FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

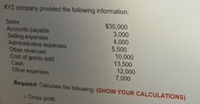

Transcribed Image Text:XYZ company provided the following information:

$30,000

3,000

4,000

5,500

10,000

13,500

12,000

7,000

Sales

Accounts payable

Seling expenses

Administrative expenses

Other revenues

Cost of goods soid

Cash

Other expenses

Required: Calcuate the following: (SHOW YOUR CALCULATIONS)

Gros profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company reports the following sales-related information. $ 220,000 Sales returns and allowances 4,400 Sales salaries expense Prepare the net sales portion only of this company's multiple-step income statement. Sales, gross Sales discounts Net sales Multiple-Step Income Statement (Partial) $ 15,000 10,400arrow_forwardThe financial statements of New World, Incorporated, provide the following information for the current year: December 31 January 1 Accounts receivable $ 288,000 $ 391,500 Inventory $ 281,250 $ 267,000 Prepaid expenses $ 73,200 $ 70,500 Accounts payable (for merchandise) $ 259,800 $ 251,550 Accrued expenses payable $ 66,150 $ 79,950 Net sales $ 3,172,500 Cost of goods sold $ 1,672,500 Operating expenses (including depreciation of $64,000) $ 382,500 What is New World's net cash flow from operating activities for the current year?arrow_forwardprepare a balance sheet and income statement from the following information: Cash $625.00 Revenue $21,000.00 Note Payable $5,000.00 Retained Earnings $10,600.00 Expenses $7,000.00 Issued Capital Stock $500.00 Accounts Receivable $2,500.00 Inventory $6,900.00 Accounts Payable $1,000.00 Cost of Goods Sold $10,500.00 Accrued Sales Tax $1,425.00 Prepaid Insurance $12,000.00 Plz answer fast without plagiarism i give up votearrow_forward

- An excerpt from Ivanhoe Company's accounting records is provided below. Sales revenue $627,000 Cost of goods sold 346,500 Wages expense 123,750 Depreciation expense 15,675 Rent expense 50,325 Interest expense 4,950 Income tax expense 14,850 Retained earnings 36,300 Dividends declared 16,500 Wages payable 12,375 Cash 41,250 Accounts receivable 61,875 Accounts payable 82,500 M σε Ac Q Ac Q Ac Using only the data provided above, record all the required closing entries using proper Journal Entry form. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Q Ac A C M Narrow_forwardFinancial information is presented below: Operating Expenses $ 92, 800 Sales Returns and Allowances 18,000 Sales Discounts 12,000 Sales Revenue 350,000 Cost of Goods Sold 176,000 The amount of net sales on the income statement would be Select one: a. $ 338,000. b. $332,000. c. $350,000. d. $320,000.arrow_forwardHansabenarrow_forward

- Income statements for Burch Company for Year 3 and Year 4 follow: BURCH COMPANY Income Statements Year 4 Year 3 $200,000 124,000 20,000 18,000 $240,000 180,000 Sales Cost of goods sold Selling expenses Administrative expenses 26,000 12,000 7,500 $225,500 14,500 1,200 $ 13,300 8,000 $170,000 30,000 3,000 $ 27,000 Interest expense Total expenses Income before taxes Income taxes expense Net income Required a. Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. b. Perform a vertical analysis, showing each income statement component as a percentage of sales for each year. Complete this question by entering your answers in the tabs below. Required A Required 8 Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. (Negative answers should be indicated by a minus sign. Round your answers to 1 decimal place, (i.e., 0.234 should be entered as 23.4).) BURCH…arrow_forwardhsd.3arrow_forwardPlease help me with show all calculation thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education