Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

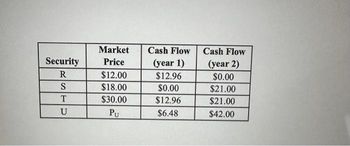

Transcribed Image Text:The attached table shows the risk-free cash flows over the next two years from owning three securities (R, S and T) and their current market prices.

What is the no-arbitrage price of asset U (P)?

No arbitrage pricing-security Updf 49 KB

A. $42.00

B. $36.42

OC. $33.00

D. $48.47

OE. $30,00

Reset Selection

Transcribed Image Text:Security

R

S

T

U

Market

Price

$12.00

$18.00

$30.00

Pu

Cash Flow

(year 1)

$12.96

$0.00

$12.96

$6.48

Cash Flow

(year 2)

$0.00

$21.00

$21.00

$42.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 15 The promised cash flows of three securities are listed below. If the cash flows are risk-free, and the risk-free interest rate is 4%, determine the no-arbitrage price of each security before the first cash flow is paid. Security Cash Flow Today ($) Cash Flow in One Year ($) A 600 600 В 1200 C 1200arrow_forwardTerm in years: Rate: 2 OA $74.862 OB $02.385 OC. $57,339 OD $40.000 10 35% 30 43755 3.125% The table above shows the interest rates available from investing in msk free US Treasury securbes with different investment ferms. If an investment offers a risk-free cash flow of $85,000 in ten years' time, what is the present value (PV) of that cash flow?arrow_forwardThe promised cash flows of three securities are listed below. If the cash flows are risk-free, and the risk-free interest rate is 4.5%, determine the no-arbitrage price of each security before the first cash flow is paid. (Click on the following icon in order to copy its contents into a spreadsheet.) Security A B C Cash Flow Today (S) 700 0 1,400 The no-arbitrage price of security A is S Cash Flow in One Year ($) 700 1,400 0 (Round to the nearest cent.)arrow_forward

- Consider the following timeline detailing a stream of cash flows: Date $1000 $2000 Cash flow O $14,311 If the current market rate of interest is 9%, then the future value (FV) of this stream of cash flows at the end of year 4 is closest to: O $11,926 O $5,963 $3000 $4000 $19,082 ?arrow_forwardAn investor who bought money-market securities at a yield of 5.50% p.a. and sold the parcel for a few weeks later at a yield of 5.85% p.a. would earn: a interest b a capital loss c a capital gain d. interest and a capital loss e. interest and capital gain.arrow_forwardstep by step instructions no excelarrow_forward

- Assume you have the following asset and liability in your Balance Sheet:Asset - Bond AModified Duration = 2.6 yearsValue= RM1.5 millionLiability - Bond BModified Duration = 3.1 yearsValue= RM1.0 million duration gap is 0.53 years, net worth reduce by 8000. What should or could you to achieve immunized balance sheet?arrow_forwardFor the given cash flow, Which of the following statements is correct? Year 1 3 +2,000 -500 -8,100 +6,800 Select one: a. There are two interest rate b. The present worth converts in sign from positive to negative two times C. Non-conventional cash flow d. all the above %24arrow_forwardstep by step instructions no excelarrow_forward

- 1) Find the PW, AW and FW of the following cashflow if the interest rate compound semiannually. P-7 i-10% --14%- Year $100 $100 S100 $100 $100 S160 S160 SIGDarrow_forwardFor each of the investments below, calculate the rate of return earned over the period. Investment ABCDE Cash Flow During Beginning-of-Period End-of-Period Value Period Value - $400 13,000 4,000 60 1,700 $1,700 140,000 60,000 800 14,500 $800 117,000 46,000 400 12,600arrow_forwardTake me to the text The following table indicates the net cash flows of a capital asset: Year Net Cash Flow 0 $-12,900 1 $4,100 2 $8,100 Do not enter dollar signs or commas in the input boxes. Use the negative sign where appropriate. Round the factor to 4 decimal places and the NPV to the nearest whole number. Assume the required rate of return is 9%. Determine the net present value of this asset. Year Net Cash Flow Factor Net Present Value $-12,900 0 1 2 Total $4,100 $8,100 SA $ 69arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education