Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

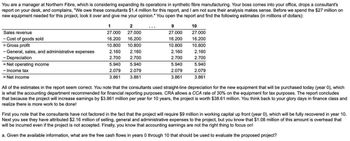

Transcribed Image Text:You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's

report on your desk, and complains, "We owe these consultants $1.4 million for this report, and I am not sure their analysis makes sense. Before we spend the $27 million on

new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars):

1

2

Sales revenue

27.000

27.000

9

27.000

10

27.000

- Cost of goods sold

16.200 16.200

16.200

16.200

= Gross profit

10.800 10.800

10.800

10.800

- General, sales, and administrative expenses

- Depreciation

2.160

2.160

2.160

2.160

2.700

2.700

2.700

2.700

Net operating income

5.940

5.940

5.940

5.940

- Income tax

2.079

2.079

2.079

2.079

= Net income

3.861

3.861

3.861

3.861

All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today (year 0), which

is what the accounting department recommended for financial reporting purposes. CRA allows a CCA rate of 30% on the equipment for tax purposes. The report concludes

that because the project will increase earnings by $3.861 million per year for 10 years, the project is worth $38.61 million. You think back to your glory days in finance class and

realize there is more work to be done!

First you note that the consultants have not factored in the fact that the project will require $9 million in working capital up front (year 0), which will be fully recovered in year 10.

Next you see they have attributed $2.16 million of selling, general and administrative expenses to the project, but you know that $1.08 million of this amount is overhead that

will be incurred even if the project is not accepted. Finally, you know that accounting earnings are not the right thing to focus on!

a. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.3 million for this report, and I am not sure their analysis makes sense. Before we spend the $22 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): Sales revenue - Cost of goods sold = Gross profit General, sales, and administrative expenses - Depreciation = Net operating income - Income tax = Net income 1 2 28.000 28.000 16.800 16.800 11.200 11.200 1.760 1.760 2.200 2.200 7.240 7.240 2.534 2.534 4.706 4.706 ... 9 28.000 16.800 11.200 1.760 2.200 7.240 2.534 4.706 10 28.000 16.800 11.200 1.760 2.200 7.240 2.534 4.706 All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new…arrow_forwardYour answer is partially correct. As a new intern for the local branch office of a national brokerage firm, you are excited to get an assignment that allows you to use your accounting expertise. Your supervisor provides you with the spreadsheet below, which contains data for the most recent quarter for three companies that the firm has been recommending to its clients as "buys." Each of the companies' returns on assets has outperformed their industry cohorts in the past. But, given recent challenges in their markets, there is concern that the companies may experience operating challenges and lower earnings. (All numbers in millions, except return on assets.) Company Sprint Nextel Washington Mutual E* Trade Financial Fair Value of Company $36,351 11,582 Loss on Impairment Account Titles and Explanation Goodwill 1,628 eTextbook and Medial Book Value (Net Assets Including Goodwill) $51,201 23,941 4,024 Carrying Value of Goodwill $30,618 9,052 2,015 (c) Estimate the amount of goodwill…arrow_forwardSuppose you have been hired as a financial consultant to Defense Electronics, Incorporated (DEI), a large, publicly traded firm that is the market share leader in radar detection systems (RDSs). The company is looking at setting up a manufacturing plant overseas to produce a new line of RDSs. This will be a five-year project. The company bought some land three years ago for $3.8 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $6.9 million on an aftertax basis. In five years, the aftertax value of the land will be $7.3 million, but the company expects to keep the land for a future project. The company wants to build its new manufacturing plant on this land; the plant and equipment will cost $33.5 million to build. The following market data on DEI’s securities are current: Debt: 145,000 bonds with a coupon rate of 6.9 percent outstanding, 22…arrow_forward

- You have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $1.39 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $1,490,000 on an aftertax basis. At the end of the project, the land could be sold for $1,590,000 on an aftertax basis. The company also hired a marketing firm to analyze the zither market, at a cost of $124,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,700, 4,600, 5,200, and 4,100 units each year for the next four years, respectively. Again, capitalizing on the name recognition of…arrow_forwardThe senior VP in charge has asked that you make a recommendation for the purchase of new equipment.Ideally, the company wants to limit its capital investment to $500,000. However, if an asset meritsspending more, an investment exceeding this limit may be considered. You assemble a team to helpyou. Your goal is to determine which option will result in the best investment for the company. Toencourage capital investments, the government has exempted taxes on profits from new investments.This legislation is to be in effect for the foreseeable future.The average reported operating income for the company is $1,430,500.The company uses an 11% discount rate in evaluating capital investments.The team is considering the following optionsOption 1:The asset cost is $300,000.The asset is expected to have an 8-year useful life with no salvage value.Straight-line depreciation is used.The net cash inflow is expected to be $62,000 each year for 8 years.A significant portion of this asset is made from…arrow_forwardYou are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.6 million for this report, and I am not sure their analysis makes sense. Before we spend the $26 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income -Income tax = Net income 2 1 29.000 29.000 17.400 17.400 11.600 11.600 2.080 2.080 2.600 2.600 6.920 6.920 2.422 2.422 4.498 4.498 10 9 29.000 29.000 17.400 17.400 11.600 11.600 2.080 2.080 2.600 2.600 6.920 2.422 4.498 6.920 2.422 4.498 All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new…arrow_forward

- You recently went to work for Allied Components Company, a sup-plier of auto repair parts used in the after-market with products from Daimler AG, Ford, Toyota, and other automakers. Your boss, the chief financial officer (CFO), has just handed you the estimated cash flows for two proposed projects. Project L involves adding a new item to the firm’s ignition system line; it would take some time to build up the market for this product, so the cash inflows would increase over time. Project S involves an add-on to an existing line, and its cash flows would decrease over time. Both projects have 3-year lives because Allied is planning to introduce entirely new models after 3 years. Here are the projects’ after-tax cash flows (in thousands of dollars): 02 1 Project L Project S ⫺$100 ⫺$100 $10 $70 $60 $50 3 $80 $20 Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. The CFO also made subjective risk assessments of…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardYou are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.9 million for this report, and I am not sure their analysis makes sense. Before we spend the $28 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): 2 9 10 Sales revenue 1 27.000 27.000 16.200 16.200 10.800 10.800 2.240 - Cost of goods sold 27.000 16.200 10.800 27.000 16.200 = Gross profit 10.800 - General, sales, and administrative expenses 2.240 2.240 2.240 - Depreciation 2.800 2.800 2.800 2.800 5.7600 = Net operating income 5.7600 5.7600 5.7600 - Income tax 2.016 2.016 2.016 2.016 = Net income 3.744 3.744 3.744 3.744 All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the…arrow_forward

- Gemma Company is a midsize manufacturing company with 120 employees and approximately $45 million in sales. Management has established a set of processes to purchase fixed assets, described in the following paragraphs: When a user department decides to purchase a new fixed asset, the departmental manager prepares an asset request form. When completing the form, the manager must describe the fixed asset, the advantages or efficiencies offered by the asset, and estimates of costs and benefits. The asset request form is forwarded to the director of finance. Personnel in the finance department review estimates of costs and benefits and revise these if necessary. A discounted cash flow analysis is prepared and forwarded to the vice president of operations, who reviews the asset request forms and the discounted cash flow analysis, and then interviews user department managers if he or she feels it is warranted. After this review, she selects assets to purchase until she has exhausted the…arrow_forwardBusiness at your design engineering firm has been brisk. To keep up with the increasing workload, you are considering the purchase of a new state-of-the-art CAD/CAM system costing $370,000, which would provide 6,500 hours of productive time per year. Your firm puts a lot of effort into drawing new product designs. At present, this is all done by design engineers on an old CAD/CAM system installed five years ago. If you purchase the system, 30% of the productive time will be devoted to drawing (CAD) and the remainder to CAM. While drawing, the system is expected to out-produce the old CAD/CAM system by a factor of 3:1. You estimate that the additional annual out-of-pocket cost of maintaining the new CAD/CAM system will be $190,000, including any tax effects. The expected useful life of the system is eight years, after which the equipment will have no residual value. As an alternative, you could hire more design engineers. Each normally works 1,950 hours per year, and 60% of this time is…arrow_forwardYou were recently hired to work in the controller's office of the Balboa Lumber Company. Your boss, Alfred Eagleton, took you to lunch during your first week and asked a favor. "Things have been a little slow lately, and we need to borrow a little cash to tide us over. Our inventory has been building up and the CFO wants to pledge the inventory as collateral for a short-term loan. But I have a better idea." Mr. Eagleton went on to describe his plan. "On July 1, 2021, the first day of the company's third quarter, we will sell $100,000 of inventory to the Harbaugh Corporation for $160,000. Harbaugh will pay us immediately and then we will agree to repurchase the merchandise in two months for $164,000. The $4,000 is Harbaugh's fee for holding the inventory and for providing financing. I already checked with Harbaugh's controller and he has agreed to the arrangement. Not only will we obtain the financing we need, but the third quarter's before-tax profits will be increased by $56,000, the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education