Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

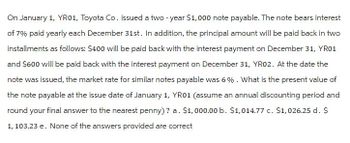

Transcribed Image Text:On January 1, YR01, Toyota Co. issued a two-year $1,000 note payable. The note bears interest

of 7% paid yearly each December 31st. In addition, the principal amount will be paid back in two

installments as follows: $400 will be paid back with the interest payment on December 31, YR01

and $600 will be paid back with the interest payment on December 31, YR02. At the date the

note was issued, the market rate for similar notes payable was 6%. What is the present value of

the note payable at the issue date of January 1, YR01 (assume an annual discounting period and

round your final answer to the nearest penny)? a. $1,000.00 b. $1,014.77 c. $1,026.25 d. $

1, 103.23 e. None of the answers provided are correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Presented below are data on three promissory notes. Determine the missing amounts. (Round answers for Total Interest to O decimal places, e.g. 825. Round annual interest rate to 0 decimal places, e.g. 15%. Use 360 days for calculation.) (a) (b) (c) Date of Note April 1 July 2 March 7 Terms 60 days 30 days 6 months Maturity Date Principal $780,000 80,400 165,000 Annual Interest Rate 15 % % 16 % $ $ Total Interest $938arrow_forwardNonearrow_forwardTORR, Inc. issues a $600,000, 9%, five-year note payable on January 1, 20X1. If the monthly payment is $12,455, what is the note's carrying value after the first month's payment is made on January 31, 20X1? Select one: a. $600,000 b. $592,045 c. $593,540 d. $595,500 e. $587,545arrow_forward

- please answer do not image formatarrow_forwardRex Corporation accepted a $4,000, 6%, 120-day note dated August 8 from Regis Company in settlement of a past bill. On October 11, Rex discounted the note at Park Bank at 7%. (Use Days in a year table.) a. What is the note's maturity value? Note: Use 360 days a year. Do not round intermediate calculations. Round your final answer to the nearest cent. Maturity value b. What is the discount period? Discount period c. What is the bank discount? Note: Use 360 days a year. Do not round intermediate calculations. Round your final answer to the nearest cent. Bank discount days d. What proceeds does Rex receive? Note: Use 360 days a year. Do not round intermediate calculations. Round your final answer to the nearest cent. Proceeds receivedarrow_forwardNonearrow_forward

- The following interest-bearing.promissory note was discounted at a bank by the payee before maturity. Use the ordinary interest method, 360 days, to calculate the missing information. (Round dollars to the nearest cent.). Face Value: $1,280 Interest Rate : 7.7 Date of Note: Sept 18 Term of Note (days) : 130 Maturity Date : ? Maturity Value (in $) $? Date of Discount : Dec 11 Discount Period (days) : ? Discount Rate (%) : 11.2 Proceeds (in $): $? If you purchase $28,000 in U.S. Treasury Bills with a discount rate of 4.9% for a period of 26 weeks, what is the effective interest rate (as a %)? Round to the nearest hundredth percent.arrow_forwardCheck my wor Solve for maturity value, discount period, bank discount, and proceeds. Assume a bank discount rate of 9%. Use the ordinary interest method. (Use Days in a year table.) (Do not round intermediate calculations. Round your final answers to the nearest cent.) Face value Rate of Length of note Date note (principal) $26, 300 interest Maturity value Date of note discounted 9% 65 days Discount period Bank discount Proceeds March 17 April 20 days 24 $4 hparrow_forwardNonearrow_forward

- EX.06.144 On April 7, Wilhelm, Inc. sold goods for $50,000 and accepted a 10%, 60-day note. On April 22, the company sold the note to a bank at a 13% discount rate. Required:Compute the amount of interest revenue and the loss on sale of the note. Assume a 360-day year. Round your answers to two decimal places. Interest revenue $ Loss on sale of note $arrow_forwardThe following interest-bearing promissory note was discounted at a bank by the payee before maturity. Use the ordinary interest method, 360 days, to calculate the missing information. (Round dollars to the nearest cent.) Face Value Interest Rate (%) Date of Note Term of Note (days) Maturity Date Maturity Value (in $) $750 141 June 9 135 ---Select--- * $ 794.96 2 Date of Discount Discount Period (days) Sept. 5 × Discount Rate (%) 15.5 $ tA Proceeds (in $)arrow_forward25. The following interest-bearing promissory note was discounted at a bank by the payee before maturity. Use the ordinary interest method, 360 days, to calculate the missing information. (Round dollars to the nearest cent.) FaceValue InterestRate (%) Date ofNote Term ofNote (days) MaturityDate MaturityValue(in $) $2,200 12 Mar. 7 80 $ Date ofDiscount DiscountPeriod (days) DiscountRate (%) Proceeds(in $) Apr. 15 19 $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education