FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hi I had posted this question but they did not complete the bottom half, please help?

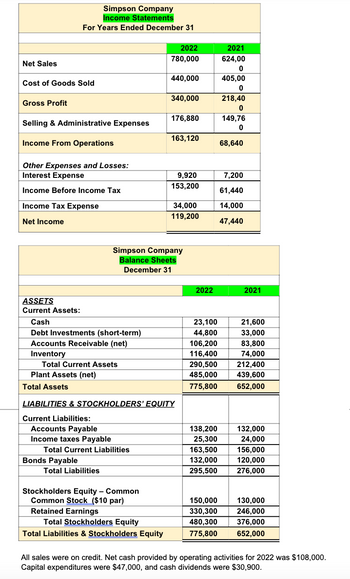

Transcribed Image Text:i) Times Interest Earned

j) Asset Turnover

k) Debt to Assets

I) Current Cash Debt

Coverage

m) Cash Debt Coverage

n) Free Cash Flow

Transcribed Image Text:Net Sales

Cost of Goods Sold

Gross Profit

Selling & Administrative Expenses

Income From Operations

Simpson Company

Income Statements

For Years Ended December 31

Other Expenses and Losses:

Interest Expense

Income Before Income Tax

Income Tax Expense

Net Income

ASSETS

Current Assets:

Cash

Debt Investments (short-term)

Accounts Receivable (net)

Inventory

Total Current Assets

Plant Assets (net)

Total Assets

Accounts Payable

Income taxes Payable

Bonds Payable

Total Current Liabilities

Total Liabilities

2022

780,000

Stockholders Equity - Common

Common Stock ($10 par)

Retained Earnings

440,000

Total Stockholders Equity

Total Liabilities & Stockholders Equity

340,000

Simpson Company

Balance Sheets

December 31

LIABILITIES & STOCKHOLDERS' EQUITY

Current Liabilities:

176,880

163,120

9,920

153,200

34,000

119,200

2022

23,100

44,800

106,200

116,400

290,500

485,000

775,800

138,200

25,300

163,500

132,000

295,500

150,000

330,300

480,300

775,800

2021

624,00

0

405,00

0

218,40

0

149,76

0

68,640

7,200

61,440

14,000

47,440

2021

21,600

33,000

83,800

74,000

212,400

439,600

652,000

132,000

24,000

156,000

120,000

276,000

130,000

246,000

376,000

652,000

All sales were on credit. Net cash provided by operating activities for 2022 was $108,000.

Capital expenditures were $47,000, and cash dividends were $30,900.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The 3rd question is a Journal entry if this information..I can’t attach a photo unfortunately the website won’t let me, but I’ve attempted my best and am unable to show it. Any help would be appreciated! Thanks!arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardWhat is the present value of $3,000 to be received 2 years from now, if the discount rate is: (a) 9%, (b) 13%, and (c) 25%? 1. Use the appropriate table (Appendix C: Table 1) to answer the above questions. 2. Use the formula shown at the bottom of Appendix C, Table 1, to answer the above questions. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Use the appropriate table (Appendix C: Table 1) to answer the above questions. (Round your answers to the nearest whole dollar amount.) (a) (b) (c) Discount Rate 9% 13% 25% $ GAGA $ X Answer is complete but not entirely correct. $ Present Values 1 x 1 x 1 xarrow_forward

- Your answers are incorrect, there are at least 4 blanks to fill in and you only provided 2 or 3. Also please do not use Excel, please use another way to show your work.arrow_forwardUsing formulas, no tables, correct answer= 6,962.6, can you try again?arrow_forwardHello, can you help me with questions 7,8, and 9 please, thanks!arrow_forward

- Hello i have attached two pictures. They are both used together to answer the question. The first picture is the information to use too answer the question. The second attachment is the for the answer. I hope it is understandable and whoever answer this can please explain how they got the answers. I need the help. I have marked a yellow x on what i have done already. I DO NOT NEED HELP WITH WHAT IS CROSSED IN YELLOW (PARTS 1-3) I NEED PARTS 4-6. THIS IS IS IS THE ANSWER TO PARTS 1-3 Analysis and Calculation: 1) Gold Medal Athletic Co., Sales Budget: For the month ended March: Product Sales Volume Sale Price per unit Sales, $ Batting helmet 1,200 units $40 $ 48,000 Football helmet 6,500 units $160 $1,040,000 Total revenue from sales $ 1,088,000 2) Production Budget: Batting Football Helmet Helmet Expected units to be sold 1,200 6,500 Add: desired Ending inventory 50 220 Total 1,250 6,720 Less: Beginning estimated inventory 40 240 Total…arrow_forwardHi I asked this question previously and the individual did not explain things clearly. For instance he provided the I'm guessing standard method of finding a missing amount on a certain type of T-Account but then would turn around and solve it using a different method. I am posting the response that were not clear below. If you could tell me what the actual method is and if there exceptions and if so what those are.Answer #1 I needed the BEGINNING balance of a debit account. As you can see the response below the individual provided a formula that included the BB which is UNKOWN because that is WHAT I NEED. At the bottom they change around the equation to come to the answer. So what is the proper way???Part-1. Begining balance of cash account is missing. The cash account is having a debit balance always. The formula for Cash account is as under:Ending balance of Cash Account = Begining Balance of cash account + All debits - All creditsHere,Ending Balance of cash = 9800All debits…arrow_forwardThe first part of the assignment is to open Excel and in column A starting in row 1 and down to row 40 generate random values using the RAND() function. Copy and special paste those values onto sheet2. You will turn in the Excel file, but you will use the information below when directed. Say an individual is faced with the decision of whether to buy auto insurance or not (like before laws in many states changed). The states of nature are that no accident occurs (with probability .992) or an accident occurs (with probability .008). Here is the payoff table for the decision maker (where -500 is read minus 500, for example) State of Nature Decision No Accident Accident Purchase insurance -500 -500 Do not purchase Ins. 0 -10000 1. Say the individual is a RISK LOVER. Create a table with plausible values of utility for the risk lover where you pick as the indifference probability for the value -500 the first value that is appropriate from your simulation in Excel (starting in cell A1 on…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education