Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

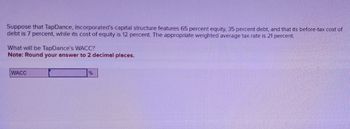

Transcribed Image Text:Suppose that TapDance, Incorporated's capital structure features 65 percent equity, 35 percent debt, and that its before-tax cost of

debt is 7 percent, while its cost of equity is 12 percent. The appropriate weighted average tax rate is 21 percent.

What will be TapDance's WACC?

Note: Round your answer to 2 decimal places.

WACC

%

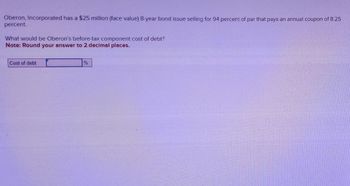

Transcribed Image Text:Oberon, Incorporated has a $25 million (face value) 8-year bond issue selling for 94 percent of par that pays an annual coupon of 8.25

percent.

What would be Oberon's before-tax component cost of debt?

Note: Round your answer to 2 decimal places.

Cost of debt

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- d) Calculate the after-tax Weighted Average Cost of Capital (WACC) for each capital structure.arrow_forwardgive me answerarrow_forwardABC Company currently has a capital structure consisting of 48% debt and the remaining as equity, a levered beta of 1.63, and its tax rate is 40%. The company is considering to adopt a new capital structure of 20% debt and the remaining as equity. What would the company’s new levered beta be under the new capital structure? Round your answer to two decimal places. (Hint: Use the Hamada equation.) Group of answer choices: 1.28 1.24 1.21 1.31 1.26arrow_forward

- Suppose that TapDance, Inc.s capital structure features 60 percent equity, 40 percent debt, and that its before-tax cost of debt is 6 percent, while its cost of equity is 11 percent. The appropriate weighted average tax rate is 21 percent. What will be TapDance's WACC? (Round your answer to 2 decimal places.)arrow_forwardman.2arrow_forwardSuppose the weighted average cost of capital of the Oriole Company is 10 percent. If Oriole has a capital structure that is 50 percent debt and 50 percent equity, its before-tax cost of debt is 7 percent, and its marginal tax rate is 20 percent, then its cost of equity capital is closest to: a. 10.40 percent. b. 12.40 percent. c. 8.40 percent. d. 14.40 percent.arrow_forward

- Suppose that MNINK Industries’ capital structure features 63 percent equity, 8 percent preferred stock, and 29 percent debt. Assume the before-tax component costs of equity, preferred stock, and debt are 11.60 percent, 9.50 percent, and 9.00 percent, respectively.What is MNINK’s WACC if the firm faces an average tax rate of 21 percent and can make full use of the interest tax shield? (Round your answer to 2 decimal places.) WACC: ____.__%arrow_forwardAssume Skyler Industries has debt of $4,326,000 with a cost of capital of 7.9% and equity of $5,974,000 with a cost of capital of 10.1%. What is Skyler’s weighted average cost of capital? Round your intermediate calculations and final answer to 3 decimal places.arrow_forwardFujita, Incorporated, has no debt outstanding and a total market value of $450,000. Earnings before interest and taxes, EBIT, are projected to be $57,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 16 percent higher. If there is a recession, then EBIT will be 24 percent lower. The company is considering a $215,000 debt issue with an interest rate of 8 percent. The proceeds will be used to repurchase shares of stock. There are currently 9,000 shares outstanding. Ignore taxes for questions (a) and (b). Assume the company has a market- to-book ratio of 1.0 and the stock price remains constant. a-1. Calculate return on equity (ROE) under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a-2. Calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be…arrow_forward

- Ursala, Incorporated, has a target debt-equity ratio of 1.43. Its WACC is 9.4 percent, and the tax rate is 25 percent. a. If the company's cost of equity is 15 percent, what is its pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If instead you know that the aftertax cost of debt is 6.2 percent, what is the cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Cost of debt b. Cost of equity % %arrow_forwardXYZ Inc. has a target capital structure of 60% equity and 40% debt. Its cost of equity is 9% and the before-tax cost of debt is 5%. The relevant tax rate is 21%. Calculate the WACC for the firm. (Enter percentages as decimals and round to 4 decimals)arrow_forwardProblem 16-3 ROE and Leverage [LO1, 2] Fujita, Incorporated, has no debt outstanding and a total market value of $356,900. Earnings before Interest and taxes, EBIT, are projected to be $50,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 16 percent higher. If there is a recession, then EBIT will be 25 percent lower. The company is considering a $180,000 debt Issue with an interest rate of 5 percent. The proceeds will be used to repurchase shares of stock. There are currently 8,300 shares outstanding. Ignore taxes for questions (a) and (b). Assume the company has a market- to-book ratio of 1.0 and the stock price remains constant. a-1. Calculate return on equity (ROE) under each of the three economic scenarios before any debt is issued. (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a-2. Calculate the percentage changes in ROE when the economy expands or enters a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education