FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

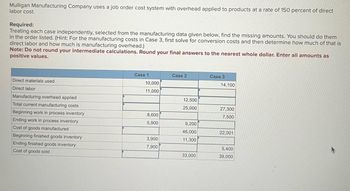

Transcribed Image Text:Mulligan Manufacturing Company uses a job order cost system with overhead applied to products at a rate of 150 percent of direct

labor cost.

Required:

Treating each case independently, selected from the manufacturing data given below, find the missing amounts. You should do them

in the order listed. (Hint: For the manufacturing costs in Case 3, first solve for conversion costs and then determine how much of that is

direct labor and how much is manufacturing overhead.)

Note: Do not round your intermediate calculations. Round your final answers to the nearest whole dollar. Enter all amounts as

positive values.

Direct materials used

Direct labor

Manufacturing overhead applied

Total current manufacturing costs

Beginning work in process inventory

Ending work in process inventory

Cost of goods manufactured

Beginning finished goods inventory

Ending finished goods inventory

Cost of goods sold

Case 1

10,000

11,000

8,600

5,900

3,900

7,900

Case 2

12,500

25,000

9,200

46,000

11,300

33,000

Case 3

14,100

27,300

7,500

22,001

5,400

39,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Time Clock Shop manufactures clocks on an automated assembly line. It utilizes two cost categories: direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of production, while conversion costs are allocated evenly throughout production. The company uses weighted-average costing. Data for the Assembly Department are given in the table. (Click the icon to view the table.) What is the total amount debited to the work-in-process account during the month of June at Time Clock Shop? A. $450,000 B. $2,270,000 C. $3,250,000 D. $2,000,000 E. $2,450,000 Table Work in process, beginning inventory Direct materials (100% complete) Conversion costs (50% complete) Units started during June Work in process, ending inventory Direct materials (100% complete) Conversion costs (75% complete) Work in process, beginning inventory Direct materials Conversion costs Direct materials costs added during…arrow_forwardThe question at hand is (b) below. The images attached are to help anmswer (b). Thank you. :) (b) Why is the amount of underapplied (overapplied) manufacturing overhead different from Requirement 2 above? (You may select more than one answer.) check all that apply The predetermined overhead rate changed.unanswered The change in the actual manufacturing overhead cost directly resulted in a comparable change in the amount of underapplied (overapplied) manufacturing overhead.unanswered The change in the estimated total amount of the allocation base affected the amount of manufacturing overhead applied.arrow_forwardHaresharrow_forward

- Please do not give solution in image format thankuarrow_forwardPlease answer all the part with detailed working, please provide answer in text form without imagearrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- Jay Give me correct answer with explanation..arrow_forwardplease give answer step by steparrow_forwardThe printing industry has become highly automated. Job costing in the printing industry would likely have the following general framework. Job cost equals: None of these answer choices are correct. direct materials cost, plus outside purchase costs, plus overhead cost applied on the basis of labor hours. direct materials cost, plus conversion costs applied on the basis of labor hours. direct materials cost, plus direct labor cost plus applied overhead based on machine hours. materials purchases, labor incurred and applied overhead based on labor hoursarrow_forward

- Nobel Ltd adopts process costing rather than job costing. Which of the following statement could explain why? a. Nobel Ltd produces units according to customer specifications. b. Nobel Ltd wants to track the cost of material, labour and overhead to specific customers. c. Nobel Ltd wants to assign overhead using machine hours as the allocation base. d. Nobel Ltd manufactures virtually identical products using a series of continuous processes.arrow_forwardShalom Company uses traditional costing method in allocating overhead. When you presented the idea of activity-based costing, the manager became interested and showed you details of its current costing method: Overhead using Products Traditional Allocation Peace Piss Piece 460,000 540,000 920,000 Cost drivers 40,000 30,000 90,000 1,920,000 The manager wants a report that shows comparison of the two costing methods. You began your analysis and applied activity-based costing. What product line/s had an overstated overhead cost?arrow_forward>>>>__arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education