FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ht

Net sales

Cost of sales

Gross margin

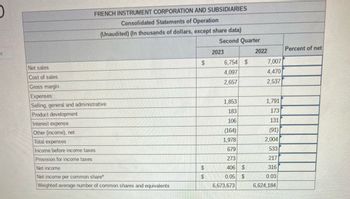

FRENCH INSTRUMENT CORPORATION AND SUBSIDIARIES

Consolidated Statements of Operation

(Unaudited) (In thousands of dollars, except share data)

Expenses:

Selling, general and administrative

Product development

Interest expense

Other (income), net

Total expenses

Income before income taxes

Provision for income taxes

Net income

Net income per common share*

Weighted average number of common shares and equivalents

$

$

$

Second Quarter

2023

6,754 $

4,097

2,657

1,853

183

106

(164)

1,978

679

273

406 $

0.05

$

6,673,673

2022

7,007

4,470

2,537

1,791

173

131

(91)

2,004

533

217

316

0.03

6,624,184

Percent of net

Transcribed Image Text:Saved

Help

Sav

From the French Instrument Corporation second-quarter report ended 2023, do a vertical analysis for the second quarter of 2023.

Note: Input all answers as positive values except other (income) which should be indicated by a minus sign. Round your answers

to the nearest hundredth percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Stargel Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Υ1 2010 $5,375,000 $4,545,000 Retained earnings, January 1. 900,000 925,000 Net income $6,275,000 $5,470,000 Total Dividends: Preferred stock dividends... $ 45,000 $ 45,000 50,000 $ 95,000 $6,180,000 50,000 2$ $5,375,000 Common stock dividends. 95,000 Total dividends....... Retained earnings, December 31 Chapter 17 Financial Statement Analysis 877 Stargel Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 Sales 20Υ2 20Y1 Cost of goods sold.. Gross profit Selling expenses Administrative expenses.. Total operating expenses Income from operations $10,000.000 5,350.000 $ 4650,000 $9,400,000 4,950.000 $450,000 $ 2,000,000 1,500,000 $ 3.500.000 $ 1,150,000 $1,880,000 1,410,000 $3.290,000 $1,160,000 Other revenue 150,000 140.000 $ 1,300.000 Other expense (interest). Income before income tax $1,300,000 170.000 150.000 Income tax expense $ 1,130,000 $1,150,000…arrow_forwardNonearrow_forwardWhat is the net increase or (net decrease) in the identifiable assets of SD Corporation?a. 13,700,500b. 13,307,500c. 13,957,500d. 13,050,500arrow_forward

- Measures of liquidity, Solvency and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall Inc. common stock was $ 60 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $ 1,024,550 $ 869,250 Net income 233,600 178,000 Total $ 1,258,150 $ 1,047,250 Dividends On preferred stock $ 7,700 $ 7,700 On common stock 15,000 15,000 Total dividends $ 22,700 $ 22,700 Retained earnings, December 31 $ 1,235,450 $ 1,024,550 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $ 1,456,350 $ 1,341,770 Cost of goods sold 520,490 478,850 Gross profit $ 935,860 $ 862,920 Selling expenses $ 319,920 $ 392,750 Administrative expenses 272,520 230,660 Total…arrow_forwardplease provide correct answer refer to attached documentarrow_forwardIncome Statement and Earnings per Share for Discontinued Operations Apex Inc. reports the following for a recent year: Income from continuing operations before income tax expense $1,000,000 Loss from discontinued operations $240,000* Weighted average number of shares outstanding 20,000 Applicable tax rate 40% *Net of any tax effect. Question Content Area a. Prepare a partial income statement for Apex Inc., beginning with income from continuing operations before income tax expense.arrow_forward

- Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent-owned subsidiary Oakley Co. follow: Cash Accounts receivable (net) Merchandise inventory Buildings and equipment (net) Trademark Totals Accounts payable Notes payable, long-term Noncontrolling interest Common stock, $10 par Retained earnings (deficit) Totals 2014 2013 $ 9,550 $ 10,600 49,550 82,750 102,000 116,500 118,500 136,500 22,750 39,750 $43,050. $43,200. $21,600. $15,700. $362,350 $326,100 $ 92,600 $ 71,000 0 31,700 52,800 43,000 200,000 200,000 16,950 (19,600) $362,350 $ 326,100 Additional Information for Fiscal Year 2014 • Iverson and Oakley's consolidated net income was $58,750. Oakley paid $7,000 in dividends during the year. Iverson paid $11,000 in dividends. Oakley sold $18,000 worth of merchandise to Iverson during the year. There were no purchases or sales of long-term assets during the year. In the 2014 consolidated statement of cash flows for Iverson Company: Net cash flows from operating…arrow_forwardPlease do not give image formatarrow_forwardConsolidated Statements of Changes in Shareholders' Equity ($ in thousands) Share Capital Contributed Surplus Retained Earnings AOCI(1) Total Balance at January 31, 2015 $ 167,460 $ 2,831 $ 140,527 $ 18,465 $ 329,283 Net earnings for the year — – 69,779 – 69,779 Other comprehensive income (Note 12) – – 4,583 11,953 16,536 Other comprehensive income of equity investee – – (15) – (15) Comprehensive income – – 74,347 11,953 86,300 Equity settled share-based payments – 124 – – 124 Dividends (Note 19) – – (58,210) – (58,210) Issuance of common shares (Note 15) 450 (335) – – 115 450 (211) (58,210) – (57,971) Balance at January 31, 2016 $167,910 $ 2,620 $156,664 $ 30,418 $357,612 Balance at January 31, 2014 $ 166,069 $ 3,528 $ 145,762 $ 7,081 $ 322,440 Net earnings for the year — – 62,883 – 62,883 Other comprehensive income (Note 12) – – (11,968) 11,384 (584) Other comprehensive income of equity investee – – 30 – 30 Comprehensive income – – 50,945 11,384…arrow_forward

- Long-Term Solvency Analysis The following information was taken from Combine Company's balance sheet: Fixed assets (net) $1,037,300 Long-term liabilities 253,000 Total liabilities 1,239,700 Total stockholders' equity 885,500 Determine the company's (a) ratio of fixed assets to long-term liabilities and (b) ratio of liabilities to stockholders' equity. If required, round your answers to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equityarrow_forwardfind P/E Ratio 2019. i attached balance sheet and income statementarrow_forwardSteele Inc. Consolidated Statements of Income (in thousands except per share amounts) 2023 2022 2021 Net sales $7,245,088 $6,944,296 $6,149,218 Cost of goods sold (5,286,253) (4,953,556) (4,355,675) Gross margin $1,958,835 $1,990,740 $1,793,543 General and administrative expenses (1,259,896) (1,202,042) (1,080,843) Special and nonrecurring items 2,617 0 0 Operating income $701,556 $788,698 $712,700 Interest expense (63,685) (62,398) (63,927) Other income 7,308 10,080 11,529 Gain on sale of investments 0 9,117 0 Income before income taxes $645,179 $745,497 $660,302 Provision for income taxes 254,000 290,000 257,000 Net income $391,179 $455,497 $403,302 Steele Inc. Consolidated Balance Sheets (in thousands) ASSETS Dec. 31, 2023 Dec. 31, 2022 Current assets: Cash and equivalents $320,558 $41,235 Accounts receivable 1,056,911 837,377 Inventories 733,700…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education