Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:O'Keefe Industries Balance Sheet December 31, 2012

Assets

Liabilities and Stockholders' Equity

Cash

$32,720

Accounts payable

$120,000

Marketable securities

25,000

Notes payable

Accounts receivable

Accruals

20,000

Inventories

Total current liabilities

Long-term debt

Stockholders' equity

Total current assets

Net fixed assets

$600,000

Total assets

Total liabilities and stockholders' equity $

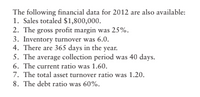

Transcribed Image Text:The following financial data for 2012 are also available:

1. Sales totaled $1,800,000.

2. The gross profit margin was 25%.

3. Inventory turnover was 6.0.

4. There are 365 days in the year.

5. The average collection period was 40 days.

6. The current ratio was 1.60.

7. The total asset turnover ratio was 1.20.

8. The debt ratio was 60%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Market Value Capital Structure Suppose the Schoof Company has this book value balance sheet: Current assets Fixed assets Total assets $30,000,000 70,000,000 $100,000,000 Current liabilities $20,000,000 Notes payable 10,000,000 Long-term debt 30,000,000 Common stock (1 million shares) Retained earnings 1,000,000 Total liabilities and equity 39,000,000 $100,000,000 The notes payable are to banks, and the interest rate on this debt is 8%, the same as the rate on new bank loans. These bank loans are not used for seasonal financing but instead are part of the company's permanent capital structure. The long-term debt consists of 30,000 bonds, each with a par value of $1,000, an annual coupon interest rate of 7%, and a 20-year maturity. The going rate of interest on new long-term debt, rd, is 12%, and this is the present yield to maturity on the bonds. The common stock sells at a price of $54 per share. Calculate the firm's market value capital structure. Do not round intermediate…arrow_forwardSelected financial information for CraneCorporation as of December are presented below. 2014 2013 Current assets $104,640 $80,080 Current liabilities 43,680 36,400 Stockholders’ equity 124,800 110,240 Total assets 312,000 280,800 Net sales and net income for 2014 were $468,000 and $37,440 respectively. Dividends of $4,160 were declared for common stockholders and $6,240for preferred shareholders in 2014. Preferred stockholders' equity is equal to 10% of total stockholders' equity.Compute the indicated ratios at December 31, 2014, or for the year ended December 31, 2014, as appropriate. (Round answers to 2 decimal places, e.g. 2.12.) 1. Return on assets enter percentages rounded to 2 demical places % 2. Profit margin enter percentages rounded to 2 demical places % 3. Payout ratio enter percentages rounded to 2 demical places % 4. Debt assets ratio enter percentages…arrow_forwardPrince Corporation's accounts provided the following information at December 31, 2019: Total income since incorporation $840,000 Total cash dividends paid 260,000 Total value of stock dividends distributed 60,000 Additional paid-in capital from treasury stock 140,000 What should be the current balance of retained earnings? a.$670,000 b.$580,000 c.$610,000 d.$520,000arrow_forward

- The summarized balance sheets of Pharoah Company and Sheridan Company as of December 31, 2025 are as follows: Assets Liabilities Capital stock Retained earnings Total equities Assets Liabilities Capital stock Retained earnings Total equities Pharoah Company Balance Sheet December 31, 2025 O $444000. O $297000. O $345000. O $350000. Sheridan Company Balance Sheet December 31, 2025 $2000000 $220000 1000000 780000 $2000000 $1480000 $330000 990000 160000 $1480000 If Pharoah Company acquired a 30% interest in Sheridan Company on December 31, 2025 for $350000 and the equity method of accounting for the investment was used, the amount of the debit to Equity Investments (Sheridan) to record the purchase would have beenarrow_forwardWant Answer in Text Formatarrow_forwardDrake Co. summarized select account balances on December 31, 2020, and activity for 2020 in the following table. Retained earnings, beginning balance $60,000 Common stock, $1 par, 100,000 shares authorized, 50,000 shares issued 40,000 Treasury stock, 1,000 shares 10,500 Paid-in capital in excess of par 440,000 Accumulated other comprehensive income 25,000 Investment in stock 100,000 Bonds payable 50,000 Net income for 2020 (not included in retained earnings above) 12,000 Dividends declared and paid during 2020 (not included in retained earnings above) 5,000 Noncontrolling interests 2,500 Based on the information provided, what is total stockholders’ equity on December 31, 2020? Select one: a. $559,000 b. $585,000 c. $564,000 d. $574,000arrow_forward

- QUESTION I Below are the balances available for Delima Berhad as at 31 December 2015: Statement of Financial Position of Delima Berhad as 31 December 2015 RM 170,000,000 115,000,000 150,000,000 435,000,000 Non-current assets Current assets (except cash at hank) Cash at bank Issued share capital 100,000,000 ordinary shares Retained profits Non-current liability 50,000,000 5% redeemable preference shares Current liabilities Additional information: On 1 January 2016, the directors decided on the following matters 100,000,000 3. To redeem 5% redeemable preference shares at a premium of 10% 240,000,000 55,000,000 20,000,000 435,000,000 1. To issue bonus shares of one (1) ordinary shares for every ten (10) shares held to the existing shareholders. 2. To repurchase 2,000,000 ordinary shares at RM1.50 each for cancellation. (u 4 To issue 30,000,000 ordinary shares at RMI. The application were paid and fully subscribed Required: a) Prepare journal entries to record above transactions b) Prepare…arrow_forwardBalance Sheet Nicole Corporation's year-end 2019 balance sheet lists current assets of $753,000, fixed assets of $603,000, current liabilities of $542,000, and long-term debt of $697,000. What is Nicole's total stockholders' equity? Multiple Choice О о $117,000 $1,356,000 There is not enough information to calculate total stockholder's equity. $1,239,000arrow_forwardWeighted Average Cost of Capital The December 31, 2018, partial financial statements taken from the annual report for AT&T Inc. (T ) follow. Consolidated Statements of Income Dollars in millions except per share amounts 2018 2017 Operating revenues Service $152,345 $145,597 Equipment 18,411 14,949 Total operating revenues 170,756 160,546 Operating expenses Equipment 19,786 18,709 Broadcast, programming and operations 26,727 21,159 Other cost of services (exclusive of depreciation and amortization show separately below) 32,906 37,942 Selling, general and administrative 36,765 35,465 Abandonment of network assets 46 2,914 Depreciation and amortization 28,430 24,387 Total operating expenses 144,660 140,576 Operating income 26,096 19,970 Other income (expense): Interest expense (7,957) (6,300) Equity in net income of affiliates (48) (128)…arrow_forward

- with examples. Balance Sheet of Sinaco Limited is given as follows: June 30 Head of Account Year 2018 Year 2017 Cash 70,000 50,000 Other Current Assets 145,000 80,000 Fixed Assets 135,000 170,000 Total 350,000 300,000 20,000 Current Liabilities 15,000 Non-current Liabilities 195,000 180,000 In Common Stock 110,000 80,000 Retained Earnings 30,000 20,000 Total 350,000 300,000 Net income for the year ended June 30, 2018 was Rs. 25,000. Sinaco Limited did not acquire any Fixed Asset during the Financial Year 2018. Requirement: Prepare statement of Cash Flow for the year ended June 30, 2018.arrow_forwardGiven the following information, what is the ratio of liabilities to stockholders’ equity?arrow_forwardProblem:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education