FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

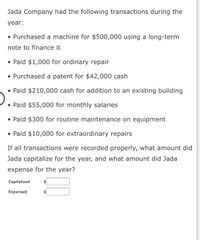

Transcribed Image Text:Jada Company had the following transactions during the

year:

• Purchased a machine for $500,000 using a long-term

note to finance it

• Paid $1,000 for ordinary repair

• Purchased a patent for $42,000 cash

• Paid $210,000 cash for addition to an existing building

• Paid $55,000 for monthly salaries

• Paid $300 for routine maintenance on equipment

• Paid $10,000 for extraordinary repairs

If all transactions were recorded properly, what amount did

Jada capitalize for the year, and what amount did Jada

expense for the year?

Capitalized

$4

Expensed

Expert Solution

arrow_forward

Introduction

Capitalized Cost:

Capitalized cost is an expense that is added to the cost basis of fixed assets on a company's balance sheet. Capitalized costs are not expensed in the period they were incurred but recognized over a period of time via depreciation or amortization.

Expense Incurred:

An incurred expense is a cost that a business incurs when it purchases goods or services on credit. For example, the purchase may be made either through credit.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Anchor Company purchased a manufacturing machine with a list price of $88,000 and received a 2% cash discount on the purchase. The machine was delivered under terms free on board (FOB) shipping point, and transportation costs amounted to $2,800. Anchor paid $3,900 to have the machine installed and tested. Insurance costs to protect the asset from fire and theft amounted to $5,000 for the first year of operations. What is the cost of the machine? Multiple Choice O O O O $92,940 $97,940 $89,040 $86,240arrow_forwardBluestone Company had three intangible assets at the end of the current year: A patent purchased this year from Miller Company on January 1 for a cash cost of $1,600. When purchased, the patent had an estimated life of 8 years. A trademark was registered with the federal government for $10,000. Management estimated that the trademark could be worth as much as $240,000 because it has an indefinite life. Computer licensing rights were purchased this year on January 1 for $42,000. The rights are expected to have a six-year useful life to the company. Required: Compute the acquisition cost of each intangible asset. Compute the amortization of each intangible for the current year ended December 31. Show how these assets and any related expenses should be reported on the balance sheet and income statement for the current year.arrow_forwardMiller Corp. purchased a new machine for its factory. The following lists shows the various expenditures for the machine during its first year: • Base purchase price, $75.000 • Sales tax incurred at the time of purchase, $4,000 • Installation charges for the machine, $700 • Insurance costs incurred while the machine was being shipped, $200 • Insurance costs for the first year of the machine's service life, $500 • Ordinary repairs and maintenance costs during the first year of the machine's service life, $1,200 Question: What should be the capitalized cost of the machine? Answer: $ (do not use commas or a decimal in the answer)arrow_forward

- GRACE Co. recently acquired two items of equipment. Acquired a press at an invoice price of P5,000,000 subject to a 5% cash discount which was taken. Costs of freight and insurance during shipment were P50,000 and installation cost amounted to P200,000. The cost of testing the equipment is P50,000 while the administration cost has amounted to P30,000. Acquired a welding machine at an invoice price of P3,000,000 subject to a 10% cash discount which was not taken. Additional welding supplies were acquired at a cost of P100,000. Required: What is the total increase in the equipment account as a result of the transactions?arrow_forwardRequired information [The following information applies to the questions displayed below.] Precision Construction entered into the following transactions during a recent year. January 2 Purchased a bulldozer for $282,000 by paying $36,000 cash and signing a $246,000 note due in five years. January 3 Replaced the steel tracks on the bulldozer at a cost of $36,000, purchased on account. The new steel tracks increase the bulldozer's operating efficiency. January 30 Wrote a check for the amount owed on account for the work completed on January 3. February 1 Repaired the leather seat on the bulldozer and wrote a check for the full $2,400 cost. March 1 Paid $13,200 cash for the rights to use computer software for a two-year period. Required: 1-a. Complete the table below, for the above transactions. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign.) Date Assets = Liabilities + Stockholders' Equity January 02…arrow_forwardThe following information relating to an investment in equipment has been extracted from the books of LRB Ltd: The total purchase price is $78,560. Net sales revenue (relating to the equipment): Year-1 $38,000; Year-2 $29,000; Year-3 $24,000; and Year-4 $20,000. The required rate of return is 12%. The expected salvage value is $14,266 at the end of year 4. The depreciation rate is 18% straight line. If the applicable tax rate is 32%, calculate the tax amount in the fourth year relating to the sale of the equipment only. Use excel spreadsheet to Answer.arrow_forward

- Want Answer please providearrow_forwardVinubhaiarrow_forwardOkl Company pays $283,000 for equipment expected to last four years and have a $30,000 salvage value. Prepare journal entries to record the following costs related to the equipment. 1. Paid $14,150 cash for a new component that increased the equipment's productivity. 2. Paid $3,538 cash for minor repairs necessary to keep the equipment working well. 3. Paid $7,100 cash for significant repairs to increase the useful life of the equipment from four View transaction list Journal entry worksheet seven years. Journal entry worksheet Journal entry worksheetarrow_forwardMidnight, Inc. incurred the following costs related to equipment purchased on January 1, 2022: • Purchased equipment for $80,000, terms 2/ 10, net 30. Paid for the equipment on January 5, 2022. • Had the equipment installed and paid the installer $5,000. • Paid the freight bill for the truck that delivered the equipment for $800. • Advertised a new product that will be produced by the new equipment, $1,900. • Sales taxes paid on the equipment amounted to $6,000. • During installation, a part was broken off and had to be replaced for $2,700. • Midnight believes the machine will be useful for 5 years, at which time it will be sold for $5,000. Assuming Midnight, Inc. uses the straight-line method of depreciation, what will depreciation expense on its 2023 income statement be? Select one: a. $35,330 b. $17,580 c. $19,170 d. $34,720 e. $17,040arrow_forwardHow to calculate the Amortization Expense?arrow_forwardOki Company pays $294,500 for equipment expected to last four years and have a $30,000 salvage value. Prepare journal entries to record the following costs related to the equipment. Paid $19,350 cash for a new component that increased the equipment’s productivity. Paid $4,838 cash for minor repairs necessary to keep the equipment working well. Paid $12,300 cash for significant repairs to increase the useful life of the equipment from four to seven years. Note: Enter debits before credits. Transaction General Journal Debit Credit 1arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education