Exploring Economics

8th Edition

ISBN: 9781544336329

Author: Robert L. Sexton

Publisher: SAGE Publications, Inc

expand_more

expand_more

format_list_bulleted

Question

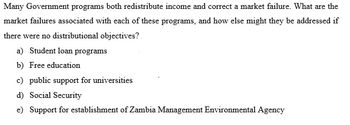

Transcribed Image Text:Many Government programs both redistribute income and correct a market failure. What are the

market failures associated with each of these programs, and how else might they be addressed if

there were no distributional objectives?

a) Student loan programs

b) Free education

c) public support for universities

d) Social Security

e) Support for establishment of Zambia Management Environmental Agency

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Describe how antipoverty programs can discouragethe poor from working. How might you reduce thisdisincentive? What are the disadvantages of yourproposed policy?arrow_forwardThis chapter discusses the importance of economicmobility.a. What policies might the government pursue toincrease economic mobility within a generation?b. What policies might the government pursue toincrease economic mobility across generations?c. Do you think we should reduce spending oncurrent welfare programs to increase spending onprograms that enhance economic mobility? Whatare some of the advantages and disadvantages ofdoing so?arrow_forwardwhat political, economic, religious and other social factors influence population policy considerations?arrow_forward

- Inequality, Social Insurance, and Redistribution-End of Chapter Problem Suppose one of your friends says that they pay taxes for no reason because the governmènt just hands cash out to people who do not truly deserve or need it. Your friend then says, "the system would be more productive if they made sure peopl who receive help are the ones who need it." Consider the tools that the government uses to help ensure aid goes to those in need, a. The social safety net programs fall into one of two categories: wealth or income. progressive or regressive. means-based or social insurance. relative or absolute. b. For aid qualification, people receiving aid must meet low income requirements, while aid is designed to insure everyone against bad outcomes. c. Another tool of the U.S. government is to provide transfers, such as SNAP benefits, instead of cash.arrow_forwardWhich statements are TRUE? 1. Solving poverty has to be done from macroeconomic and microeconomic levels. 2. Where to Meet Dilemma is the situation where parties know that it is better to cooperate than compete yet they do not know how to do so. 3. The Kuznets Curve is a graphical presentation of the relationship of the Gini coefficient and GNI per capita. 4. The formal sectors is the part of the urban economy that is characterized by small competitive individuals or small firms, petty retail trade and services, labor-intensive methods, free entry and market determined prices. 5. The Comprehensive Agrarian Reform Program is a means of asset distribution. 6. The Social Amelioration Program is a subsidy. 7. Poverty is a cause and effect of other economic problems. 8. Information, communication and coordination between and among government institutions are requisites of successful economic development program implementation. 9. A super-entrepreneur can solve poverty in any nation. 10.…arrow_forwardQUESTION 4 The Myth of Global Poverty is: O Global poverty is a myth, meaning it doesn't exist and most of the worlds population have equal opportunity O UN development statistics only make it seem like so many people are impoverished O The 1st world is actually more impoverished becuse it has a greater amount of debt O Poverty is often incorrectly assumed to simply be a lack of resources, but people experience poverty locally and for different reasons. QUESTION 5 According to your textbook, the authors experiences working on a development project found that people located furthest from the project area (donors and administrators) were most interested in: O Understanding what local communities were most interested in O Projects that saved them money O Big picture issues like healthcare access and clean water O Harmful traditional practices"arrow_forward

- Explain whether each of the following governmentactivities is motivated by a concern about equality ora concern about efficiency. In the case of efficiency,discuss the type of market failure involved.a. regulating cable TV pricesb. providing some poor people with vouchers thatcan be used to buy foodc. prohibiting smoking in public places d. breaking up Standard Oil (which once owned90 percent of all U.S. oil refineries) into severalsmaller companiese. imposing higher personal income tax rates onpeople with higher incomesf. enacting laws against driving while intoxicatedarrow_forwardTo what extent can the government improve economic situation by changing theinterest rate?arrow_forwardExplain what the long- and short-termconsequences are of not promoting equality or workingto reduce povertyarrow_forward

- How can profit motive lead to income inequality? (Pages 33 – 35) pages 33 Investment is necessary but risky. It has already been establishedthat capitalism is the most effective and efficient system for wealthcreation and economic prosperity. The path to economic successconsists in investment that is guided by supportive governmentpolicies and institutions. The success of capitalism, in turn, isderived from the success of business enterprises in their roles asjob creators and income-generating agents. However, investmentrequires enormous risk and sacrifice, along with one’s willingnessto undertake such risky ventures, which are based on the potentialreturns on the investment capital. A successful investor must notonly possess organizational and managerial skills, but he or shemust also be willing to take enormous risks. Tanner (2016) madethe point that one of the prerequisites for economic growth isto have individuals who are ambitious, skilled risk-takers andwho are ever striving for…arrow_forward1 According to Chapter 9 (Unemployment, Inflation & Business Cycles), a "negative GDP gap" describes an economy that is underperforming versus the full-employment potential. True or Fase True False If two million new babies were born in the U.S. and if two million more immigrants came to the U.S., then the Real GDP Per Copita will go down if we assume no change in the actual GDP number. True or False True Falsearrow_forwardWhat is the main goal of redistribution policies in welfare economics? A. To increase government revenue B. To reduce income inequality C. To maximize consumer surplus D. To minimize deadweight lossarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Microeconomics: Principles & Policy

Economics

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning