FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text::

1:25 ¹36 Q

+

10

Security

A

B

C

Total

277B/s

INVESTMENT 4...

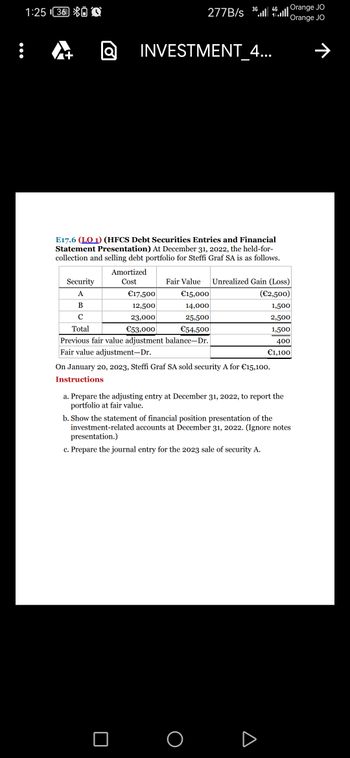

E17.6 (LO 1) (HFCS Debt Securities Entries and Financial

Statement Presentation) At December 31, 2022, the held-for-

collection and selling debt portfolio for Steffi Graf SA is as follows.

Amortized

Cost

4G

3646

€17,500

€15,000

12,500

14,000

23,000

25,500

€53,000

€54,500

Previous fair value adjustment balance-Dr.

Fair value adjustment-Dr.

Fair Value Unrealized Gain (Loss)

(€2,500)

1,500

2,500

1,500

400

€1,100

On January 20, 2023, Steffi Graf SA sold security A for €15,100.

Instructions

a. Prepare the adjusting entry at December 31, 2022, to report the

portfolio at fair value.

□ O

Orange JO

Orange JO

b. Show the statement of financial position presentation of the

investment-related accounts at December 31, 2022. (Ignore notes

presentation.)

c. Prepare the journal entry for the 2023 sale of security A.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At December 31, 2020, the available-for-sale debt portfolio for Whispering, Inc. is as follows. Security Cost Fair Value UnrealizedGain (Loss) A $ 27,125 $ 23,250 $( 3,875 ) B 19,375 21,700 2,325 C 35,650 39,525 3,875 Total $ 82,150 $ 84,475 2,325 Previous fair value adjustment balance—Dr. 620 Fair value adjustment—Dr. $ 1,705 On January 20, 2021, Whispering, Inc. sold security A for $ 23,405. The sale proceeds are net of brokerage fees. (a) Prepare the adjusting entry at December 31, 2020, to report the portfolio at fair value. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardThe following information is available for Tamarisk Corporation's available-for-sale debt securities at December 31, 2020. Security Cost Fair Value X $40,120 $35,400 28,320 37,760 $68,440 $73,160 Prepare the adjusting entry to record the securities at fair value at December 31, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry.) Account Titles and Explanation Debit Creditarrow_forwardE10-11 (Algo) (Supplement 10A) Recording the Effects of a Premium Bond Issue and First Interest Period (Straight-Line Amortization) [LO 10-S1] Part 4 Grocery Corporation received $330,653 for 9.50 percent bonds issued on January 1, 2021, at a market interest rate of 6.50 percent. The bonds had a total face value of $272,000, stated that interest would be paid each December 31, and stated that they mature in 10 years. Assume Grocery Corporation uses the straight-line method to amortize the bond premium. Required: 1. & 2. Prepare the required journal entries to record the bond issuance and the first interest payment on December 31. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Round your answers to the nearest whole dollar.)arrow_forward

- PB5. LO 13.3Dixon Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018 and received $480,000. Interest is payable annually. The discount is amortized using the straight-line method. Prepare journal entries for the following transactions. July 1, 2018: entry to record issuing the bonds June 30, 2019: entry to record payment of interest to bondholders June 30, 2019: entry to record amortization of discount June 30, 2020: entry to record payment of interest to bondholders June 30, 2020: entry to record amortization of discountarrow_forwardEf 591.arrow_forwardS5.arrow_forward

- E9.14 (LO) (Debt Investment Entries - FV - OCI) On July 1, 2023, Miron Aggregates Ltd. purchased 6% bonds with a maturity value of $100,000 for $103,585. The bonds provide the bondholders with a 5% yield. The bonds mature four years later, on July 1, 2027, with interest receivable June 30 and December 31 of each year. Miron uses the effective interest method to allocate unamortized discount or premium. The bonds are accounted for using the FV - OCI model with recycling. Miron has a calendar year end. The fair value of the bonds at December 31, 2023 and 2024, was $103,400 and $102, 200, respectively. Assume fair value adjustments are recorded at year end only. Immediately after collecting interest on December 31, 2024, the bonds were sold for $102, 200.arrow_forward(5 points) Which of the following is true of the straight-line method for amortizing premiums and discounts on long-term debt? (LE 3) O The method can be used by any company for any debt. O The journal entries are the same for every payment. O The method is preferred by FASB. O The premium or discount amortized away is the plug figure in the journal entry. EEarrow_forwardA5arrow_forward

- E14.7 (LO 1) Groupwork (Determine Proper Amounts in Account Balances) Presented below are three independent situations. Instructions a. McEntire Co. sold $2,500,000 of 11%, 10-year bonds at 106.231 to yield 10% on January 1, 2022. The bonds were dated January 1, 2022, and pay interest on July 1 and January 1. Determine the amount of interest expense to be reported on July 1, 2022, and December 31, 2022. b. Cheriel Inc. issued $600,00o of 9%, 10-year bonds on June 30, 2022, for $562,500. This price provided a yield of 10% on the bonds. Interest is payable semiannually on December 31 and June 30. Determine the amount of interest expense to record if financial statements are issued on October 31, 2022. c. On October 1, 2022, Chinook Company sold 12% bonds having a maturity value of $800,000 for $853,382 plus accrued interest, which provides the bondholders with a 10% yield. The bonds are dated January 1, 2022, and mature January 1, 2027, with interest payable December 31 of each year.…arrow_forwardc5arrow_forwardHh3.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education