FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

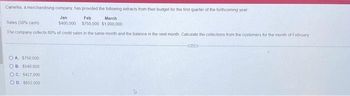

Transcribed Image Text:Camellia, a merchandising company, has provided the following extracts from their budget for the first quarter of the forthcoming year

Jan

Feb

Sales (30% cash)

March

$750,000 $1,000,000

$400,000

The company collects 60% of credit sales in the same month and the balance in the next month Calculate the collections from the customers for the month of February

OA $750,000

OB $540,000

OC. $427,000

OD 1652,000

Corre

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Help Save & Exit Submit 9. Benton Company's sales budget shows the following expected total sales: Month Sales January $20,000 February $24,000 $29,000 March April $46,000 The company expects 70% of Its sales to be on account (credit sales). Credit sales are collected as follows: 25% In the month of sale and 72% In the month following the sale, with the remainder being uncollectible and wrtten off The total cash recelpts during Aprti would be: Multiple Choice $29.200. $24,150. $21.705. $36.466. 1147 AM 83F Mostly cloudy 10/3/2021 Mc Grawarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardSubject: accarrow_forward

- Estate Ltd begins trading on January 1st, 2017. The following sales figures are budgeted for January to March in 2017 January February March $ 13,000 $ 17,000 $ 10,000 5 % of sales will be for cash. The remainder will be credit sales. A discount of 5 % will be offered on all cash sales The payment pattern for credit sales is expected to be as follows. Invoices paid the month after sale 75 % Invoices paid in the second month after sale 23 % Bad debts 02 % Invoices are issued on the last day of each month. The amount budgeted to be received in March 2017 isarrow_forwardA corporation makes collections on sales according to the following schedule: 45% in month of sale 53% in month following sale 2% in the second month following sale The following sales have been budgeted: Sales April $220,000 May $150,000 June $140,000 Budgested cash collections in June would: ___________________________arrow_forwardCloudy Company had the following historical collection pattern for its credit sales:70% collected in the month of sale12% collected in the first month after month of sale10% collected in the second month after month of sale5% collected in the third month after month of sale3% uncollectibleThe sales on open account (credit sales) have been budgeted for the last six months of the year as shown below: July $ 92,000 August $ 104,000 September $ 116,000 October $ 128,000 November $ 140,000 December $ 122,000 The estimated cash collection by Cloudy Company during August from July and August credit sales is: Multiple Choice $100,160. $90,880. $102,880. $64,400. $83,840.arrow_forward

- sub : Accounting pls answer ASAP.Please type the answer. dnt CHATGPT. i ll upvote.arrow_forwardCorning Incorporated sells its product for $24 per unit. Its actual and projected sales follow: Units Dollars January (actual) 18,500 $444,000 February (actual) 23,000 552,000 March (budgeted) 19,800 475,200 April (budgeted) 18,950 454,800 May (budgeted) 22,000 528,000 Here is added information about Corning’s operations: All sales are on credit. Recent experience show that 35% of sales are collected in the month of the sale, 45% in the month following the sale, 17% in the second month after the sale, and 3% prove to be uncollectible. The product’s purchase price is $15 per unit. All payments are payable within 21 days. Thus 30% of purchases in any given month are paid for in that month, with the remaining 70% paid for in the following month. The company has a policy to maintain an ending inventory of 20% of the next month’s projected sales plus a safety stock of 100 units. The January 31 and February 28…arrow_forwardProvide tablearrow_forward

- Preparing an Accounts Payable Schedule Wight Inc. purchases raw materials on account for use in production. The direct materials purchases budget shows the following expected purchases on account: April $374,400 May 411,100 June 416,700 Wight typically pays 25% on account in the month of billing and 75% the next month. Required: 1. How much cash is required for payments on account in May? 2. How much cash is expected for payments on account in June?arrow_forwardZily Co. predicts sales of $185,000 for June. Zily pays a sales manager a monthly salary of $6.600 and a commission of 8% of that month's sales dollars. Prepere a selling expense budget for the month of June. ZILLY CO. Selling Expense Budget For Month Ended June 30 Budgeled salesarrow_forwardi need the answer quicklyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education