FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

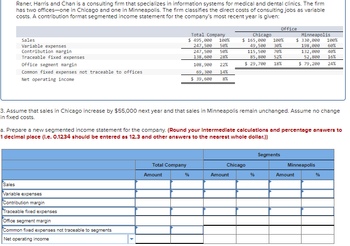

Transcribed Image Text:### Raner, Harris, and Chan Consulting Firm Case Study

The Raner, Harris and Chan consulting firm specializes in information systems for medical and dental clinics. The firm has two offices— one in Chicago and one in Minneapolis.

**Contribution Format Segmented Income Statement for the Most Recent Year:**

| | Total Company | Office |

|---|---|---|---|---|

| | Amount | % | Chicago | Amount | % | Minneapolis | Amount | % |

| Sales | $495,000 | 100% | $165,000 | 100% | $330,000 | 100% |

| Variable Expenses | $247,500 | 50% | $49,500 | 30% | $198,000 | 60% |

| Contribution Margin | $247,500 | 50% | $115,500 | 70% | $132,000 | 40% |

| Traceable Fixed Expenses | $188,000 | 38% | $85,000 | 52% | $103,000 | 31% |

| Office Segment Margin | $188,000 | 38% | $29,700 | 18% | $79,200 | 24% |

| Common Fixed Expenses not Traceable to Offices | $60,900 | 14% |

| Net Operating Income | $39,600 | 8% |

### Future Projections

If sales in Chicago increase by $55,000 next year while sales in Minneapolis remain unchanged, with no changes in fixed costs, the following adjustment is required:

1. **Compute the New Segmented Income Statement**

#### Given Adjustments:

- **Chicago Sales Increase**: $55,000

- **Fixed Costs** remain the same.

**Instruction for Calculation Adjustments**:

- **Round intermediate calculations and percentage answers to 1 decimal place** (e.g., 12.3%).

- **Round other answers to the nearest whole dollar**.

Below is the table template for the new segmented income statement for the company. You can use this template to compute the new projections based on the given data and adjustments.

| | Segments |

|---|---|---|---|---|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gadubhaiarrow_forwardA sada manufacturer has two operating departments. Miong and Botting Mixing has 600 employees and Botting has 400 employees. Office costs of $320,000 are allocated to operating departments based number of employees. The office costs allocated to the Botting department are Murple Choice O O O $90,000 $64,000 $200,000 $192.000arrow_forwardCompute for the total cost per month using costing labor cost by the given data Compute for the percentage weight of the monetary benefit, non monetary benefit, and deferred monetary benefit Compute for the percentage of cost relevant to the sales of total labor cost, given that there are 40 employees in the company and the revenue of the company is 2,500,000 monthly.arrow_forward

- Jorgansen Lighting, Incorporated, manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: Year 1 Year 2 Year 3 Inventories Beginning (units) 220 160 180 Ending (units) 160 180 240 Variable costing net operating income $ 290,000 $ 269,000 $ 250,000 The company’s fixed manufacturing overhead per unit was constant at $560 for all three years. Required: 1. Calculate each year’s absorption costing net operating income. (Enter any losses or deductions as a negative value.)arrow_forwardPlease help mearrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Total Department Hardware Linens Sales $4,200,000 $3,090,000 $1,110,000 Variable expenses 1,240,000 840,000 400,000 Contribution margin 2,960,000 2,250,000 710,000 Fixed expenses 2,300,000 1,470, 000 830,000 Net operating income (loss) $ 660,000 $ 780,000 $ (120,000) A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 11% decrease in the sales of the Hardware Department. Required: What is the financial advantage ( disadvantage) of discontinuing the Linens Department?arrow_forward

- Davenport Incorporated has two divisions, Howard and Jones. The following is the segmented income statement for the past month: Howard Jones Total Sales revenue $ 800,000 $ 600,000 $ 1,400,000 Variable costs 400,000 480,000 880,000 Contribution margin $ 400,000 $ 120,000 $ 520,000 Direct fixed costs 200,000 100,000 300,000 Segment margin $ 200,000 $ 20,000 $ 220,000 Fixed costs (allocated) 150,000 150,000 300,000 Net operating income (loss) $ 50,000 $ (130,000) $ (80,000) What would Davenport's income (loss) be if the Jones Division was dropped?arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Fixed expenses Contribution margin Net operating income (loss) 1,307,000 Department Total $ 4,210,000 Hardware $ 3,040,000 Linens $ 1,170,000 403,000 767,000 840,000 $ (73,000) 2,903,000 2,290,000 $ 613,000 904,000 2,136,000 1,450,000 $ 686,000 A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 15% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,310,000 1,313,000 2,997,000 2,200,000 $ 797,000 Department Hardware $ 3,130,000 901,000 2,229,000 1,360,000 $ 869,000 Linens $ 1,180,000 412,000 768,000 840,000 $ (72,000) A study indicates that $377,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 11% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education