FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

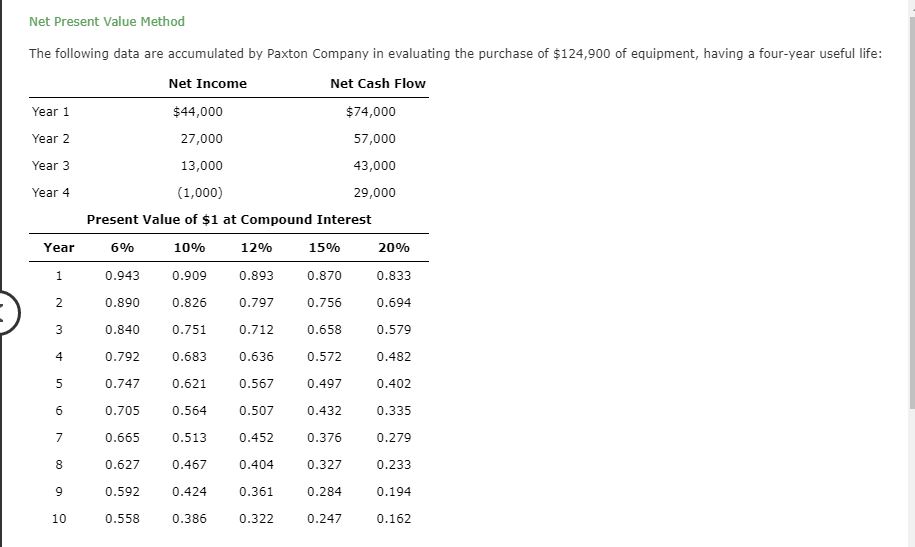

Transcribed Image Text:Net Present Value Method

The following data are accumulated by Paxton Company in evaluating the purchase of $124,900 of equipment, having a four-year useful life:

Net Income

Net Cash Flow

$44,000

$74,000

Year 1

57,000

Year 2

27,000

Year 3

13,000

43,000

(1,000)

29,000

Year 4

Present Value of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

1

0.943

0.909

0.893

0.870

0.833

0.756

2

0.890

0.826

0.797

0.694

3

0.840

0.751

0.712

0.658

0.579

0.792

0.683

4

0.636

0.572

0.482

0.497

5

0.747

0.621

0.567

0.402

6

0.705

0.564

0.507

0.432

0.335

.376

0.665

0.5

.279

0.627

0.467

0.404

0.327

0.233

0.284

0.592

0.424

0.361

0.194

10

0.558

0.386

0.322

0.247

0.162

LO

co

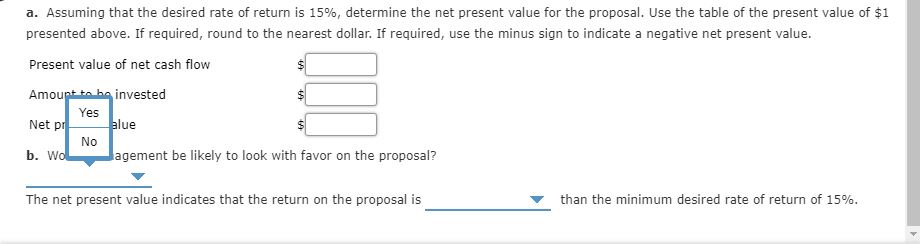

Transcribed Image Text:a. Assuming that the desired rate of return is 15%, determine the net present value for the proposal. Use the table of the present value of $1

presented above. If required, round to the nearest dollar. If required, use the minus sign to indicate a negative net present value.

Present value of net cash flow

Amoupt binvested

Yes

alue

Net pr

No

agement be likely to look with favor on the proposal?

b. Wo

The net present value indicates that the return on the proposal is

than the minimum desired rate of return of 15%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- d. Determine the minimum annual net cash flow necessary to generate a positive net present value, assuming a desired rate of return of 12%. Round to the nearest dollar.Annual Net Cash Flow fill in the blank 1 of 1$arrow_forward2. Discounted Payback (DCPB) and IRR evaluations. Use the cash flow situation (table below) to answer. a. Determine the DCPB based on a MARR rate of 4.0% b. Determine the IRR Year Cash Flow (in $1000's) 0 -1250 1 +350 2 3 +300 +250 4 +200 5 +150 6 +100 7 +50arrow_forwardConsider the following future value problem. The respective cash flows for t = 0, 1, 2, and 3 are $3,000, $2,000, $8,000, and $5,000 and the discount rate is ten percent. What is the future value at t = 4? do not use excelarrow_forward

- Please do not give solution in image format thankuarrow_forwardA product manager prepared the following forecasts for a product line: 1 3 4 5 6 and later 2 + $2m $2m $3m $4m $4m g=2.5% If the appropriate discount rate is 8.5%, what is the present value of these future cash flows?arrow_forwarda. Find the present values of the following cash flow streams at an 8% discount rate. Do not round intermediate calculations. Round your answers to the nearest cent. 0 1 2 3 4 5 Stream A $0 $100 $350 $350 $350 $300 Stream B $0 $300 $350 $350 $350 $100 Stream A: $ Stream B: $ b. What are the PVs of the streams at a 0% discount rate? Round your answers to the nearest dollar. Stream A: $ Stream B: $arrow_forward

- a. Find the present values of the following cash flow streams at a 6% discount rate. Do not round intermediate calculations. Round your answers to the nearest cent. 1 3 4 Stream A $0 $150 $400 $400 $400 $300 Stream B $0 $300 $400 $400 $400 $150 Stream A: $ Stream B: $ b. What are the PVs of the streams at a 0% discount rate? Round your answers to the nearest dollar. Stream A: $ Stream B: $arrow_forwardDetermine the present value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. 2 3. 4. Future Amount $ $ $ $ 32,000 26,000 37,000 52,000 i= 5% 6% 11% 10% n = 11 19 40 13 Present Valuearrow_forwardThe website is www.moneychimp.com. THE ANSWER MUST BE CORRECT.arrow_forward

- Net Present Value Use Exhibit 128.1 and Exhibit 128.2 to locate the present value of an annuity of $1, which is the amount to be multiplied times the future annual cash flow amount. Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. a. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per year. The system costs $2,650,000 and will lam 10 years. b. Evee Cardenas is interested in investing in a women's specialty shop. The cost of the investment is $180,000. She estimates that the return from owning her own sta will be $35,000 per year. She estimates that the shop will have a useful life of 6 years. c. Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. Required: 1.…arrow_forward4. For the proposals accepted for further analysis in part (3), compute the net present value. Use a rate of 12% and the present value of $1 table above. Round to the nearest dollar.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education