Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

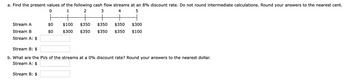

Transcribed Image Text:a. Find the present values of the following cash flow streams at an 8% discount rate. Do not round intermediate calculations. Round your answers to the nearest cent.

0

1

2

3

4

5

Stream A

Stream B

Stream A: $

$0

$0

Stream B: $

$100

$300 $350

$350 $350 $350

$350 $350

$300

$100

Stream B: $

b. What are the PVs of the streams at a 0% discount rate? Round your answers to the nearest dollar.

Stream A: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Can I get some help with this practice questionarrow_forward1. Discounted Payback (DCPB) and IRR analysis. Use the cash flow situation (table below) to answer. a. Determine the DCPB based on a MARR rate of 8.0% b. Determine the IRR Year Cash Flow (in $1000's) 0 1 -5500 +1500 2 +1800 3 +1500 4 +1800 5 6 +1500 +1800 7 +1500arrow_forwardCalculate the NPV of the following cash flows using a 10% discount rate? The first cashflow is negative, Year 0= -900, all others are positive Year 1= +100, Year 2= +100, Year 3= +400, Year 4= +500, Year 5= +500 a. $36 b. $ 520 c. $ 996 d. $ 326 e. $ 226arrow_forward

- a. Find the present values of the following cash flow streams at an 11% discount rate. Do not round intermediate calculations. Round your answers to the nearest cent. 0 1 2 3 4 5 Stream A Stream B Stream A: $ $0 $0 Stream B: $ $100 $400 $400 $250 $400 $400 $400 $250 $400 $100 Stream B: $ b. What are the PVs of the streams at a 0% discount rate? Round your answers to the nearest dollar. Stream A: $arrow_forwardWhat is the present value of the following stream of cash flows if the discount rate is 9%? Year 1-5: $14,000 inflow Years 6-20: $23,000 inflow (Use the present value tables in your course packet for any present value calculations. Round your final answer to the nearest dollar.)arrow_forwardDifferent cash flow. Given the cash inflow in the following table. what is the present value of this cash flow at 8%, 11%, and 23% discount rates? What is the present value of this cash flow at 8% discount rate? (Round to the nearest cent.) What is the present value of this cash flow at 11% discount rate? (Round to the nearest cent.) What is the present value of this cash flow at 23% discount rate? (Round to the nearest cent.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 1: Year 2: $1,500 $8,000 Years 3 through 7: $0 Year 8: $30,000 -Xarrow_forward

- Consider two assets with the following cash flow streams: Asset A generates $4 at t=1, $3 at t=2, and $10 at t=3. Asset B generates $2 at t=1, $X at t=2, and $10 at t=3. Suppose X=6 and the interest rate r is constant. For r=0.1, calculate the present value of the two assets. Determine the set of all interest rates {r} such that asset A is more valuable than asset Draw the present value of the assets as a function of the interest rate. Suppose r=0.2. Find the value X such that the present value of asset B is 12. Suppose the (one-period) interest rates are variable and given as follows: r01=0.1,r12=0.2, r23=0.3. Calculate the yield to maturity of asset A. (You can use Excel or ascientific calculator to find the solution numerically.)arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardDetermine the present value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. 2. 3. 4. Future Amount $ 24,000 $ 18,000 $ 29,000 $ 44,000 i 5% 9% 11% 10% n= 10 13 25 9 Present Valuearrow_forward

- Please solve step by step for clarity, thank you!arrow_forwardFind the present values of the following cash flow streams at a 3% discount rate. Do not round intermediate calculations. Round your answers to the nearest cent. 0 1 2 3 4 5 Stream A $0 $150 $400 $400 $400 $250 Stream B $0 $250 $400 $400 $400 $150arrow_forward2. Discounted Payback (DCPB) and IRR evaluations. Use the cash flow situation (table below) to answer. a. Determine the DCPB based on a MARR rate of 4.0% b. Determine the IRR Year Cash Flow (in $1000's) 0 -1250 1 +350 2 3 +300 +250 4 +200 5 +150 6 +100 7 +50arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education