FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:прапу

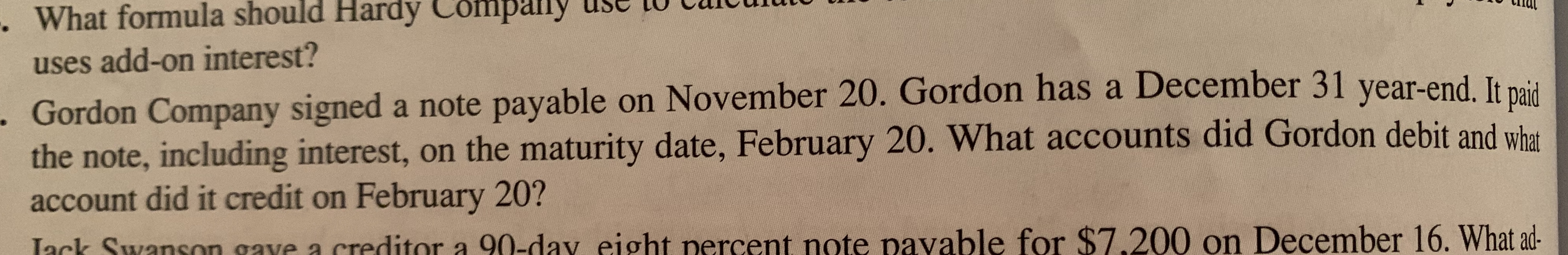

What formula should Hardy Company

uses add-on interest?

Gordon Company signed a note payable on November 20. Gordon has a December 31 year-end. It naid

the note, including interest, on the maturity date, February 20. What accounts did Gordon debit and what

account did it credit on February 20?

Lack Swanson gave a creditor a 90-dav eight percent note pavable for $7.200 on December 16. What ad-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Example 4 (Notes Receivable): On November 30, 2020, James Co. lent money to Scott Co. and issued a 5-month, $120,000, 8% note receivable. Scott paid James the full amount of interest and principal on April 30, 2021. What is the journal entry for James Co. to record the issuance of the note receivable? What is the end-of-year adjusting journal entry for James Co. to record interest revenue earned as of December 31?arrow_forwardPina Colada Corp. has the following transactions related to notes receivable during the last 2 months of 2020. The company does not make entries to accrue interest except at December 31. Nov. 1 Dec 11 16 31 Loaned $12,600 cash to Manny Lopez on a 12 month, 10% note. Sold goods to Ralph Kremer, Inc., receiving a $24,750, 90-day, 8% note. Received a $22,800, 180 day, 10% note in exchange for Joe Fernetti's outstanding accounts receivable. Accrued interest revenue on all notes receivable. Journalize the transactions for Pina Colada Corp. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Use 360 days for calculation. Round answers to 0 decimal places, eg. 5,275. Record journal entries in the order presented in the problem.) Date > > > eTextbook and Media List of Accounts Date Account Titles and Explanation V Record the collection of the Lopez note at its maturity in 2021. (Credit account titles are automatically indented when amount is…arrow_forward1. A $9,600, 60-day, 12% note recorded on November 21 is not paid by the maker at maturity. The journal entry to recognize this event is a.debit Notes Receivable, $9,792; credit Accounts Receivable, $9,600; Credit Interest Receivable, $192. b.debit Accounts Receivable, $9,792; credit Notes Receivable, $9,600; Credit Interest Revenue, $192. c.debit Cash, $9,792; credit Notes Receivable, $9,792. d.debit Notes Receivable, $9,792; credit Accounts Receivable, $9,792.arrow_forward

- On May 22, Jarrett Company borrows 9, 200, signing a 90-day, 7% $9, 200 noteWhat is the journal entry made by Jarrett Company to record the payment of the note on the maturity date? Choice Notes Payable $9,200, credit interest Expense $161 credit Cash $9,039 Notes Payable 9.200 credit Cash $9.200 Debit Notes Payable $9,361, credit Cash $9.361arrow_forwardI need fast answer and show work without plagiarism pleasearrow_forwardDo not give answer in imagearrow_forward

- Nonearrow_forwardThe following interest-bearing.promissory note was discounted at a bank by the payee before maturity. Use the ordinary interest method, 360 days, to calculate the missing information. (Round dollars to the nearest cent.). Face Value: $1,280 Interest Rate : 7.7 Date of Note: Sept 18 Term of Note (days) : 130 Maturity Date : ? Maturity Value (in $) $? Date of Discount : Dec 11 Discount Period (days) : ? Discount Rate (%) : 11.2 Proceeds (in $): $? If you purchase $28,000 in U.S. Treasury Bills with a discount rate of 4.9% for a period of 26 weeks, what is the effective interest rate (as a %)? Round to the nearest hundredth percent.arrow_forwardBramble Corp. lends Sheffield Corp. $50400 on April 1, accepting a four-month, 9% interest note. Bramble Corp. prepares financial statements on April 30. What adjusting entry should be made before the financial statements can be prepared? O Interest Receivable 378 Interest Revenue 378 Interest Revenue 80 Cash Note Receivable Cash Interest Receivable Interest Revenue Type here to search 378 50400 1134 S 378 50400 1134 17arrow_forward

- Gentry Wholesalers accepts from Concord Stores a $8,850, 4-month, 8% note dated May 31 in settlement of Concord’soverdue account. The maturity date of the note is September 30. What entry does Gentry make at the maturity date,assuming Concord pays the note and interest in full at that time?Date Account Titles and Explanation Debit CreditSept.30 Notes ReceivableInterest ReceivableNotes Payablearrow_forwardEX.06.144 On April 7, Wilhelm, Inc. sold goods for $50,000 and accepted a 10%, 60-day note. On April 22, the company sold the note to a bank at a 13% discount rate. Required:Compute the amount of interest revenue and the loss on sale of the note. Assume a 360-day year. Round your answers to two decimal places. Interest revenue $ Loss on sale of note $arrow_forwardAnne Taylor comapany borrowed cash on august 1 of year 1, by signing a $46,620(face amount), one year note payable, due on july 31 of year 2. the accounting period of Anne yalor ends December 31. Assume an effective interest rate of 11%. How much cash should Anne Taylor Company receive from the note on August 1 of Year 1, assuming the note is a noninterest-bearing note?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education