FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please make it book balance of cash and bank balance of cash clearly

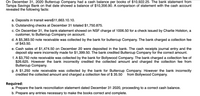

Transcribed Image Text:On December 31, 2020 Buttercup Company had a cash balance per books of $10,922.25. The bank statement from

Tampa Savings Bank on that date showed a balance of $10,356.90. A comparison of statement with the cash account

revealed the following facts:

a. Deposits in transit were$11,663.10.10.

b. Outstanding checks at December 31 totaled $1,750.875.

c. On December 31, the bank statement showed on NSF charge of 1006.50 for a check issued by Charlie Holston, a

customer, to Buttercup Company on account.

d. A $5,383.50 note receivable was collected by the bank for buttercup Company. The bank charged a collection fee

of $43.50.

e. Cash sales of $1,474.50 on December 20 were deposited in the bank. The cash receipts journal entry and the

deposit slip were incorrectly made for $1,399.50. The bank credited Buttercup Company for the correct amount.

f. A $3,750 note receivable was collected by the bank for Bollywood Company. The bank charged a collection fee of

$26.625. However the bank incorrectly credited the collected amount and charged the collection fee from

Buttercup Company.

g. A $1,250 note receivable was collected by the bank for Buttercup Company. However the bank incorrectly

credited the collected amount and charged a collection fee of $ 35.50

from Bollywood Company.

Required:

a. Prepare the bank reconciliation statement dated December 31 2020, proceeding to a correct cash balance.

b. Prepare any entries necessary to make the books correct and complete.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For number 13 how do i post that in a cash receipts journal?arrow_forwardWhy does the bank treat an account balance as a Credit when there is money in the account, while in the general ledger cash records of the business, the balance would show as a Debit?arrow_forwardcan you cash a check from an equity reserve accountarrow_forward

- H7. What specific information would you need to begin a cash receipts forecast? Identify three items that would be helpful. Please explain with detailsarrow_forwardhow do we record in the cash payment journal for the payment in cash and with the GST included and received discountarrow_forwardOn the Excel worksheet are the T- accounts for cash and other accounts need to record the bank reconciliation. Also, the format for the bank reconciliation is provided. Complete the bank reconciliation, using formulas when possible.arrow_forward

- Distinguish among the following: (1) a general checkingaccount, (2) an imprest bank account, and (3) a lockboxaccount.arrow_forwardWhat are the four accounts that are typically affected by cash transactions. Please use the following illustration to help you answer this question.arrow_forwardIndicate with Yes or No whether each of items should be included in the cash balance presented on the balance sheet. If yes is selected for the Included in Cash Balance column for NSF checks, Savings account,Compensating balance,post dated checks,IOU,cash on hand,cash in sinking fund, travel advance, bank draft and prepaid debit card. Include the Classification items excluded?arrow_forward

- do i add the opening balance after the difference of opening balance of bank statement and cash book gives me zero when i update the cash book?arrow_forwardWhen a company records a bank deposit, it will: O A. credit the Cash account on the company's books. O B. debit the Accounts Receivable account on the company's books. OC. debit the Cash account on the company's books. O D. credit the Accounts Payable account on the company's books.arrow_forwardA(n) electronic _____ is the electronic exchange of money or scrip. a. cash transfer b. array c. payment d. exchangearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education