FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

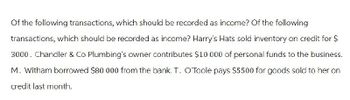

Transcribed Image Text:Of the following transactions, which should be recorded as income? Of the following

transactions, which should be recorded as income? Harry's Hats sold inventory on credit for $

3000. Chandler & Co Plumbing's owner contributes $10 000 of personal funds to the business.

M. Witham borrowed $80 000 from the bank. T. O'Toole pays $5500 for goods sold to her on

credit last month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Elegant Electronics sells a cellular phone on September 2 for $439. On September 6, Elegant sells another cellular phone for $353. Sales tax is computed at 6% of the total sale. What is the total cash collected rounded to the nearest penny, two decimals?arrow_forwardDamon Associates reported the following transactions during September 2017: Sept. 8 Sold $3,000 of merchandise to Bruce Company for cash. The cost of the merchandise was $1,250 10 Owner invested $3,400 into the business. 15 Collected $580 from Lucille Adams on account. 16 Issued a credit memo for $650 to Susan Wilson for merchandise she purchased on credit several days ago. The cost of the returned merchandise was $250. Required: Record the above transactions below in either the cash receipts journal or the general journal. Note: Individual entries will only belong in one of these two journals.arrow_forwardThe Viennese Pastry Company sells pastries to Bavarian restaurants. On January 1, the company had accounts receivable of $400,000 and an Allowance for Uncollectible Accounts of negative $12,750 (i.e.: the bad debt expense in the prior period had been under estimated). During the year, the company had total credit sales of $1,000,000 and collected $950,000 of accounts receivable. Also during the year, the company wrote off $15,250 of bad debts. At year end, the company determined that the Allowance for Uncollectible Accounts should have a balance of positive $17,250.What amount should be added to the account to achieve the correct year-end balance in the Allowance for Uncollectible Accounts?arrow_forward

- Big Buy Appliances sells Mike and Katy a refrigerator for $1,200 in March. Big Buy paid $500 for the refrigerator in Feburary. Big Buy received a 900 payment from Mike and Katy in March and will receive an additional 300 in April. If Big Buy uses the Accrual Basis of Accounting then the gross profit rate for the month of March would bea. 500b. 800c. 900d. 700arrow_forwardPLEASE SHOW SOLUTIONS IN GOOD ACCOUNTING FORM. 6. On January 01, 2020 Kit Company, Inc. establishes a branch in Bauang. During the year, Kit Inc. transfers cash and merchandise to the branch worth P15,000 and P45,000 respectively. Freight was paid by the home office worth P1,500 included in the cost of merchandise. The home office also incurred P5,700 expenses of which 30 percent was allocated to the branch. On December 31, 2020, the branch incurred a loss of P4,000. What is the balance of the branch account as per home office books?arrow_forwardChurch Company completes these transactions and events during March of the current year (terms for all its credit sales are 1/10, n/30). March 1 Purchased $37,000 of merchandise from Van Industries, terms 1/15, n/30. March 2 Sold merchandise on credit to Min Cho, Invoice Number 854, for $14,800 (cost is $7,400). March 3 (a) Purchased $1,110 of office supplies on credit from Gabel Company, terms n/30. March 3 (b) Sold merchandise on credit to Linda Witt, Invoice Number 855, for $7,400 (cost is $3,700). March 6 Borrowed $72,000 cash from Federal Bank by signing a long-term note payable. March 9 Purchased $18,500 of office equipment on credit from Spell Supply, terms n/30. March 10 Sold merchandise on credit to Jovita Albany, Invoice Number 856, for $3,700 (cost is $1,850). March 12 Received payment from Min Cho for the March 2 sale less the discount of $148. March 13 (a) Sent Van Industries Check Number 416 in payment of the March 1 invoice less the discount of $370.…arrow_forward

- How is income defined by the IRC? For example, suppose you decided to hold a garage sale one fine summer weekend. The proceeds of such came out to $40. Do you report this? Why or why not?arrow_forwardSales at Joslin's Shoe Mart totaled $2,505 in August. The shoes cost $1,030. During the month, the owner paid $871 in rent, supplies, insurance, and utilities. The $614 left over is the owner's...........arrow_forwardIn performing accounting services for small businesses, you encounter these situations pertaining to cash sales. 1. Oriole Company enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales $53,000 and sales taxes $2,650. Sheffield Company does not segregate sales and sales taxes. Its register total for April 15 is $24,300, which includes a 89% sales tax. 2. Prepare the entries to record the sales transactions and related taxes for each client. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit ORIOLE COMPANY SHEFFIELD COMPANY >arrow_forward

- Listed below are selected transactions of Ben’s HomeGoods Store for the current year ending December 31, 2022. a) During December, credit card sales totaled $675,000, which includes the 8% sales tax that must be remitted to the state by the fifteenth day of the following month. (At time of sale, the total amount is recorded in Sales.) b) On December 1, the store received $5,000 from the local community theater for the rental of certain furniture to be used in a stage production during December and January. The furniture will be returned on February 1. c) On December 31 the store was notified it will be required to restore the area (considered a land improvement) surrounding one of its parking lots, when the store moves in 5 years. Ben determined it will cost $78,000 in 2027. Ben estimates the fair value of the asset retirement obligation on December 31, 2022 is $61,500. Prepare the necessary journal entries necessary to record the above transactions as they occurred and any adjusting…arrow_forwardAt the beginning of the year, the inventory of a convenience store was 189,950. The purchases made during the year amounted to 90,460.00. the ending inventory wqs 86,780. its salary expenses amounted to 325,450.00, and its rental expense was 420,000. The store owner also collected 135,200 for utilities. the store also received sales returns worth P50,000. The total sales of the convenience store was p1,875,500. what is the net profit/loss of the convenience store?arrow_forwardAssignment#2-handwritte-in-class Mark as done 1 Dec1, 2020 Jimmy, the business owner input cash $7,000 and $2000 computer into the business 2 Dec2, 2020 Business purchased office supplies $1,500 and office equipment $4,500, paid $4000 cash and signing a note payable for the balance 3 Dec3, 2020 Business paid $2400 for a two-years insurance 4 Dec4, 2020 Business received $4,200 cash for the services provided. 5 Dec6, 2020 Business paid owing balance for Transaction#21 6 Dec12, 2020 Business received $6,300 from the customer for the services to be performed in the near future. 7 Dec 17, 2020 Business bought office supplies for $5,500 on credit. 8 Dec20, 2020 Business finished $3000 services for the Transaction#6 9 Dec22, 2020 Business found $600 defective office supplies from the Dec 17, 2020 purchase, returned them back to supplier 10 Dec28, 2020 Business received electricity bill for Dec, 2020 $270, it will be paid in next month. 11 Dec 31, 2020 Business paid the owing amount for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education