Concept explainers

Working with a Segmented Income Statement; Break-Even Analysis

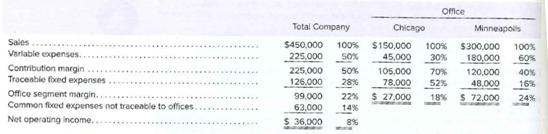

Raner, Harris&Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices—one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company’s most recent year is given:

Required:

1. Compute the companywide break-even point in dollar sales. Also, compute the break-even point for the Chicago office and for the Minneapolis office. Is the companywide break-even point greater than, less than, or equal to the sum of the Chicago and Minneapolis break-even points? Why?

2. By how much would the company’s net operating income increase if Minneapolis increased its sales by $75,000 per year? Assume no change in cost behavior patterns.

3. Refer to the original data. Assume that sales in Chicago increase by 550,000 next year and that sales in Minneapolis remain unchanged. Assume no change in fixed costs.

a. Prepare a new segmented income statement for the company using the above format. Show both amounts and percentages.

b. Observe from the income statement you have prepared that the contribution margin ratio for Chicago has remained unchanged at 70% (the same as in the above data) but that the segment margin ratio has changed. How do you explain the change in the segment margin ratio?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

- Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices—one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company’s most recent year is given: Required: 1-a. Compute the companywide break-even point in dollar sales. 1-b. Compute the break-even point for the Chicago office and for the Minneapolis office. 1-c. Is the companywide break-even point greater than, less than, or equal to the sum of the Chicago and Minneapolis break-even points? 2. By how much would the company’s net operating income increase if Minneapolis increased its sales by $52,500 per year? Assume no change in cost behavior patterns. 3. Assume that sales in Chicago increase by $35,000 next year and that sales in Minneapolis remain unchanged. Assume no change in fixed costs. a. Prepare a new segmented…arrow_forwardSports-Reps, Inc., represents professional athletes and movie and television stars. The agencyhad revenue of $12,345,000 last year, with total variable costs of $5,678,700 and fixed costs of$2,192,400.Required:1. What is the contribution margin ratio for Sports-Reps based on last year’s data? What is thebreak-even point in sales revenue?2. What was the margin of safety for Sports-Reps last year?3. One of Sports-Reps’s agents proposed that the firm begin cultivating high school sports starsaround the nation. This proposal is expected to increase revenue by $230,000 per year, withincreased fixed costs of $122,500. Is this proposal a good idea? Explain.arrow_forwardContribution Margin and Contribution Margin Ratio For a recent year, McDonald's (MCD) company-owned restaurants had the following sales and expenses (in millions): Sales Food and packaging Payroll Occupancy (rent, depreciation, etc.) General, selling, and administrative expenses Ь Operating income Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? Round to the nearest million. (Give answer in millions of dollars.) million $34,900 $(12,194) (8,800) (7,756) (5,100) $(33,850) $1,050 Whatarrow_forward

- 4. Redo the intern’s segmented income statement using the contribution format. 5. Compute the companywide break-even point in dollar sales. 6. Compute the break-even point in dollar sales for the Commercial Division and for the Residential Division. 7. Assume the company decided to pay its sales representatives in the Commercial and Residential Divisions a total monthly salary of $22,000 and $44,000, respectively, and to lower its companywide sales commission percentage from 10% to 5%. Calculate the new break-even point in dollar sales for the Commercial Division and the Residential Division.arrow_forwardVulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement For the Month Ended June 30 Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 850,000 308,000 Management is disappointed with the company's performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following: 542,000 490,000 $ 52,000 a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $200,000 in variable expenses during June, the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $152,000 and $126,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $180,000 and…arrow_forwardPlease help me with correct answer thankuarrow_forward

- Please Complete the last subpartarrow_forwardRaner, Harris and Chan is a consulting firm that specializes in Information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented Income statement for the company's most recent year is given: Office Chicago Sales Variable expenses Contribution margin Total Company $ 495,000 100% 247,5ee 58% 247,500 sex 138,600 28% 108,900 22% 69,300 14% $39,600 $ 165,000 100% 49,500 30% 115,500 70% 85,800 52% $ 29,700 18% Minneapolis $ 330,000 100% 198,000 60% 132,000 48% 52,800 16% 24% Traceable fixed expenses $ 79,200 Office segment margin Common fixed expenses not traceable to offices Net operating income 8% 3. Assume that sales in Chicago Increase by $55,000 next year and that sales in Minneapolis remain unchanged. Assume no change In fixed costs. a. Prepare a new segmented Income statement for the company. (Round your Intermediate calculations…arrow_forwardRequired information The Personnel Department at Hernandez Bros. is centralized and provides services to the two operating units: Miami and New York. The Miami unit is the original unit of the company and is well established. The New York unit is new, much like a start-up company. The costs of the Personnel Department are allocated to each unit based on the number of employees in order to determine unit profitability. The current rate is $610 per employee. Data for the fiscal year just ended show the following: Miami New York Number of employees 1,310 410 Number of new hires 11 31 Number of employees departing 19 19 Required: a. Compute the cost allocated to each unit using the current allocation system. b. Livan, the manager of the Miami unit, is unhappy with the allocation from Personnel. He believes that he gets little benefit other than the occasional hire and termination help. He asks the controller’s office to estimate the amount of Personnel Department…arrow_forward

- Compute for the total cost per month using costing labor cost by the given data Compute for the percentage weight of the monetary benefit, non monetary benefit, and deferred monetary benefit Compute for the percentage of cost relevant to the sales of total labor cost, given that there are 40 employees in the company and the revenue of the company is 2,500,000 monthly.arrow_forwardLucido products markets two computer games: claimjumper and makeover. A contribution format income statement for a recent month for the two games appears in top of picture. prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products.arrow_forwardneed help pleasearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education