FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

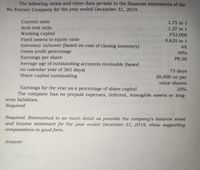

Transcribed Image Text:The following ratios and other data pertain to the financial statements of the

No Forever Company for the year ended December 31, 2019.

Current ratio

1.75 to 1

Acid-test ratio

1.27 to 1

Working capital

Fixed assets to equity ratio

Inventory turnover (based on cost of closing inventory)

Gross profit percentage

Earnings per share

Average age of outstanding accounts receivable (based

on calendar year of 365 days)

Share capital outstanding

P33,000

0.625 to 1

4X

40%

PO.50

73 days

20,000 no par

lat

value shares

Earnings for the year as a percentage of share capital

The company has no prepaid expenses, deferred, intangible assets or long-

25%

term liabilities.

Required:

Required. Reconstruct in as much detail as possible the company's balance sheet

and income statement for the year ended December 31, 2019, show supporting

computations in good form.

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ratio AnalysisPresented below are summary financial data from Porter’s annual report: Amounts in millions Balance Sheet Cash and Cash Equivalents $1,850 Marketable Securities 19,100 Accounts Receivable (net) 9,367 Total Current Assets 39,088 Total Assets 123,078 Current Liabilities 38,450 Long-Term Debt 7,279 Shareholders’ Equity 68,278 Income Statement Interest Expense 400 Net Income Before Taxes 14,007 Calculate the following ratios:(Round to 2 decimal points) a. Times-interest-earned ratio Answer b. Quick ratio Answer c. Current ratio Answerarrow_forwardThe comparative financial statements of Stargel Inc. are as follows. The market price of Stargel common stock was $119.70 on December 31, 20Y2. InstructionsDetermine the following measures for 20Y2. Round to one decimal place including percentages, except for per-share amounts, which should be rounded to the nearest cent.1. Working capital2. Current ratio3. Quick ratio4. Accounts receivable turnover5. Number of days' sales in receivables6. Inventor)’ turnover7. Number of days' sales in inventoryarrow_forwardBased on the financial statements below, what is the current ratio and quick ratio?arrow_forward

- Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Total current assets Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities $387,600 448,800 183,600 1,032,200 531,800 $2,584,000 1. Working capital 2. Current ratio 3. Quick ratio b. The liquidity of Nilo has improved increased $394,400 285,600 $680,000 $306,800 345,200 115,000 719,800 460,200 $1,947,000 $413,000 177,000 $590,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year ✔ from the preceding year to the current year. The working capital, current ratio, and quick ratio have all ✔Most of these channes are the result of an increase ✔in nurrent accets…arrow_forwardBarger Corporation has the following data as of December 31, 2024: Total Stockholders' Equity Total Current Liabilities Total Current Assets $ 36,210 58,200 181,630 Other Assets Long-term Liabilities Property, Plant, and Equipment, Net Compute the debt to equity ratio at December 31, 2024. (Round your answer to two decimal places, X.XX.) = = C $? 45,600 269,640 Debt to equity ratioarrow_forwardN1. Account Calculate the following ratios for Lake of Egypt Marina, Inc. as of year-end 2021. (Use sales when computing the inventory turnover and use total stockholders' equity when computing the equity multiplier. Round your answers to 2 decimal places. Use 365 days a year.)arrow_forward

- Based on the following information as of December 31,2020, compute the company’s debt-equity ratio. Assume current liabilities are all interest-bearing. Round to nearest two decimal places. Current assets: 15 Non-current assets: 12 Current Liabilities: 22 Non-current Liabilities: 4 Debt to Equity Ratio = ?arrow_forwardWhat is the year-over-year revenue change percent? Use the attached financial data to calculate the ratios for 2022. Round to the nearest decimal. Abercrombie & Fitch Co (ANF) Financial Data Revenues Cost of Sales Total Operating Expenses Interest Expense Income Tax Expense Diluted Weighted Shares Outstanding Cash + Equivalents Accounts Receivable Inventories Total Current Assets Total Assets Accounts Payable Total Current Liabilities Total Stockholders' Equity ANF Stock Price = $10.30 Select one O A. 5.3% B. 14.4% C. -1.4% O D. -3.5% 2022 $3,659.3 $1,545.9 $2,026.9 $28.5 $37.8 52.8 $257.3 $108.5 $742.0 $1,220.4 $2,694.0 $322.1 $935.5 $656.1 2021 $3,712.8 $1,400.8 $1,968.9 $34.1 $38.9 62.6 $823.1 $69.1 $525.9 $1,507.8 $2,939.5 $374.8 $1,015.2 $826.1arrow_forwardMeasures of liquidity, solvency, and profitabilityThe comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $82.60 on December 31, 20Y2. InstructionsDetermine the following measures for 20Y2 (round to one decimal place, including percentages, except for per-share amounts):1. Working capital2. Current ratio3. Quick ratio4. Accounts receivable turnover5. Number of days' sales in receivables6. Inventory turnover7. Number of days' sales in inventory8. Ratio of fixed assets to long-term liabilities9. Ratio of liabilities to stockholders' equity10. Times interest earned11. Asset turnover12. Return on total assets13. Return on stockholders' equity14. Return on common stockholders' equity15. Earnings per share on common stock16. Price-earnings ratio17. Dividends per share of common stock18. Dividend yieldarrow_forward

- Using these data from the comparative balance sheets of Bonita Company, perform a vertical analysis. Accounts receivable (net) Inventory Total assets (Round percentages to 1 decimal place, e.g. 12.1%.) Accounts receivable (net) Inventory Total assets Amount $435.960 December 31, 2022 December 31, 2021 $422,800 720.720 2.520,000 $435.960 December 31, 2022 720.720 2,520.000 Percentage 624,400 2,800,000 Amount $422,800 624,400 2.800,000 December 31, 2021 Percentage % 8arrow_forwardThe comparative accounts payable and long-term debt balances for a company follow. Current Year Previous YearAccounts payable $114,240 $102,000Long-term debt 127,200 120,000 Based on this information, what is the amount and percentage of increase or decrease that wouldbe shown on a balance sheet with horizontal analysis?arrow_forwardComputing Financial Statement Measures The following pretax amounts are taken from the adjusted trial balance of Mastery Inc. on December 31, 2020, its annual year-end. Assume that the income tax rate for all items is 25%. The average number of common shares outstanding during the year was 20,000. Balance, retained earnings, December 31, 2019 $ 45,000 Sales revenue 300,000 Cost of goods sold 105,000 Selling expenses 36,000 Administrative expenses 34,000 Gain on sale of investments 10,000 Unrealized holding gain on debt investments, net of tax 4,250 Prior period adjustment, understatement of depreciation from prior period (2019) 20,000 Dividends declared and paid 16,000 Required Compute the following amounts for the year-end financial statements of 2020. Do not use negative signs with any of your answers. Round the per share amount to two decimal places. Item Amount a. Gross profit (2020). b. Operating income (2020). c. Net…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education