FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

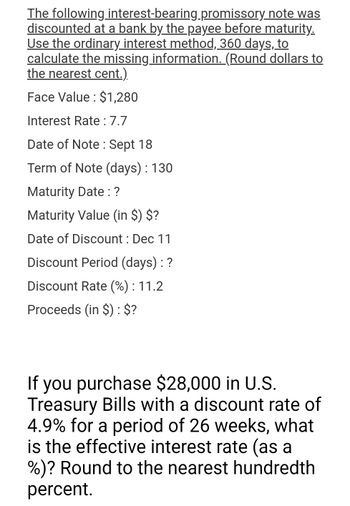

Transcribed Image Text:The following

interest-bearing.promissory note was

discounted at a bank by the payee before maturity.

Use the ordinary interest method, 360 days, to

calculate the missing information. (Round dollars to

the nearest cent.).

Face Value: $1,280

Interest Rate : 7.7

Date of Note: Sept 18

Term of Note (days) : 130

Maturity Date : ?

Maturity Value (in $) $?

Date of Discount : Dec 11

Discount Period (days) : ?

Discount Rate (%) : 11.2

Proceeds (in $): $?

If you purchase $28,000 in U.S.

Treasury Bills with a discount rate of

4.9% for a period of 26 weeks, what

is the effective interest rate (as a

%)? Round to the nearest hundredth

percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following certificate of deposit (CD) was released from a particular bank. Find the compound amount and the amount of interest earned by the following deposit. $2500 at 7% compounded daily for 10 years. What is the compound amount? $ (Round to the nearest cent.)arrow_forwardCalculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous mo th's balance. (Round dollars to the nearest cent.) Annual Monthly Finance Purchases Payments New Previous Percentage Rate (APR) (as a %) Periodic Charge and Cash and Balance Balance Rate (in $) Advances Credits (in $) 1-% $ 31.12 $2,490.00 15 % $1,354.98 $300.00 3576.1 4arrow_forwardThe following interest-bearing promissory note was discounted at a bank by the payee before maturity. Use the ordinary interest method, 360 days, to calculate the missing information. (Round dollars to the nearest cent.) Maturity Face Interest Date of Term of Maturity Value Value Rate (%) Note Note (days) Date (in $) 11- $250 June 5 135 -Select--- $ Date of Discount Discount Proceeds Discount Period (days) Rate (%) (in $) Sept. 7 12.5 $arrow_forward

- 1. A $9,600, 60-day, 12% note recorded on November 21 is not paid by the maker at maturity. The journal entry to recognize this event is a.debit Notes Receivable, $9,792; credit Accounts Receivable, $9,600; Credit Interest Receivable, $192. b.debit Accounts Receivable, $9,792; credit Notes Receivable, $9,600; Credit Interest Revenue, $192. c.debit Cash, $9,792; credit Notes Receivable, $9,792. d.debit Notes Receivable, $9,792; credit Accounts Receivable, $9,792.arrow_forwardI need fast answer and show work without plagiarism pleasearrow_forwardplease answer do not image formatarrow_forward

- Check my wor Solve for maturity value, discount period, bank discount, and proceeds. Assume a bank discount rate of 9%. Use the ordinary interest method. (Use Days in a year table.) (Do not round intermediate calculations. Round your final answers to the nearest cent.) Face value Rate of Length of note Date note (principal) $26, 300 interest Maturity value Date of note discounted 9% 65 days Discount period Bank discount Proceeds March 17 April 20 days 24 $4 hparrow_forwardThe following certificate of deposit (CD) was released from a particular bank. Find the compound amount and the amount of interest earned by the following deposit. $2500 at 6% compounded daily for 2 years. What is the compound amount? (Round to the nearest cent.)arrow_forwardYou are told that a note has repayment terms of $1,700 per quarter for 6 years, with a stated interest rate of 8%. How much of the total payment is for principal, and how much is for interest? Calculate using (a) financial calculator or (b) Excel function PV. (Round answers to 2 decimal places, eg. 5,275.25.) Total payment for principal Total interest Determine if the total interest will be higher or lower than with an annual payment. The total interest will be than with an annual payment.arrow_forward

- The following certificate of deposit (CD) was released from a particular bank. Find the compound amount and the amount of interest earned by the following deposit. $3000 at 5.7% compounded quarterly for 5 years. What is the compound amount?arrow_forwardThe following interest-bearing promissory note was discounted at a bank by the payee before maturity. Use the ordinary interest method, 360 days, to calculate the missing information. (Round dollars to the nearest cent.) Face Value Interest Rate (%) Date of Note Term of Note (days) Maturity Date Maturity Value (in $) $750 141 June 9 135 ---Select--- * $ 794.96 2 Date of Discount Discount Period (days) Sept. 5 × Discount Rate (%) 15.5 $ tA Proceeds (in $)arrow_forward25. The following interest-bearing promissory note was discounted at a bank by the payee before maturity. Use the ordinary interest method, 360 days, to calculate the missing information. (Round dollars to the nearest cent.) FaceValue InterestRate (%) Date ofNote Term ofNote (days) MaturityDate MaturityValue(in $) $2,200 12 Mar. 7 80 $ Date ofDiscount DiscountPeriod (days) DiscountRate (%) Proceeds(in $) Apr. 15 19 $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education