchase price $103,000 $159,000 Estimated salvage value 0 0 Estimated useful life 5 years 4 years Depreciation method Straight-line Straight-line Annual operating costs other than depreciation: Variable Fixed $35,800 $10,000 23,300 8,600 Annual revenues are $240,000, and selling and administrative expenses are $30,000, regardless of which elevator is used. If the old elevator is replaced now, at the beginning of 2022, Richter Condos will be able to sell it for $24,300. (a) Determine any gain or loss if the old elevator is replaced. $arrow_forward

- Blossom Company incurs these expenditures in purchasing a truck: cash price $26,470, accident insurance (during use) $2,080, sales taxes $1.660, motor vehicle license $570, and painting and lettering $2.190 What is the cost of the truck? The cost of the truck $arrow_forwardStoney Run Construction Company (U.S. GAAP) enters into a 3-year contract to build a new warehouse facility. Information for Years 1, 2, and 3 is shown below: Year 1 Year 2 Year 3 Sale price $2,800,000 $2,800,000 $2,800,000 Estimated costs 1,600,000 2,000,000 2,000,000 Costs incurred to date (paid in cash) 400,000 900,000 2,000,000 Billed to date 250,000 1,150,000 2,800,000 Received in cash to date 190,000 950,000 2,800,000 Record the necessary journal entries for Years 1-3.arrow_forward1. Anniston Company purchased equipment and incurred the following costs: Purchase price $52,000 Cost of trial runs 750 Installation costs 250 Sales tax 2,600 What is the cost of the equipment? a.$52,000 b.$54,600 c.$54,850 d.$55,600arrow_forward

- Owearrow_forwardA company's research department incurred $1,000,000 in material, labor, and overhead costs to construct a prototype of a new product and $100,000 to test and modify the prototype. Which of the following statements correctly describes the accounting treatment of prototype costs incurred by the company? 1. Capitalize $1,100,000 and amortize it over the expected sales life of the new product 2. Capitalize $1,100,000 and amortize it over the life of the prototype. 3. Capitalize $1,000,000 and amortize it over the life of the prototype and expense $100,000 as incurred. 4. Expense $1,100,000 as incurred.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Question 2. Using terms of 2/10 and n/30, Granite Company spent $133,000 on a machine. The equipment was delivered FOB the shipment location, and the freight charged $3,300. Special installation and electrical connections for the machine are necessary and will cost $11,300. Damages of $2,800 were incurred during equipment installation. Assuming Granite paid during the discount period, calculate the cost reported for this machine. A. $163,000. B. $154,140. C. $150,340. D. $154,440. E. $144,940.arrow_forward28. A company paid $150,000, plus a 6% commission, and $4,000 in closing costs for a property. The property included land appraised at $87,500, land improvements appraised at $35,000, and a building appraised at $52,500. What should be the allocation of this property's costs in the company's accounting records? A. Land $84,100; Land Improvements, $30,000; Building, $48,900B. Land $75,000; Land Improvements, $30,800; Building, $46,200C. Land $81,500; Land Improvements, $32,600; Building, $48,900D. Land $82,700; Land Improvements, $32,600; Building, $47,700arrow_forwardCorristan Company purchased equipment and incurred these costs: Cash price $24,000 Sales taxes 1,200 Insurance during transit 200 Annual maintenance costs 400 Total costs $25,800 What amount should be recorded as the cost of the equipment? $25,200 $25,800 $24,000 $25,400 O Oarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education