FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

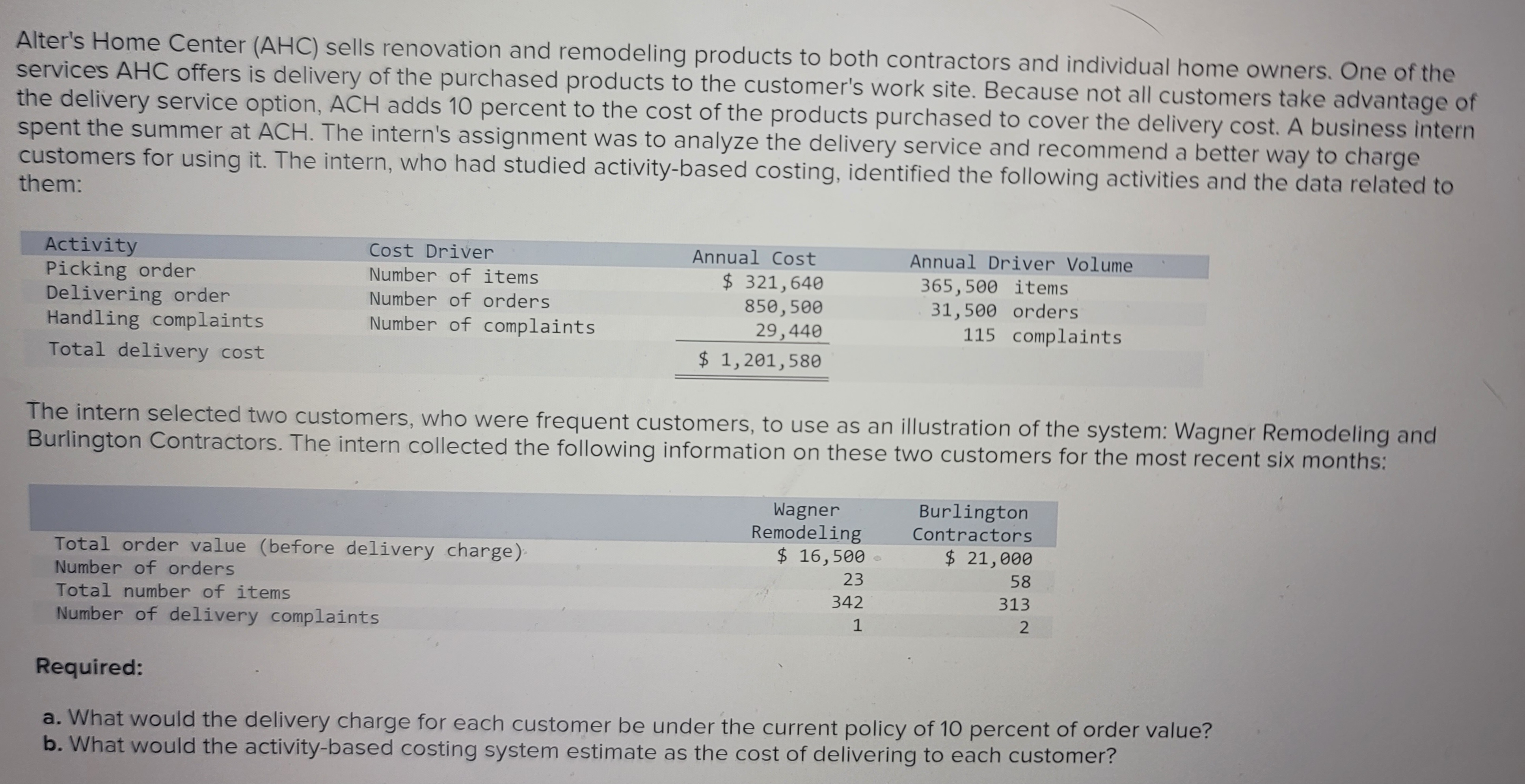

Transcribed Image Text:Alter's Home Center (AHC) sells renovation and remodeling products to both contractors and individual home owners. One of the

services AHC offers is delivery of the purchased products to the customer's work site. Because not all customers take advantage of

the delivery service option, ACH adds 10 percent to the cost of the products purchased to cover the delivery cost. A business intern

spent the summer at ACH. The intern's assignment was to analyze the delivery service and recommend a better way to charge

customers for using it. The intern, who had studied activity-based costing, identified the following activities and the data related to

them:

Activity

Picking order

Delivering order

Handling complaints

Total delivery cost

Cost Driver

Number of items

Number of orders

Number of complaints

Total order value (before delivery charge)

Number of orders

Annual Cost

$ 321,640

850,500

29,440

$ 1,201,580

The intern selected two customers, who were frequent customers, to use as an illustration of the system: Wagner Remodeling and

Burlington Contractors. The intern collected the following information on these two customers for the most recent six months:

Total number of items

Number of delivery complaints

Wagner

Remodeling

$ 16,500

Annual Driver Volume

365,500 items

31,500 orders

115 complaints

23

342

1

Burlington

Contractors

$ 21,000

58

313

2

Required:

a. What would the delivery charge for each customer be under the current policy of 10 percent of order value?

b. What would the activity-based costing system estimate as the cost of delivering to each customer?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lead timeSound Tek Inc. manufactures electronic stereo equipment. Themanufacturing process includes printed circuit (PC) board assembly,final assembly, testing, and shipping. In the PC board assemblyoperation, a number of individuals are responsible for assembling electronic components into printed circuit boards. Each operator isresponsible for soldering components according to a given set ofinstructions. Operators work on batches of 45 printed circuit boards.Each board requires 5 minutes of board assembly time. After each batchis completed, the operator moves die assembled boards to the finalassembly area. This move takes 10 minutes to complete. The final assembly for each stereo unit requires 15 minutes and is alsodone in batches of 45 units. A batch of 45 stereos is moved into the testbuilding, which is across the street. The move takes 20 minutes. Beforeconducting the test, the test equipment must be set up for the particularstereo model. The test setup requires 25 minutes. The…arrow_forwardLisa is a contractor, and she owns a small home renovation company that specializes in kitchen renovations. Lisa fears she has been underbidding her projects, and that translates into lost profits that could help sustain her through slow periods. She is putting together an estimate for a potential client and has determined the following activities: Activity Cost Driver Rate Estimated Use for Job Demo of Existing Space Square Footage $3.26 /square foot 520 square feet Cabinet Installation # of Hours $205 /hour 8 hours Countertop Installation Square Footage $12.00/square foot 280 square feet Previously, Lisa was billing at a flat rate of $16 per square foot of the demo space with no additional markup. Lisa would like to add a 20% markup to the cost to arrive at the final bid price. Using Activity-Based Costing (ABC), what is the final bid price for her potential customer? (Round intermediate calculations and final answer to 2 decimal places, eg. 25,000.25.) Final bid price $arrow_forwardSample Exercise opens EA2. Rene is working with the operations manager to determine what the standard labor cost is for a spice chest. He has watched the process from start to finish and taken detailed notes on what each employee does. The first employee selects and mills the wood, so it is smooth on all four sides. This takes the employee 1 hour for each chest. The next employee takes the wood and cuts it to the proper size. This takes 30 minutes. The next employee assembles and sands the chest. Assembly takes 2 hours. The chest then goes to the finishing department. It takes 1.5 hours to finish the chest. All employees are cross-trained so they are all paid the same amount per hour, $17.50. A. What are the standard hours per chest? B. What is the standard cost per chest for labor?arrow_forward

- Rene is working with the operations manager to determine what the standard labor cost is for a spice chest. He has watched the process from start to finish and taken detailed notes on what each employee does. The fırst employee selects and mills the wood, so it is smooth on all four sides. This takes the employee 1 hour(s) for each chest. The next employee takes the wood and cuts it to the proper size. This takes 32 minutes. The next employee assembles and sands the chest. Assembly takes 3 hour(s). The chest then goes to the finishing department. It takes 3 hour(s) to finish the chest. All employees are cross-trained so they are all paid the same amount per hour, $18.62. What is the standard cost per chest for labor? Round to the nearest penny, two decimal places.arrow_forwardFree Wheels has a plant that assembles bicycles. The plant currently has a small cafeteria for the workers but the kitchen equipment is in need of a substantial overhaul. Free Wheels has been offered a contract by Beasteats to supply food to the workers. The particulars of the situation are shown in the table. Should Free Wheels continue with the in-house food services or contract the services to Beasteats? (Hint: Create a table with the columns for year (for 0-8 years), In-house current cost, contract current cost, in-house PW, and contract PW). Food Service: In-House Versus Contract Food service labour (hours/year) Wage rate (real, time 1, $/hour) Overhead cost (real, time 1, S/year) Kitchen equipment first cost (current, time 0, S) Contract cost, years 1 to 3 (current S) Contract cost, years 4 to 6 (current S) Current dollar MARR Expected annual inflation rate Study period (years) 6000 15 18 000 25 000 55 000 63 700 22% 5% 6arrow_forwardYe Old Bump and Grind inc is an automobile body and fender repair shop. repair work is done by hand and with the use of small tools. Customers are billed based on time (direct labor hours) and materials used in each repair job. The shops overhead costs consist of primaily of indirect materials(welding materials, metal putty and sandpaper), rent, indirect labor and utilities. Rent is equal to a percentage of the shops gross revenue for each month. The indirect labor relates primarily to ordering parts and processing insurance claims. The amount of indirect labor, therefore, tends to vary with the size of each job. Harvy Lee,manager of the business, is considering using either direct labor hours or number of repair jobs as the basis for allocating overhead costs. He has estimated the following amounts for the coming year: Estimated total overhead $123,000 Estimated direct labor hours 10,000 Estimated number of repair jobs 300 a. (1) - Compute the overhead application rate…arrow_forward

- parrow_forwardNoteworthy, Incorporated, produces and sells small electronic keyboards. Assume that you have the following information about Noteworthy's costs for the most recent month. Depreciation on factory equipment Depreciation on CEO's company car Speakers used in the keyboard Production supervisor's salary Glue and screws used in the keyboards Cost to run an ad on local radio stations Wages of persons who install the speakers $ 820 180 1,140 2,370 250 2,970 Utilities for the factory Personnel manager's salary Wages of person who attaches legs to keyboards Required: 1. Calculate the total product cost for Noteworthy. 2. Calculate the prime cost for Noteworthy. 3. Calculate the manufacturing overhead for Noteworthy. 4. Calculate the direct labor for Noteworthy. 5. Calculate the conversion cost for Noteworthy. 650 1,250 2,640 2,070 6. Calculate the total variable cost (with number of units produced as the activity) for Noteworthy. 7. Calculate the total fixed cost (with number of units produced…arrow_forwardMarine Components produces parts for airplanes and ships. The parts are produced to specification by their customers, who pay either a fixed price (the price does not depend directly on the cost of the job) or price equal to recorded cost plus a fixed fee (cost plus). For the upcoming year (year 2), Marine expects only two clients (client 1 and client 2). The work done for client 1 will all be done under fixed-price contracts while the work done for client 2 will all be done under cost-plus contracts. The controller at Marine Components chose direct labor cost as the allocation base in year 2, based on what she considered reflected the relation between overhead and direct labor cost. Year 3 is approaching and again the company only expects two clients: client 1 and client 3. Work for client 1 will continue to be billed using fixed-price contracts, and client 3 will be billed based on cost-plus contracts. Manufacturing overhead for year 3 is estimated to be $18 million. Other…arrow_forward

- Please help mearrow_forwardThe following data set is used for S5-14 through S5-18: Crystal Springs Data Set: Filtration Department Crystal Springs produces premium bottled water. Crystal Springs purchases artesian water, stores the water in large tanks, and then runs the water through two processes: • Filtration, where workers microfilter and ozonate the water • Bottling, where workers bottle and package the filtered water During May, the filtration process incurs the following costs in processing 205,000 liters: Wages of workers operating the filtration equipment.... Wages of workers operating ozonation equipment... Manufacturing overhead allocated to filtration. Water...... $ 10,280 $ 11,500 $ 25,500 $118,900 Crystal Springs has no beginning inventory in the Filtration Department. • your spinigs nee in veyinmy menseny i ime i mison exp S5-14 Compute cost per liter (Learning Objective 1) Refer to the Crystal Springs Filtration Department Data Set. 1. Compute the May conversion costs in the Filtration…arrow_forwardTaylor Inc. produces summer dresses for women. Their dresses are made of cotton fabrics. The line workers are paid an hourly wage and the production supervisor is paid an annual salary. The products are tested for quality control by an independent party which charges a set price per month and an additional charge for each item tested. Which of the following items should be classified as a fixed cost? Group of answer choices Line workers’ wages Production supervisor’s salary Cotton fabrics Quality control costsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education