Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

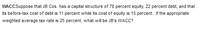

Transcribed Image Text:WACCSuppose that JB Cos. has a capital structure of 78 percent equity, 22 percent debt, and that

its before-tax cost of debt is 11 percent while its cost of equity is 15 percent. If the appropriate

weighted average tax rate is 25 percent, what will be JB's WACC?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- F. Pierce Products Inc. is considering changing its capital structure. F. Pierce currently has no debt and no preferred stock, but it would like to add some debt to take advantage of the tax shield. Its investment banker has indicated that the pre-tax cost of debt under various possible capital structures would be as follows: Market Debt-to Equity Ratio (D/S) 0.00 0.1111 0.2500 0.4286 0.6667 Market Equity-to- Value Ratio (ws) 1.0 0.90 6.0% 6.4 0.80 7.0 8.2 0.70 0.60 10.0 F. Pierce uses the CAPM to estimate its cost of common equity, rs, and at the time of the analaysis the risk-free rate is 6%, the market risk premium is 8%, and the company's tax rate is 25%. F. Pierce estimates that its beta now (which is "unlevered" because it currently has no debt) is 0.7. Based on this information, what is the firm's optimal capital structure, and what would be the weighted average cost of capital at the optimal capital structure? Do not round intermediate calculations. Round your answers to two…arrow_forwardSuppose that JB Cos. has a capital structure of 80 percent equity, 20 percent debt, and that its before-tax cost of debt is 12 percent while its cost of equity is 16 percent. Assume the appropriate weighted-average tax rate is 21 percent and JB estimates that they can make full use of the interest tax shield. What will be JB’s WACC? (Round your answer to 2 decimal places.)arrow_forward9arrow_forward

- Check my we Suppose that T-shirts, Incorporated's capital structure features 25 percent equity, 75 percent debt, and that its before-tax cost of debt is 8 percent, while its cost of equity is 12 percent. If the appropriate weighted average tax rate is 21 percent, what will be T-shirts' WACC? Multiple Choice 7.74 percent 4.75 percent 7.20 percent 9.00 percentarrow_forwardSuppose that TapDance, Inc.’s capital structure features 75 percent equity, 25 percent debt, and that its before-tax cost of debt is 9 percent, while its cost of equity is 14 percent. The appropriate weighted average tax rate is 21 percent. What will be TapDance’s WACC? (Round your answer to 2 decimal places.)arrow_forwardSuppose that MNINK Industries’ capital structure features 63 percent equity, 8 percent preferred stock, and 29 percent debt. Assume the before-tax component costs of equity, preferred stock, and debt are 11.40 percent, 9.30 percent, and 8.00 percent, respectively.What is MNINK’s WACC if the firm faces an average tax rate of 21 percent and can make full use of the interest tax shield? (Round your answer to 2 decimal places.)arrow_forward

- Golden Gate Construction Associates, a real estate developer and building contractor in San Francisco, has two sources of long-term capital: debt and equity. The cost to Golden Gate of issuing debt is the after-tax cost of the interest payments on the debt, taking into account the fact that the interest payments are tax deductible. The cost of Golden Gate's equity capital is the investment opportunity rate of Golden Gate's investors, that is, the rate they could earn on investments of similar risk to that of investing in Golden Gate Construction Associates. The Interest rate on Golden Gate's $62 million of long-term debt is 8 percent, and the company's tax rate is. 30 percent. The cost of Golden Gate's equity capital is 15 percent. Moreover, the market value (and book value) of Golden Gate's equity is $81 million. The company has two divisions: the real estate division and the construction division. The divisions' total assets, current liabilities, and before-tax operating income for…arrow_forwardUse the following information for Cronos Group, Inc. (CRON): EBIT / Revenue 25.50% Government Tax Rate 42.50% Revenue / Assets 1.95 times Current Ratio 3.15 times EBT / EBIT 0.80 times Assets / Equity 2.00 times Its interest coverage ratio is closest to: A. 2.50. B. 5.00. C. 7.15. D. 9.25.arrow_forwardF. Pierce Products Inc. is considering changing its capital structure. F. Pierce currently has no debt and no preferred stock, but it would like to add some debt to take advantage of the tax shield. Its investment banker has indicated that the pre-tax cost of debt under various possible capital structures would be as follows: Market Debt-to Equity Ratio (D/S) Before-Tax Cost of Debt (ra) Market Debt-to- Value Ratio (wd) Market Equity-to- Value Ratio (ws) 0.0 1.0 0.10 0.90 0.20 0.80 0.30 0.40 0.70 0.60 0.00 0.1111 0.2500 0.4286 0.6667 6.0% 6.4 7.0 8.2 10.0 F. Pierce uses the CAPM to estimate its cost of common equity, rs, and at the time of the analaysis the risk-free rate is 6%, the market risk premium is 7%, and the company's tax rate is 25%. F. Pierce estimates that its beta now (which is "unlevered" because it currently has no debt) is 0.7. Based on this information, what is the firm's optimal capital structure, and what would be the weighted average cost of capital at the optimal…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education