FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Obj. 2

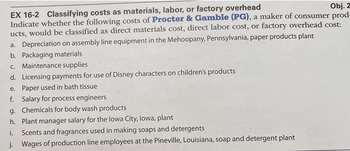

EX 16-2 Classifying costs as materials, labor, or factory overhead

Indicate whether the following costs of Procter & Gamble (PG), a maker of consumer prod-

ucts, would be classified as direct materials cost, direct labor cost, or factory overhead cost:

a. Depreciation on assembly line equipment in the Mehoopany, Pennsylvania, paper products plant

b. Packaging materials

C. Maintenance supplies

d. Licensing payments for use of Disney characters on children's products

e. Paper used in bath tissue

f. Salary for process engineers

g. Chemicals for body wash products

h. Plant manager salary for the lowa City, lowa, plant

i.

Scents and fragrances used in making soaps and detergents

j.

Wages of production line employees at the Pineville, Louisiana, soap and detergent plant

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Select and “X” in the column that corresponds to the cost classification for each of the following scenarios. Some items may fit in more than one column.arrow_forwardRequired: Classify the following costs as period or traceable costs. Depreciation on office building Insurance expense for factory building Product liability insurance premium Transportation charges for raw materials Factory repairs and maintenance Rent for inventory warehouse Cost of raw materials Factory wages Salary to chief executive officer Depreciation on factory Bonus to factory workers Salary to marketing staff Administrative expenses Bad debt expense Advertising expense Research and development Warranty expense Electricity for plantarrow_forwardMarsden Company has three departments occupying the following amount of floor space: 20,000 square feet 10,500 square feet 30,000 square feet Department 1 Department 2 Department 3 How much store rent should be allocated to Department 3 if total rent is equal to $94,000? Note: Do not round Intermediate calculations. Multiple Choice $30,000 $46.612 $16,314 None of the answers are correct.arrow_forward

- 9:01 5:34 Manufacturing Overhead consists of which of the following costs: (check all that apply) HUUM ◄ Previous Utilities in the factory Utilities in the corporate office Property taxes on the factory Salary of factory supervisor Materials that are incorporated into a product Prime costs SUBMIT K + CCarrow_forwardIndicate whether each cost is: A. Fixed or Variable b. Selling, General/Administrative, or Manufacturingarrow_forwardWhich of the following costs is best classified as a fixed cost with respect to volume of activity? (See your Chapter 20 notes, page 5) Direct labor Electricity used to heat, light, and cool a factory Cleaning supplies used in an automobile assembly plant Straight-line depreciation expense of a machine used in a factory Total cost of salaries paid to quality inspectors in a manufacturing plant Tires used in an automobile manufacturing plantarrow_forward

- :14 es Howell Corporation's activity-based costing system has three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation (total) Indirect labor (total) Distribution of Resource Consumption Across Activity Cost Pools Setting Up 0.30 0.10 Equipment depreciation Indirect labor Product S4 Product CO Total Costs in the Machining cost pool are assigned to products based on machine-hours (MHS) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Sales (total) Direct materials (total) Direct labor (total) $ 33,800 $ 7,950 MHS 8,900 6,300 15,200 Required A Machining 0.30 0.30 Additional data concerning the company's products appears below: Product S4 Product Co $ 88,100 $ 75,500 $…arrow_forwardRequired: 1. What was the cost of raw materials put into production during the year? 2. How much of the materials in requirement 1 consisted of indirect materials? 3. How much of the factory labour cost for the year consisted of indirect labour? 4. What was the cost of goods manufactured for the year? 5. What was the cost of goods sold for the year (before considering underapplied or overapplied overhead)? 6. If overhead is applied to production on the basis of direct materials cost, what rate was in effect during the year? 7. Was manufacturing overhead underapplied or overapplied? By how much? 8. Compute the ending balance in the Work in Process inventory account. Assume that this balance consists entirely of goods started during the year. If $33,200 of this balance is direct materials cost, how much of it is direct labour cost? Manufacturing overhead cost?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education