Concept explainers

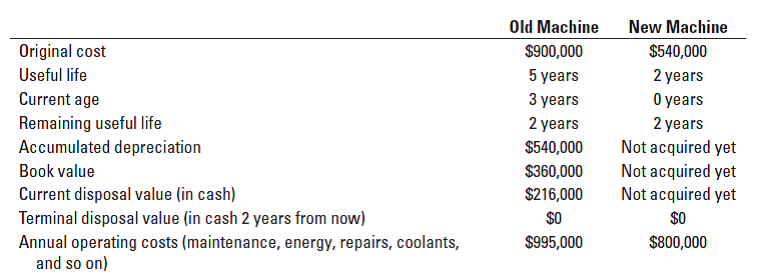

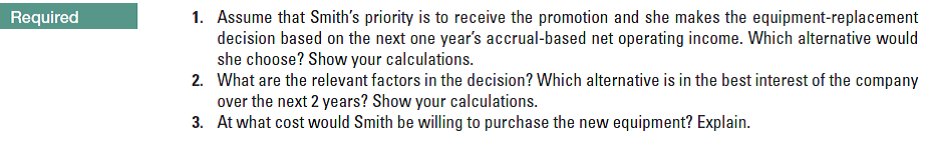

Equipment replacement decisions and performance evaluation. Susan Smith manages the Wexford plant of Sanchez Manufacturing. A representative of Darnell Engineering approaches Smith about replacing a large piece of manufacturing equipment that Sanchez uses in its process with a more efficient model. While the representative made some compelling arguments in favor of replacing the 3-year-old equipment, Smith is hesitant. Smith is hoping to be promoted next year to manager of the larger Detroit plant, and she knows that the accrual-basis net operating income of the Wexford plant will be evaluated closely as part of the promotion decision. The following information is available concerning the equipment replacement decision:

Sanchez uses straight-line

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps with 1 images

- The sales manager is deciding between two possible compensation structures for sales staff. Under one plan, salespeople would receive a base compensation of $80,000 per year plus a 1% commission on all sales to their customers. Under the other plan, the base compensation would drop to $40,000 per year, but the commission rate would increase to 5%. What are the advantages and disadvantages, to the company of both plans? As the accounting manager, would you have a preference? Why or why not? (answer in text form please (without image), Note: .Every entry should have narration please)arrow_forwardYou are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.0 million for this report, and I am not sure their analysis makes sense. Before we spend the $25 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): (Click on the following icon in order to copy its contents into a spreadsheet.) Project Year Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income 1 30.000 18.000 12.000 2.000 2.500 7.500 2 30.000 18.000 12.000 2.000 2.500 7.500 9 30.000 18.000 12.000 2.000 2.500 7.500 10 30.000 18.000 12.000 2.000 2.500 7.500 a. Given the available information, what are the free cash flows in years 0 through 10 that should be…arrow_forwardYou are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.2 million for this report, and I am not sure their analysis makes sense. Before we spend the $29 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): (Click on the following icon in order to copy its contents into a spreadsheet.) Project Year Sales revenue Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income - Income tax 1 25.000 15.000 10.000 2.320 2.900 4.780 1.434 2 25.000 15.000 10.000 2.320 2.900 4.780 1.434 9 25.000 15.000 10.000 2.320 2.900 4.780 1.434 10 25.000 15.000 10.000 2.320 2.900 4.780 1.434 a. Given the available information, what are the free cash flows in…arrow_forward

- Alter's Home Center (AHC) sells renovation and remodeling products to both contractors and individual home owners. One of the services AHC offers is delivery of the purchased products to the customer's work site. Because not all customers take advantage of the delivery service option, ACH adds 10 percent to the cost of the products purchased to cover the delivery cost. A business intern spent the summer at ACH. The intern's assignment was to analyze the delivery service and recommend a better way to charge customers for using it. The intern, who had studied activity-based costing, identified the following activities and the data related to them: Activity Picking order Delivering order Handling complaints Total delivery cost Cost Driver Number of items Number of orders Number of complaints Annual Cost $ 286,000 522,500 32,400 $ 840,900 Total order value (before delivery charge) Number of orders The intern selected two customers, who were frequent customers, to use as an illustration of…arrow_forwardYou are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.4 million for this report, and I am not sure their analysis makes sense. Before we spend the $28 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): (Click on the following icon in order to copy its contents into a spreadsheet.) Project Year Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income - Income tax 1 31.000 18.600 12.400 2.240 2.800 7.360 1.472 2 31.000 18.600 12.400 2.240 2.800 7.360 1.472 9 31.000 18.600 12.400 2.240 2.800 7.360 1.472 10 31.000 18.600 12.400 2.240 2.800 7.360 1.472 a. Given the available information, what are the free cash flows…arrow_forwardAlter's Home Center (AHC) sells renovation and remodeling products to both contractors and individual home owners. One of the services AHC offers is delivery of the purchased products to the customer's work site. Because not all customers take advantage of the delivery service option, ACH adds 10 percent to the cost of the products purchased to cover the delivery cost. A business intern spent the summer at ACH. The intern's assignment was to analyze the delivery service and recommend a better way to charge customers for using it. The intern, who had studied activity-based costing, identified the following activities and the data related to them: Activity Picking order Delivering order Handling complaints Total delivery cost Cost Driver Number of items Number of orders Number of complaints Total order value (before delivery charge) Number of orders Annual Cost $ 321,640 850,500 29,440 $ 1,201,580 The intern selected two customers, who were frequent customers, to use as an illustration…arrow_forward

- Danielle Hastings was recently hired as a cost analyst by CareNet Medical Supplies Inc. One of Danielle’s first assignments was to perform a net present value analysis for a new warehouse. Danielle performed the analysis and calculated a present value index of 0.75. The plant manager, Jerrod Moore, is very intent on purchasing the warehouse because be believes that more storage space is needed. Jerrod asks Danielle into his office and the following conversation takes place: Jerrod: Danielle, you’re new here, aren’t you? Danielle: Yes, I am. Jerrod: Well, Danielle, I’m not at all pleased with capital investment analysis that you performed on this new warehouse. I need that warehouse for my production. If I don’t get it, where am I going to place out output? Danielle: Well, we need to get product into our customer’s hands. Jerrod: I agree, and we need a warehouse to do that. Danielle: My analysis does not support constructing a new warehouse. The numbers don’t lie; the warehouse does not…arrow_forwardYou are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.5 million for this report, and I am not sure their analysis makes sense. Before we spend the $17 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income 1 2 28.000 28.000 16.800 16.800 11.200 11.200 1.360 1.360 1.700 1.700 8.1400 8.1400 9 28.000 16.800 11.200 1.360 1.700 8.1400 10 28.000 16.800 11.200 1.360 1.700 8.1400 b. If the cost of capital for this project is 9%, what is your estimate of the value of the new project? Value of project = $ million (Round to three decimal places.)arrow_forwardPlease show work and explanations on how you got your answers.arrow_forward

- Alter's Home Center (AHC) sells renovation and remodeling products to both contractors and individual home owners. One of the services AHC offers is delivery of the purchased products to the customer's work site. Because not all customers take advantage of the delivery service option, ACH adds 10 percent to the cost of the products purchased to cover the delivery cost. A business intern spent the summer at ACH. The intern's assignment was to analyze the delivery service and recommend a better way to charge customers for using it. The intern, who had studied activity-based costing, identified the following activities and the data related to them: Activity Cost Driver Annual Cost Annual Driver Volume Picking order Number of items $ 286,000 357,500 items Delivering order Number of orders 522,500 27,500 orders Handling complaints Number of complaints 32,400 135 complaints Total delivery cost $ 840,900 The intern selected two customers, who were frequent customers, to…arrow_forwardEe 417.arrow_forwardYou are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.5 million for this report, and I am not sure their analysis makes sense. Before we spend the $16 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): Sales revenue -Cost of goods sold Gross profit - General, sales, and administrative expenses -Depreciation Net operating income -Income tax 2 26.000 15.600 10.400 10.400 1.280 1.280 1,600 1.600 7.5200 7.5200 2.632 2.632 1 26.000 15.600 9 10 26.000 26.000 15.600 15.600 10.400 1.280 1.600 7.5200 2.632 10.400 1.280 1.600 7.5200 2.632 b. If the cost of capital for this project is 9%, what is your estimate of the value of the new project? Value of project = $ million (Round to three decimal…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education