FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

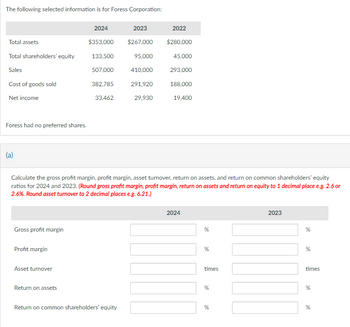

Transcribed Image Text:The following selected information is for Foress Corporation:

Total assets

Total shareholders' equity

Sales

Cost of goods sold

Net income

Foress had no preferred shares.

(a)

Gross profit margin

Profit margin

Asset turnover

2024

$353,000

133,500

507,000

Return on assets

382,785

33,462

Calculate the gross profit margin, profit margin, asset turnover, return on assets, and return on common shareholders' equity

ratios for 2024 and 2023. (Round gross profit margin, profit margin, return on assets and return on equity to 1 decimal place e.g. 2.6 or

2.6%. Round asset turnover to 2 decimal places e.g. 6.21.)

2023

$267,000

Return on common shareholders' equity

2022

$280,000

95,000

45,000

410,000

293,000

291,920 188,000

29,930

19,400

2024

%

%

times

%

%

2023

%

%

times

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 26 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- DuPont system of analysis Use the following financial information for AT&T and Verizon to conduct a DuPont system of analysis for each company. Sales Earnings available for common stockholders Total assets Stockholders' equity a. Which company has the higher net profit margin? Higher asset turnover? b. Which company has the higher ROA? The higher ROE? c. Which company has the higher financial leverage multiplier? a. Net profit margin (Round to three decimal places.) AT&T Net profit margin AT&T $164,000 13,333 403,921 201,934 Verizon Verizon $126,280 13,608 244,280 24,232arrow_forwardcalculate the ratio (expressed to two decimal places) that would reflect each of the following: The amount of funds available relative to sales, to pay the company’s expenses other than its cost of sales (expressed as a percentage) The company's net income as a percentage of the company's net sales.The ability of the company to generate profits from its shareholders investments in the company.A measure of the dividend pay-out per share of the company's ordinary shares. The capacity of the company to pay off its current commitments using just its most liquid assets.The degree to which the company’s assets are financed by debt. A measure of how easily the company can pay the interest on its outstanding debt.arrow_forwardCalculate the following ratios, follow the steps and must interpret your answers , Current ratio Earning per share ratio Current assets=$89000 Current liabilities= 61000 Net income/profit=$18000 Number of shares common stock=76262 Total asset=770000arrow_forward

- Assume the following relationships for the Caulder Corp.: Sales/Total assets 1.5× Return on assets (ROA) 8.0% Return on equity (ROE) 12.0% Calculate Caulder's profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: % Debt-to-capital ratio: %arrow_forwardMatch the following ratio functions with the ratio (place the number of your chosen answer into the box with the border beside the term you think it goes with : Dividend Yield Debt ratio Current Ratio Price/Earnings Ratio Acid-test ratio Earnings per share 1. The amount of net income earned for each share of the company's common stock 2. The percentage of a stock's market value returned to stockholders as dividends each period 3. The ability to pay current liabilities with current assets. 4. The percentage of assets financed with debt. 5. The ability to pay all current liabilities if they come due immediately. 6. The market price of $1 of earnings.arrow_forwardSome selected financial statement items belonging to Fanar Company are given in the table below. According to this information, which of the following is the Current Ratio? Inventory 13,500 Current Assets 63,000 Current Liabilities 36,000 Non-current Assets 85,000 Net Profit 14,000 Shareholders' Equity 68,000 Select one: O a. 1.09 O b. 1.75 O c. 1.35 O d. 1.79arrow_forward

- Please provide answer in text (Without image)arrow_forwardSuppose the following historical data is from the consolidated income statements filed by a media corporation. *chart attached* A: Prepare a horizontal analysis of the net income comparing 2012 and 2013. (Round percentages to one decimal place.) *Chart attached*arrow_forwardFinancial statements for Askew Industries for 2024 are shown below (in thousands): 2024 Income statement Net sales Cost of goods sold Gross profit Operating expenses Interest expense Income tax expense Net income Assets Cash $ 9,400 (6,400) 3,000 (2,200) (240) (224) $ 336 Bonds payable Common stock Retained earnings Comparative Balance Sheets. Accounts receivable Inventory Property, plant, and equipment (net) Liabilities and Shareholders' Equity Current liabilities December 31 2024 $ 640 640 840 2,400 $ 4,520 $ 1,340 1,600 640 940 $ 4,520 2023 $ 540 440 640 2,500 $4,120 $ 1,090 1,600 640 790 $ 4,220 Required: Calculate the following ratios for 2024 Note: Consider 365 days a year. Do not round intermediate calculations and round your final answers to 2 decimal places.arrow_forward

- Please help mearrow_forwardCompute Measures for DuPont Disaggregation Analysis Use the information below for 2018 for 3M Company to answer the requirements. ($ millions) Sales Net income, consolidated Net income attributable to 3M shareholders Pretax interest expense Assets Total equity Equity attributable to 3M shareholders Net income consolidated S a. Compute return on equity (ROE) from the perspective of a 3M shareholder. Note: 1. Select the appropriate numerator and denominator used to compute ROE from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROE Numerator Denominator E Net income consolidated (adjusted) 2018 2017 $32,765 5,363 5,349 S 207 36,500 $37,987 9,848 11,622 9,796 11,563 S + Average total equity 5,349 $ b. Compute the DuPont model component measures for profit margin, asset turnover, and financial leverage. (Perform these computations from a consolidated perspective). Profit Margin (PM) Note: 1. Select the appropriate numerator and denominator used to…arrow_forwardPlease analyze company Savola using below table of common size balance sheet compared to other companies:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education