FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

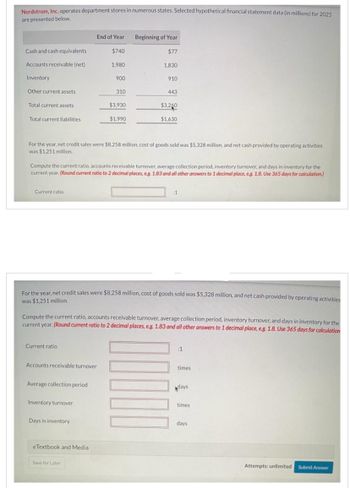

Transcribed Image Text:Nordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial statement data (in millions) for 2025

are presented below.

Cash and cash equivalents

Accounts receivable (net)

Inventory

Other current assets

Total current assets

Total current liabilities

Current ratio.

Current ratio

End of Year

Accounts receivable turnover

Average collection period

Inventory turnover

$740

Days in inventory

1,980

eTextbook and Media

900

Save for Later

310

$3,930

For the year, net credit sales were $8,258 million, cost of goods sold was $5,328 million, and net cash provided by operating activities

was $1,251 million.

$1.990

Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the

current year. (Round current ratio to 2 decimal places, e.g. 1.83 and all other answers to 1 decimal place, e.g. 1.8. Use 365 days for calculation.)

Beginning of Year

$77

1,830

For the year, net credit sales were $8,258 million, cost of goods sold was $5,328 million, and net cash provided by operating activities

was $1,251 million.

910

Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the

current year. (Round current ratio to 2 decimal places, e.g. 1.83 and all other answers to 1 decimal place, e.g. 1.8. Use 365 days for calculation

443

$3,260

$1,630

00000

:1

:1

times

days

times

days

Attempts: unlimited

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The table below contains data on Fincorp Incorporated. The balance sheet items correspond to values at year-end 2021 and 2022, while the income statement items correspond to revenues or expenses during the year ending in either 2021 or 2022. All values are in thousands of dollars. Revenue Cost of goods sold Depreciation Inventories Administrative expenses Interest expense Federal and state taxes Accounts payable Accounts receivable 2021 $ 4.500 1,900 600 290 540 130 420 280 440 Price 5,300 1.800 856 440 850 per share 2022 $ 4.600 2,000 620 350 590 Net fixed assets Long-tern debt Notes payable Dividends paid Cash and marketable securities *Taxes are paid in their entirety in the year that the tax obligation is incurred. 130 440 320 510 6. 190 *Net fixed assets are fixed assets net of accumulated depreciation since the asset was installed. Suppose that the market value (in thousands of dollars) of Fincorp's fixed assets in 2022 is $6,500 and that the value of its long-term debt is only…arrow_forwardNordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial statement data (in millions) for 2022 are presented below. End of Year Beginning of Year Cash and cash equivalents $ 1,289 $ 126 Accounts receivable (net) 3,600 3,400 Inventory 1,600 1,600 Other current assets 571 531 Total current assets $7,060 $5,657 Total current liabilities $3,530 $2,802 For the year, net credit sales were $14,350 million, cost of goods sold was $9,280 million, and net cash provided by operating activities was $1,256 million.Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the current year. (Round Current ratio to 2 decimal places, e.g. 1.62 and all other answers to 1 decimal place, e.g. 1.6.) Current ratio enter the ratio rounded to 2 decimal places :1 Accounts…arrow_forwardThe 2021 income statement of Adrian Express reports sales of $15,960,000, cost of goods sold of $9,600,000, and net income of $1,600,000. Balance sheet information is provided in the following table. ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 2021 2020 Assets Current assets: Cash Accounts receivable $ 600,000 $ 760,000 1,400,000 1,800,000 4,800,000 $8,600,000 1,000,000 1,400,000 4,240,000 $7,400,000 Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities $2,020,000 2,300,000 2,000,000 2,280,000 $8,600,000 $1,660,000 2,400,000 2,000,000 1,340,000 $7,400,000 Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Industry averages for the following four risk ratios are as follows: Average collection period Average days in inventory Current ratio 25 days 60 days 2 to 1 50% Debt to equity ratioarrow_forward

- Here is some financial statement data for Nestlé (in millions of Swiss francs): After reviewing the information, calculate the following ratios for Nestlé for 2021:1) Inventory turnover2) Profit margin3) Return on assets4) Free cash flowRound all answers to two decimal places. Do not include dollar signs because Nestlé's accounting information is in Swiss francs. Show the calculations for each answer.arrow_forwardJanice Wong has extracted the following information from her income statement and balance sheet for 2021 and 2020: 2021 2020 Profit After Tax $687,511 $665,763 Cash at Bank $109,805 $102,213 Mortgage payable this year $21,488 $31,995 Inventory $39,432 $42,929 Accounts payable $128,057 $121,309 Accounts receivable (trade debtors) $444,563 $393,798 Mortgage payable in 5 years time $516,150 $633,164 Owner's Equity $1,479,443 $1,096,378 Based on the information provided, calculate the Return on Equity for 2021.arrow_forwardYou are considering two possible companies for investment purposes. The following data is available for each company. Company A Net credit sales, Dec. 31, 2019 $540,000 Net Accounts receivable, Dec 31, 2018 $120,000 Net accounts receivable, Dec 31, 2019 $180,000 Number of days sales in receivables ratio, 2018 103 days Net Income, Dec. 31, 2018 $250,000 Company B Net credit sales, Dec. 31, 2019 $620,000 Net Accounts receivable, Dec 31, 2018 $145,000 Net accounts receivable, Dec 31, 2019 $175,000 Number of days sales in receivables ratio, 2018 110 days Net Income, Dec. 31, 2018 $350,000 Additional Information: Company A: Bad debt estimation percentage using the income statement method is 6%, and the balance sheet…arrow_forward

- Nordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial statement data (in millions) for 2022 are presented below. End of Year Beginning of Year Cash and cash equivalents $ 1,441 $137 Accounts receivable (net) 3,900 3,700 Inventory 1,700 1,700 Other current assets 619 576 Total current assets $7,660 $6,113 Total current liabilities $3,830 $3,042 For the year, net credit sales were $15,580 million, cost of goods sold was $10,200 million, and net cash provided by operating activities was $1,273 million. Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the current year. (Round Current ratio to 2 decimal places, e.g. 1.62 and all other answers to 1 decimal place, e.g. 1.6.) Current ratio Accounts receivable turnover Average collection period Inventory turnover Days in inventory :1 times days times daysarrow_forwardNordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial statement data (in millions) for 2025 are presented below. Cash and cash equivalents Accounts receivable (net) Inventory Other current assets Total current assets Total current liabilities End of Year Current ratio: $740 2,080 Accounts receivable turnover Average collection period 860 650 $4,330 $2,010 Beginning of Year $79 1.900 For the year, net credit sales were $8,258 million, cost of goods sold was $5,328 million, and net cash provided by opcing activities was $1,251 million. 890 Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the current year. (Round current ratio to 2 decimal places, eg 1.83 and all other answers to 1 decimal place, e.g. 1.8. Use 365 days for calculation) 371 $3,240 $1,640 :1 times days Carrow_forwardCompany A's net credit sales in 2020 and 2021 are 21115 and 35118 respectively. Cost of sales in 2020 is 15432, and in 2021 is 17088. Company A'a account receivable in 2020 and 2021 are 500 and 1000 respectively and its inventory in 2020 and 2021 are 2839 and 3489 respectively. Company A's cash collections from customers in 2021 are:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education